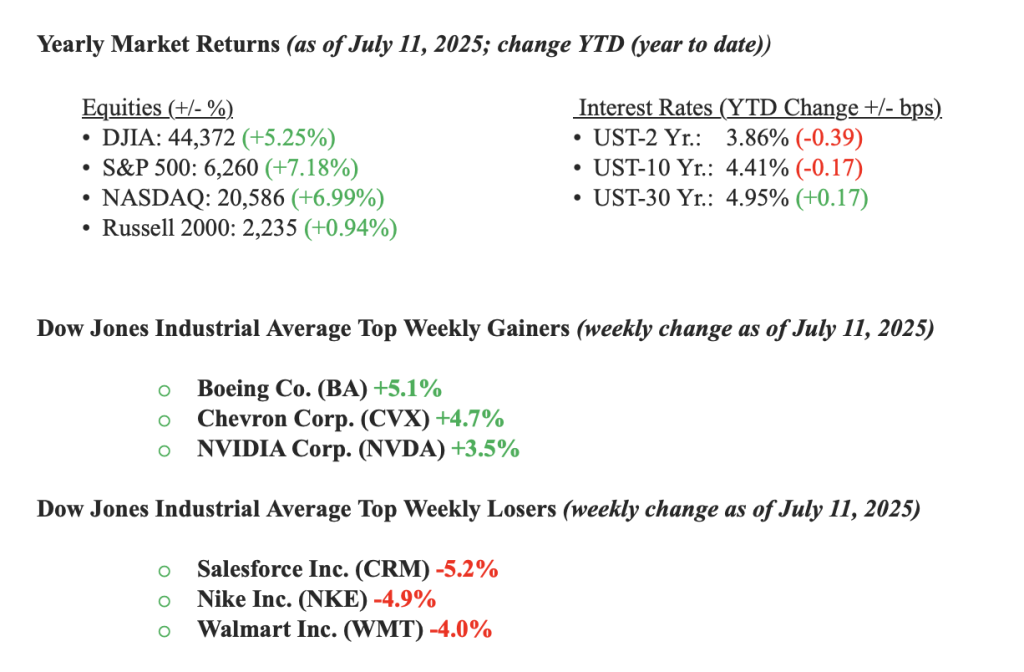

Last week, U.S. stock markets posted modest declines, with the S&P 500 down 0.3%, the Dow down 0.6%, and the Nasdaq slipping 0.2%. This came despite earlier record highs, driven by optimism over AI-driven earnings and potential Federal Reserve rate cuts, even as new tariff tensions emerged. Tech stocks remained resilient, while financials and healthcare underperformed. High-yield bonds signaled investor confidence, with spreads narrowing to their lowest levels since 2021. Global bond funds also attracted $16 billion in inflows. U.S. Treasury yields ticked higher, reflecting mixed signals from labor market data and trade developments. The 10-year yield rose to 4.41%, the 2-year to 3.89%, and the 30-year to 4.95%. Overall, markets appeared to strike a balance, steady equity performance alongside cautious moves in bonds, amid strong jobs data and ongoing trade uncertainties. Despite a robust labor market and strength in the tech sector, President Trump’s shifting tariff policies continue to inject significant policy uncertainty into the economic outlook.

U.S. & Global Economy

Last week, the U.S. labor market showed continued resilience as unemployment claims fell to 227,000, remaining within historically healthy levels. In a major policy shift, President Trump announced 30% tariffs on imports from the European Union and Mexico, effective August 1, escalating trade tensions and prompting swift responses from key U.S. partners. Despite these geopolitical disruptions, a Wall Street Journal survey of economists revealed improving sentiment, with reduced recession risk and expectations for modest GDP growth and easing inflation through late 2025. Meanwhile, global markets absorbed the tariff news with some volatility, but strong demand for U.S. Treasury bonds—especially the 10-year note—signaled investor confidence, while metals such as copper rallied on the outlook for infrastructure and AI-led growth.

Policy and Politics

- In U.S. politics last week, Washington developments were dominated by escalating trade tensions and major legislative moves with broad market implications. President Trump announced a 35% tariff on Canadian imports starting August 1 over fentanyl concerns and signaled the possibility of a blanket 15–20% tariff increase, along with a forthcoming letter to the EU, stoking fears of wider trade disruptions even as U.S.-China negotiations showed tentative progress. At the same time, the passage of the “One Big Beautiful Bill” on July 4 raised the debt ceiling by $5 trillion and included sweeping tax cuts and business-friendly measures, which helped buoy investor sentiment. However, the Federal Reserve’s June meeting minutes, released last week, revealed a more cautious tone, with most policymakers awaiting clearer data on tariff effects before considering a rate cut in September. These crosscurrents, fiscal stimulus versus trade uncertainty, left markets volatile, as investors grappled with short-term policy risks and long-term growth prospects, especially amid concerns that supply chain disruptions and inflationary pressures could challenge the narrative of economic resilience. Again, here, we are concerned about the impact on the markets by continued policy uncertainty from Washington.

Economic Numbers to Watch This Week

- U.S. Consumer Price Index YoY for June 2025, prior rate 2.35%

- U.S. Core Consumer Price Index YoY for June 2025, prior rate 2.77%

- U.S. Producer Price Index YoY for June 2025, prior rate 2.62%

- U.S. Core Producer Price Index YoY for June 2025, prior rate 3.03%

- U.S. Initial Claims for Unemployment Insurance for the week of July 12, prior 227,000

- U.S. Import Prices YoY for June 2025, prior rate 0.21%

- U.S. Export Prices YoY for June 2025, prior rate 1.68%

- U.S. Housing Starts for June 2025, prior rate 1.256M

- U.S. Index for Consumer Sentiment for July 2025, prior 60.70

As we wrap up the week ending July 11, 2025, U.S. stock markets showed resilience despite modest losses. Optimism around AI-driven earnings and the possibility of Federal Reserve rate cuts helped support sentiment, even as new 30% tariffs on EU and Mexican imports—announced by President Trump and set to take effect August 1, introduced fresh policy uncertainty. The passage of the $5 trillion “One Big Beautiful Bill,” which raises the debt ceiling and delivers broad tax cuts, further boosted investor confidence, supported by a healthy labor market, with weekly jobless claims holding steady at 227,000. However, mixed economic signals, including a slight rise in Treasury yields (10-year at 4.41%), suggest ongoing volatility. Looking ahead, markets will turn their focus to this week’s key data releases, including inflation figures and the University of Michigan Consumer Sentiment report, as well as the kickoff of Q2 earnings season, with results expected from JPMorgan, Wells Fargo, Citigroup, Bank of America, American Express, and Taiwan Semiconductor. At Valley National Financial Advisors, we remain vigilant, recognizing the market’s efficiency while monitoring the impact of policy shifts, and we encourage you to consult your advisor for tailored guidance amidst these dynamic conditions.