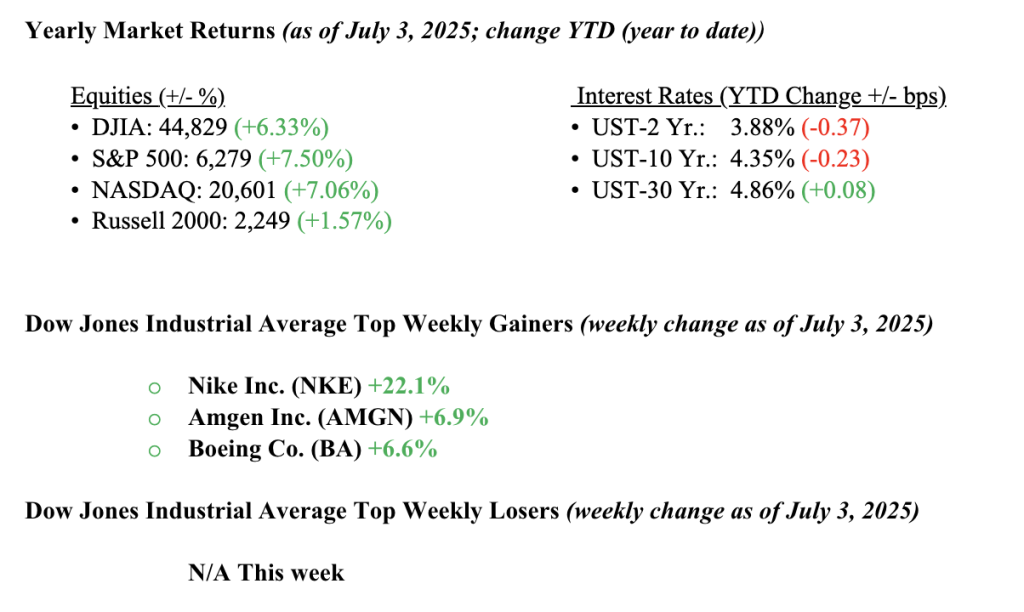

During the holiday-shortened week of June 30 to July 3, 2025, all three major U.S. stock market indexes recorded gains, supported by a robust labor report from the U.S. Bureau of Labor Statistics, which reported the creation of 147,000 new jobs in June, surpassing all analyst expectations. This upward movement propelled all indexes into positive year-to-date territory as of July 3, with notable strength in financials and materials sectors, alongside a significant rally in small-cap stocks that lifted the Russell 2000 to a +1.6% year-to-date return. The positive market sentiment was further bolstered by ongoing, albeit gradual, progress in resolving global and U.S. tariff policies, as well as the final passage of President Trump’s One, Big Beautiful Bill, which is anticipated to stimulate increased foreign and domestic investment in the U.S., particularly through enhanced capital expenditures by U.S. companies due to favorable tax treatments. U.S. Treasury bonds experienced a modest rally amid a slight sell-off and risk-off sentiment, with the 10-year Treasury yield concluding the week at 4.35%.

U.S. & Global Economy

Last week’s U.S. economic data releases were a mixed bag. Manufacturing activity showed modest improvement, with the S&P final manufacturing PMI for June rising to 52.9 and ISM manufacturing ticking up to 49.0, though still in contraction territory. The Chicago PMI remained weak at 40.4. Construction spending unexpectedly declined by 0.3% in May. On the labor front, job openings rose to 7.8 million in May, exceeding expectations, while the June employment report showed a stronger-than-expected gain of 147,000 jobs, though nearly half were government hires. The unemployment rate dipped to 4.1%, and jobless claims came in slightly below forecasts. However, private sector hiring was disappointing, with ADP reporting a surprise decline of 33,000 jobs. Wage growth slowed to 0.2%, missing expectations and suggesting cooling labor cost pressures. Meanwhile, the trade deficit widened to $71.5 billion in May, reflecting weaker net exports. Overall, the data indicates moderate economic activity with signs of the labor market slightly softening beneath the surface.

Policy and Politics

- U.S. politics last week was dominated by President Trump’s signing of the “Big Beautiful Bill,” a sweeping tax cut and spending package that narrowly passed Congress, with Vice President JD Vance casting the deciding vote in the Senate. The bill delivers significant tax cuts but includes deep rollbacks to safety-net programs like Medicaid and food stamps, drawing strong opposition from Democrats and some moderate Republicans. It’s already shaping up to be a major flashpoint in the upcoming 2026 midterm elections. On the trade front, attention turned to the administration’s 90-day freeze on broad U.S. tariffs, which is set to expire on July 9. President Trump signaled that he didn’t plan to extend the pause, though his advisers suggested that countries showing progress in negotiations might get an extension until August 1. Warning letters about new tariffs are expected to go out soon, creating uncertainty for businesses and trade partners. In other developments, Elon Musk announced the creation of a new third party, adding a wildcard to the 2026 political landscape.

Economic Numbers to Watch This Week

- U.S. NFIB optimism index for June 2025, prior reading 98.8

- U.S. Consumer credit for May 2025, prior reading $17.9 billion

- U.S. Claims for Unemployment Insurance for the week of July 5th, 2025, prior level 233,000

- U.S. Minutes of Fed’s May FOMC meeting

This week, investors will be focused on the upcoming July 9 deadline for the U.S. tariff pause, watching for possible trade deals or extensions with key partners like the EU, Japan, India, and China. While the White House downplays the urgency, uncertainty remains, and any surprises could shake markets, which are currently near record highs after a strong rally last week. Investors are also paying close attention to key economic data releases, including the U.S. NFIB small business optimism index for June, consumer credit for May, weekly jobless claims, and the Fed’s May FOMC meeting minutes. With the Q2 earnings season starting soon and interest rate cuts now expected in September rather than July, the market faces a mix of optimism and risk, making volatility more likely as trade developments and investor sentiment take center stage. However, our mantra remains steadfast: be mindful of risks, but stick to a well-developed investment and financial plan, because long-term generational wealth is created that way. We encourage you to contact your Valley National Financial Advisor for personalized insights or support.