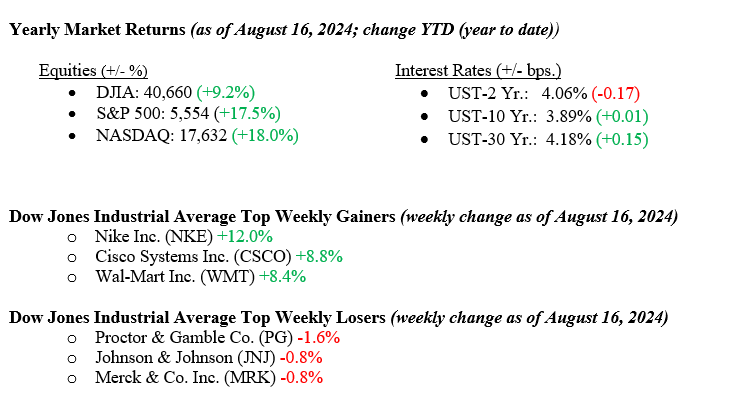

U.S. stock indexes delivered substantial gains across the board last week. The NASDAQ increased 5.3%, the S&P 500 added 4%, and the Dow rose 3%. Information technology was the top-performing sector last week (+8%), while real estate was the worst-performing sector (+0.6). The move higher last week can be attributed to encouraging data on inflation, retail sales, and consumer sentiment. In addition, Walmart’s above-consensus earnings report signaled the resilience of the consumer. The S&P 500 is now 7% above its recent trough on August 5 and only 2% below the record high reached in mid-July. For the week, the 10-year U.S. Treasury bond yield fell six basis points, closing Friday at 3.89%.

U.S. & Global Economy

Recent economic data suggests a cooling of growth rather than an imminent recession. Retail sales data released last week indicated a still-healthy U.S. consumer, with monthly growth of 1%, surpassing forecasts of 0.4%. This broad-based spending increase, led by a rebound in auto sales, was complemented by a strong University of Michigan consumer expectations figure of 72.1, exceeding the forecast of 68.51. In addition, PPI and CPI inflation came in below expectations for July, offering noted price relief to consumers. Headline CPI inflation is now at its lowest reading for the year. Headline PPI inflation came in at 2.2% annually, below forecasts of 2.3%, while headline CPI inflation came in at 2.9%, below expectations of 3.0%. These indicators point to a resilient U.S. consumer base that continues to spend and maintain an optimistic outlook, alleviating concerns about an economic downturn.

Policy and Politics

Recent polls have shown a significant shift in the 2024 U.S. presidential race, with Vice President Kamala Harris emerging as a formidable contender against former President Donald Trump in key battleground states. According to new surveys from The New York Times and Siena College, Harris is now leading Trump among voters in Arizona (50% to 45%), and the Vice President has edged ahead in North Carolina (49% to 47%), while simultaneously narrowing Trump’s lead in Georgia and Nevada. This marks a substantial improvement for Democrats compared to earlier polls, with Trump leading in these states. Additionally, recent polling showed Harris pulling ahead of Trump by narrow margins in the crucial northern battleground states of Michigan, Pennsylvania, and Wisconsin. As both campaigns gear up for the general election, these polls indicate a closely contested race shaping up for November 5th, 2024.

In the Israel-Hamas conflict, Israeli airstrikes continue in Gaza, causing Palestinian casualties, while ceasefire talks involving the U.S., Egypt, and Qatar face challenges. The Russia-Ukraine war is intense, with Ukraine struggling against increased Russian attacks and ammunition shortages as Western allies rush military aid. In addition, it is worth noting that over 70 countries are set to hold elections in 2024, which could shift international alliances and impact global policies.

Economic Numbers to Watch This Week

- U.S. leading economic indicators for July, prior 0.2%.

- U.S. Initial Claims for Unemployment Insurance for the week of August 17, 2024, prior 230,000

- U.S. S&P flash services PMI for August, prior 55.0.

- U.S. S&P flash manufacturing PMI for August, prior 49.6.

- U.S. Existing Home Sales for July, prior 3.89 million.

- U.S. New Home Sales for July, prior 617,000.

Markets have responded positively to easing inflation and better-than-expected economic data recently. Since the August 5 sell-off, the S&P 500 has rebounded over 6.5%, and the 10-year Treasury yield has risen from 3.66% to 3.89%, reflecting renewed confidence. The VIX index, which spiked to 65 on August 5, has dropped back below 15, which aligns with its average. It is also worth noting that Q2 corporate earnings have been healthy, with 56% of S&P 500 firms beating consensus EPS forecasts. The Federal Reserve will meet in Jackson Hole this week with Fed Chair Jerome Powell speaking on August 23, where he may signal potential policy changes. The Fed could also address current trends in inflation and the labor market and hint at the possibility of a rate-cutting cycle starting in September. Please contact your advisor at Valley National Financial Advisors with any questions.