Equity markets declined for the third week in a row while bonds moved higher (in price) as investors reacted to everything from turmoil in Washington D.C. to turmoil on the Russia/Ukraine border. The equity market continued its slide downward last week with poor returns across all three major indexes, albeit modest negative returns. Inflation continues to be the word of the year with a release last week of December 2021 CPI (Consumer Price Index) topping 7% for the month compared with 2020, which arguably was exactly what was predicted by economists.

The Dow Jones Industrial Average fell by –5.1%, the S&P 500 Index lost –5.6%, and the NASDAQ also fell by –7.0%. Last week’s negative returns added to the poor returns we have already had in 2022. Year-to-date, the Dow Jones Industrial Average is down –5.6%, the S&P 500 Index down –7.7% and the NASDAQ down by –12.0%. Investors, spooked by the volatility in the equity markets, moved to money to the relative stability of the bond market and as a result bond yields moved lower last week. The 10-Year U.S Treasury bond fell seven basis points to close the week at 1.75%.

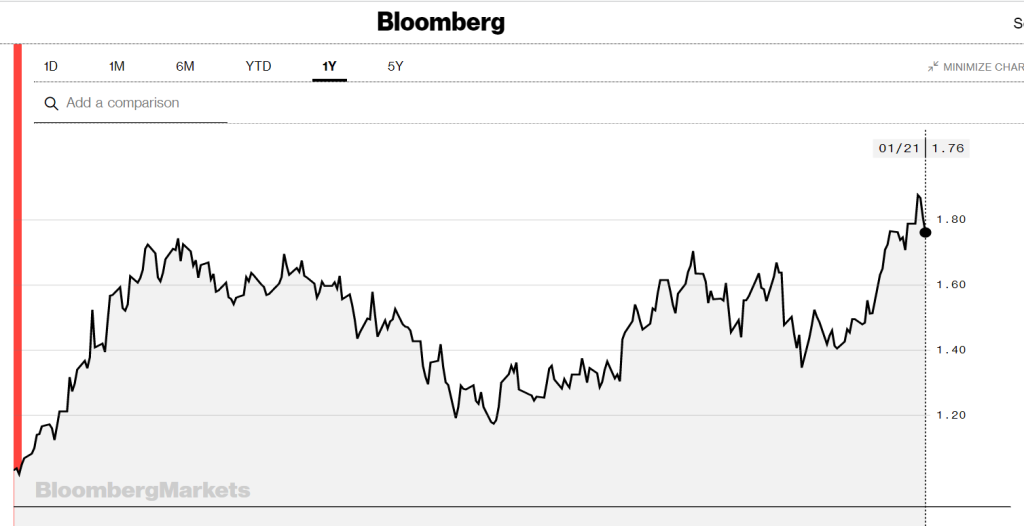

Equity markets seem poised to react more so to higher interest rates rather than corporate earnings. In 2021, we had a perfect storm of events that fueled the bull market for most of the year. We had fiscal stimulus in the form of trillions of dollars flooding the economy, monetary stimulus with the Federal Reserve keeping interest rates near zero and record-breaking corporate profits across many sectors. 2022 is going to be a transition year for both the markets and the economy as both are forced to adapt to higher interest rates and significantly less fiscal stimulus. Higher interest rates are a given as the Federal Reserve has clearly telegraphed their intentions to do so, and current futures markets are pricing in as many as 4 to 25 basis point rate hikes in the Fed Funds rate. Typically, in stable economic conditions, long-term rates move higher as well. We have already seen the 10-Year U.S. Treasury move higher by 23 basis points this year alone (see chart below from Bloomberg), and over 70 basis points higher than the low seen in 2021.

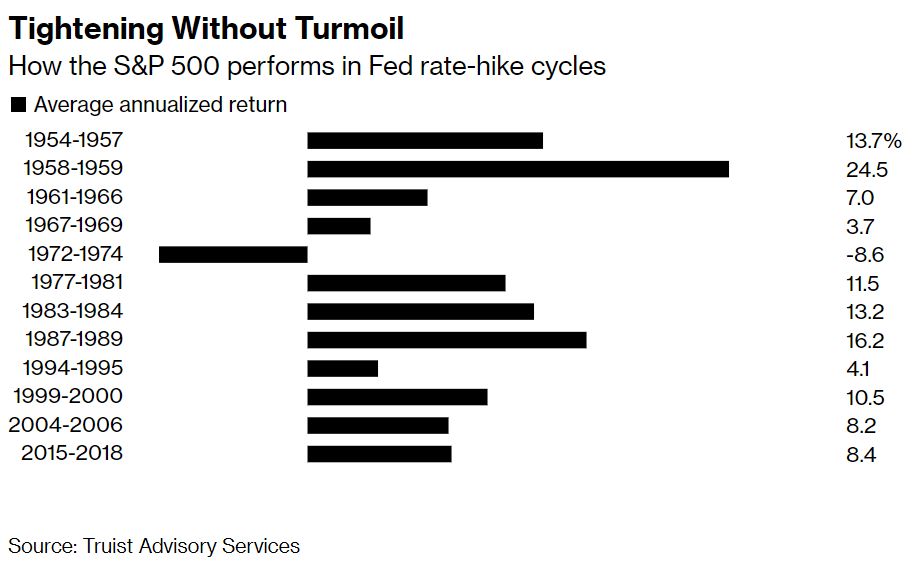

Higher interest rates alone are not a recipe for poor returns in equity markets. In fact, in an article published over the weekend in Bloomberg, Truist Advisory Services reported that the S&P 500 Index averaged a +9% annually during the 12 rate-rising cycles since the 1950s (See chart below).

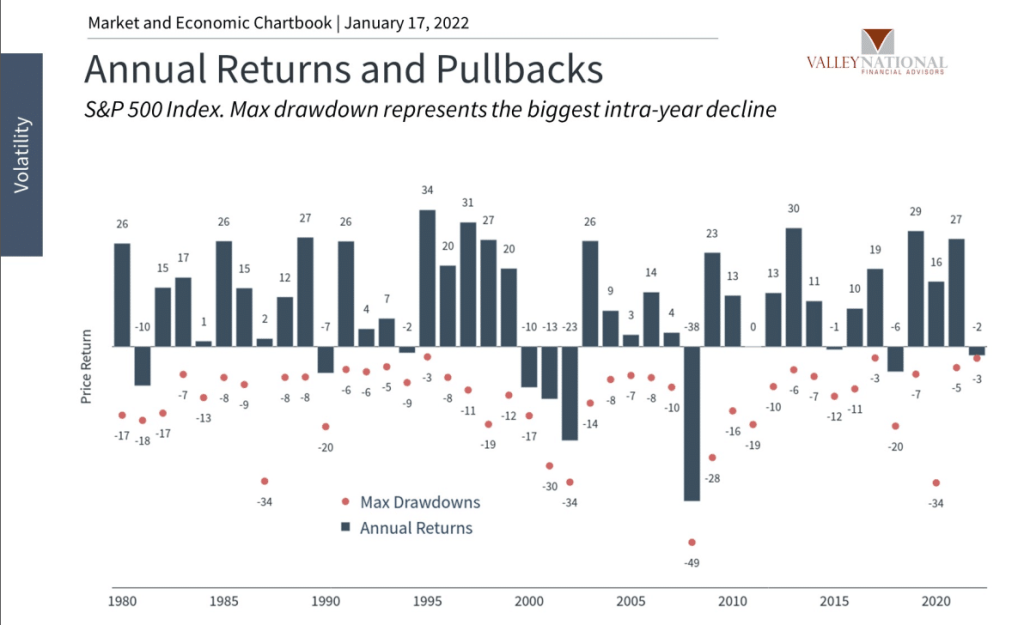

One needs to understand why we are seeing higher rates already and why the Fed will continue this rate path well into 2023. Typically, the Fed reacts to economic growth, inflation, and employment in their calculations for rate movements. 2021 could see real GDP nearing 5% for the full year, unemployment is at 3.9% and inflation is running at 7% year-over-year. These figures tell us the economic recovery is far from over and corporate earnings, as a result, still have room to grow and improve. However, as we have said before, stocks never go up in a straight line from bottom left to upper right; in fact, the path is bumpy to say the least and we expect a similar path this time as well. Further, pull-backs in the equity markets are to be expected and are a normal part of functioning markets. (See the chart below from Valley National Financial Advisors and Clearnomics on annual returns and pullbacks).

When volatility is high it is tougher to remain focused on a long-term strategy, but the fundamentals underlying the economy are solidly in place, businesses are sound, and the consumer is in strong financial shape. Mix in the employment situation and there is still reason to believe markets can move higher from here simply based on sound economic fundamentals. Volatility is the watchword for 2022 just like COVID was for 2020 & 2021.