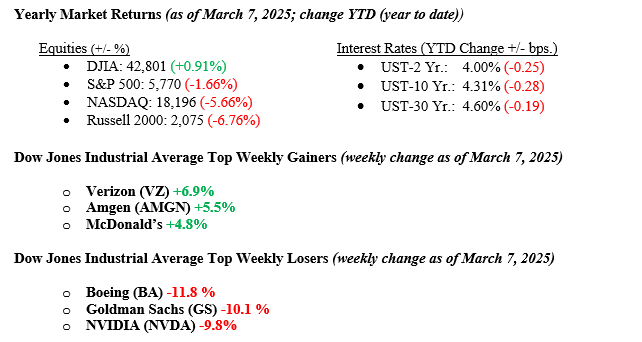

U.S. stock markets experienced a challenging week, with the Dow Jones Industrial Average dropping 2.4%, the S&P 500 down 3.10%, and the tech-heavy Nasdaq losing 3.3%. Small-cap stocks, represented by the Russell 2000, saw a steeper decline of 4.1%. Investor sentiment was weighed down by ongoing uncertainty around trade policy and its potential impact on economic growth and inflation. While consumer non-durables, health services, and communications stocks showed resilience, sectors like consumer durables, technology, and retail underperformed. On Friday, Federal Reserve Chairman Jerome Powell assured that “the economy is fine” but acknowledged heightened uncertainty in trade, immigration, fiscal policy, and regulation. The 10-year U.S. Treasury bond yield ended at 4.31%, 15 basis points higher than the previous week.

U.S. & Global Economy

Last week, U.S. economic data showed a mix of positive and negative trends. On Monday, the final U.S. manufacturing PMI for February came in at 52.7, slightly better than expected, while construction spending for January dropped 0.2%, missing expectations. The ISM manufacturing index also showed a slight slowdown at 50.3%. On Wednesday, the Federal Reserve’s Beige Book indicated modest economic growth but noted lower consumer spending, higher price sensitivity, and moderate price increases in most districts. The ADP employment report revealed a sharp slowdown in job growth, with only 77,000 jobs added in February, well below expectations. However, the final services PMI showed a positive shift to 51%, and factory orders rose 1.7%. The ISM services index also improved to 53.5%. On Thursday, initial jobless claims were lower than expected at 221,000, while the U.S. trade deficit widened to $131.4 billion. Friday’s jobs report revealed that 151,000 jobs were added in February, slightly missing expectations, and the unemployment rate rose to 4.1%. Hourly wages grew by 0.3%, matching expectations, but down from January’s 0.5% increase.

Policy and Politics

The week ending March 8, 2025, saw notable developments in both global geopolitical tensions and U.S. trade policy. In Ukraine, Russian forces escalated their offensive, making significant gains in Kursk Oblast and launching one of the largest missile and drone attacks on Ukrainian targets in recent months. The suspension of U.S. military aid and intelligence sharing with Ukraine has strengthened Russia’s position, undermining Ukraine’s negotiating leverage on territorial matters. On the trade front, President Trump introduced new tariffs on imports from Canada, Mexico, and China, ranging from 10% to 25%, signaling a more aggressive stance on trade imbalances. Additionally, the administration launched a review of what it described as unfair and non-reciprocal foreign trade practices, which could pave the way for more targeted trade measures. These actions align with Trump’s ongoing efforts to boost U.S. manufacturing and address trade imbalances. Still, they have raised concerns over potential economic fallout, including disruptions to supply chains and tensions with international trade partners.

Economic Numbers to Watch This Week

- U.S. NFIB optimism index for February 2025, prior level, 102.8

- U.S. Job Openings for January 2025, prior level, 7.6 million

- U.S. Consumer Price Index for February 2025, prior level, +0.5%

- U.S. Initial Claims for Unemployment Insurance for the week of March 1, 2025, prior 221,000

- U.S. Producer Price Index for February 2025, prior rate +0.4%

- U.S. Consumer sentiment (prelim), for March 2025, prior level 65.7

For the week ahead, key earnings reports from Oracle, Dick’s Sporting Goods, Adobe, Lennar, and Dollar General will provide insights into how different sectors are performing. Additionally, important economic data releases, including the NFIB Small Business Optimism Index, job openings, inflation reports (CPI and PPI), and consumer sentiment, will offer clues about the economy’s health and potential inflationary pressures. Given the recent market volatility, it is important to remember that pullbacks are a regular part of investing. While market fluctuations can be unsettling, history shows that, despite varying in length and severity, market downturns have always been followed by recoveries, with the market eventually reaching new highs. Investors should maintain a long-term perspective, staying focused on fundamentals and the broader economic and corporate growth trend rather than reacting to short-term volatility. If you have any questions or need more information, feel free to reach out to your advisor at Valley National Financial Advisors.