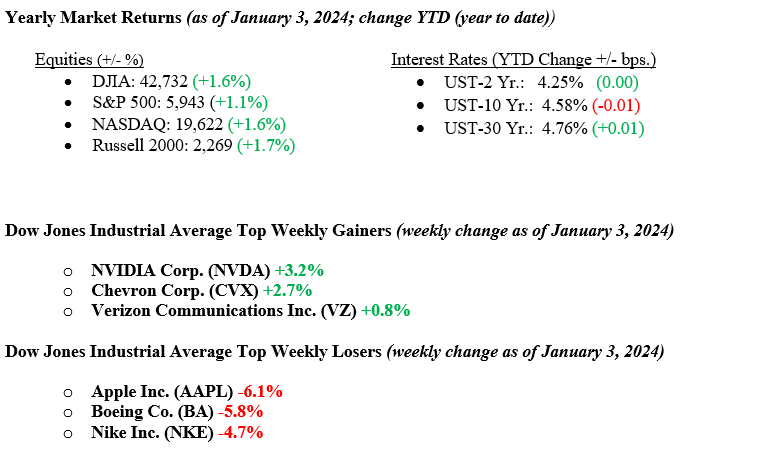

The stock market delivered a strong performance in 2024, defying expectations, with the S&P 500 gaining 25.0% and the Nasdaq Composite surging 29.6%. The Dow Jones Industrial Average was up 15.0% for the year. This marked the second consecutive year of 20%+ returns for the S&P 500, a feat not seen since 1998. The “Magnificent Seven” tech stocks contributed significantly, especially in the year’s first half. Ten out of eleven large-cap sectors finished higher for the year, with Communications leading at 40.2% and Materials lagging with flat returns. The market’s strength broadened in the year’s second half, with smaller caps also performing well: the S&P Midcap 400 gained 13.9%, and the Russell 2000 rose 11.5%. Historically, the S&P 500’s two-year total return of 57.8% was its strongest in over 25 years. This remarkable performance occurred against a backdrop of continued economic strength, including 2.7% GDP growth, a 4.2% unemployment rate, and a 3.7% growth in consumer spending. Despite some year-end profit-taking, the overall sentiment remained positive, with S&P 500 corporate earnings forecasted to grow 9.4% for 2024 and 14.8% in 2025, setting the stage for continued optimism in the financial markets. The 10-year U.S. Treasury bond ended the year at 4.58%, up from 3.88% at year-end 2023. Markets are now pricing in just one additional interest rate cut in 2025 as disinflation has slowed and labor markets remain resilient.

U.S. & Global Economy

The U.S. economy demonstrated remarkable resilience in 2024, significantly outpacing other major global economies. The IMF revised U.S. growth forecast to 2.8% for 2024 and 2.2% for 2025, reinforcing the U.S.’s position as a dominant force among G7 nations, outshining economic powerhouses like Japan and Germany. This impressive performance was fueled by robust consumer spending, a resilient labor market, and strong productivity growth, all of which helped sustain domestic demand and investment. Moreover, the U.S. benefited from long-term structural advantages often underestimated by global observers. These include an unparalleled culture of innovation and entrepreneurship, energy independence, expanding onshore manufacturing, strong corporate balance sheets, and increasingly healthy household finances. Together, these factors enabled the U.S. economy to navigate global disruptions with greater agility than many of its peers, reinforcing its leadership in the worldwide marketplace. With an economy that continues to evolve and adapt, looking ahead to 2025, economists expect a modest slowdown due to the full effect of tightening monetary policies. However, the outlook remains positive, with the U.S. projected to maintain its economic momentum, supported by continued job growth, easing inflation, and a stable GDP growth rate estimated to be around 2.0%. This positions the U.S. to weather short-term challenges and emerge as an even more competitive, resilient economy in the long term.

Policy and Politics

The year 2024 was marked by significant political activity in the United States. President Joe Biden’s withdrawal from the presidential race in July led Vice President Kamala Harris to become the Democratic nominee. In a historic comeback, Donald Trump secured the presidency, defeating Harris in the general election and becoming the first president since Grover Cleveland to be elected to non-consecutive terms. The Republican Party achieved a trifecta, gaining control of the White House, Senate, and House of Representatives. Looking ahead to 2025, investors will watch for a potential shift in U.S. foreign policy, including changes in aid to Ukraine and NATO relations. Economic policies to monitor include possible tariff increases and immigration reforms. Additionally, Trump’s promises to implement significant changes in various sectors may impact market dynamics and international relations in the coming year.

Economic Numbers to Watch This Week

- U.S. S&P final Services PMI for December 2024, previously 58.5

- U.S. Factory Orders for November 2024, previously +0.2%

- U.S. ISM services for December 2024, previously 52.1%

- U.S. Job opening for November 2024, previously 7.7 million.

- U.S. ADP employment for December 2024, previously 146,000

- U.S. Initial Claims for Unemployment Insurance for the week of Jan 4, 2025, previously 211,000.

- U.S. Employment Report for December 2024, previously +227,000

- U.S. Unemployment Rate for December 2024, previously 4.2%

Investors will be closely monitoring several key events and data releases this week, with the December jobs report on Friday being the most anticipated. The consensus is for 153,000 new non-farm payrolls and an unemployment rate holding steady at 4.2%, providing essential insights into the labor market and potentially influencing Federal Reserve policy. Other economic indicators, such as job openings, ADP private payrolls, and ISM employment data, will also help shape job report expectations. Additionally, Q4 2024 earnings season kicks off next week, starting with major banks. Analysts expect S&P 500 companies to report a solid 11.9% increase in earnings per share for the quarter. If you have any questions or need further insights, please get in touch with your advisor at Valley National Financial Advisors.