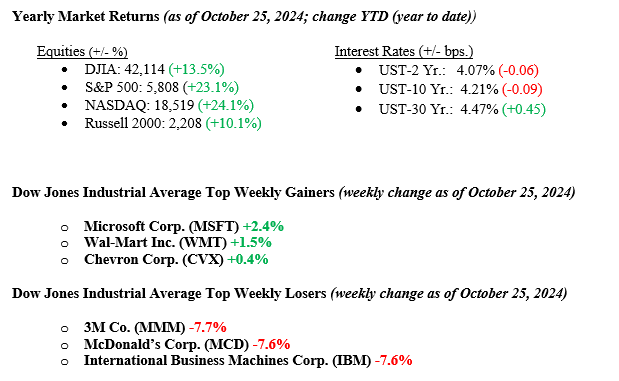

Last week brought mixed results for major stock indexes: the Dow Jones Industrial Average fell 2.7%, the S&P 500 dropped 1.0%, and the NASDAQ edged up by 0.2%. A notable exception to the general market trend was Tesla, whose stock surged 25% following a stronger-than-expected earnings report. Despite strong sector performances in communications and health services, these gains were insufficient to fuel a broader market rally. Meanwhile, the ten-year Treasury yield rose 11 basis points to 4.21% as investors adjusted for a potentially less aggressive path of Fed rate cuts. The week will bring updates on inflation data, employment figures, and October’s unemployment rate.

U.S. & Global Economy

This past week’s economic data offered a mixed view of U.S. conditions. The housing market remains sluggish, with the National Association of Realtors reporting a 1.0% drop in September home sales from the previous month and a 3.5% decline year-over-year. In contrast, consumer sentiment showed improvement, with the University of Michigan’s index reaching a six-month high of 70.5, the third consecutive monthly increase. The Fed’s Beige Book indicated minimal economic growth across regions, reporting softer labor demand and moderating inflation pressures. Notably, weekly jobless claims came in below expectations, defying predictions of a surge from recent hurricane impacts and signaling resilience in the labor market.

Policy and Politics

Geopolitical tensions continue to shape investor sentiment, driven by three major global hotspots. In the Middle East, escalating conflicts risk regional stability and potential disruptions in energy markets. The ongoing Russia-Ukraine war brings concerns over regional stability and energy supplies as winter nears. Additionally, U.S.-China relations remain strained due to China’s assertive stance on Taiwan and persistent trade restrictions, adding uncertainty to the global economic outlook.

A recent national poll by The New York Times and Siena College reveals a tight race between Harris and Trump, tied at 48% among likely voters. This marks a shift from early October when Harris held a slight lead of 49% to 46%. Meanwhile, Trump has shown momentum gains in critical swing states, potentially reshaping key battleground dynamics as the election approaches.

Economic Numbers to Watch This Week

- U.S. Job Openings: Total Nonfarm, prior 8.04M

- ADP Employment Change for October 2024, prior 143,000

- U.S. Real GDP QoQ for 3Q 2024, prior 3.00%

- U.S. PCE Price Index YoY for September 2024, prior 2.24%

- U.S. Core PCE Price Index YoY for September 2024, prior 2.68%

- U.S. Labor Force Participation Rate for October 2024, prior 62.7%

- U.S. Nonfarm Payrolls MoM for October 2024, prior 254,000

- U.S. Unemployment Rate for October 2024, prior 4.1%

Next week will be packed with important economic data and corporate earnings reports. The U.S. will release its Q3 GDP data, providing insight into economic growth amid mixed signals on consumer demand and inflation trends. Large-cap technology firms, including Apple, Microsoft, Alphabet, and Amazon, will report earnings, offering a look into corporate spending and advancements in artificial intelligence. Beyond tech, other major companies like Visa, Mastercard, and Eli Lilly are set to announce their financial results, showcasing broader sector performance. On Friday, the U.S. nonfarm payrolls report will offer the last significant reading on the labor market ahead of the upcoming election and Federal Reserve meeting on November 7. Analysts expect a moderation in job growth to around 100,000, with the unemployment rate anticipated to hold steady at 4.1%, suggesting a labor market that is softening gradually rather than undergoing a deep downturn. If you have questions or need more insights, feel free to reach out to your advisor at Valley National Financial Advisors.