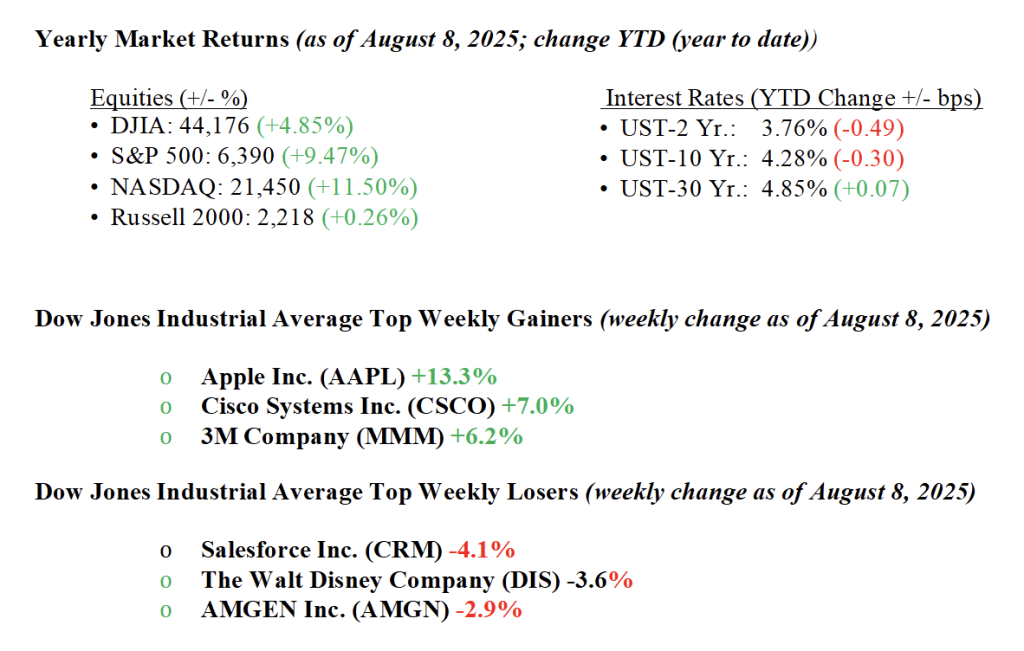

U.S. markets bounced back last week, with the S&P 500 up 2.48%, the Nasdaq jumping 3.91% to a new all-time high, its best week since June, and the Dow adding 1.45%. Tech stocks led the charge, gaining 4.3%, while the energy sector was the weakest, down 1.0%. Solid Q2 earnings helped fuel the rally, with about 80% of S&P 500 companies beating expectations so far. Hopes for easing geopolitical tensions also gave markets a lift, as Trump and Putin are expected to meet next week. At the same time, trade tensions escalated with the rollout of Trump’s “reciprocal tariff” policy, which imposed 10%–50% tariffs on imports from nearly 200 countries, thereby pushing the average U.S. tariff rate above 18%. Chip imports could face 100% tariffs unless companies boost U.S. production, though firms like TSMC and Apple’s partners secured exemptions thanks to new investment plans. Trump also floated a new tariff on pharmaceutical imports, starting small but potentially climbing as high as 250% within 18 months. Despite growing expectations for a Fed rate cut in September, now priced at over 90%, demand for government debt was soft, with both the 10- and 30-year Treasury auctions showing weak results. The 10-year note yield rose to end the week at 4.28%.

U.S. & Global Economy

- Economic data from last week painted a slightly mixed picture of the U.S. economy. On the bright side, Q2 labor productivity jumped 2.4%, the best in several years, helping ease concerns about rising labor costs, which increased just 1.6%. The trade deficit also narrowed to $60.2 billion in June, its lowest in two years, thanks to a drop in imports, which gave a boost to GDP. However, not all was upbeat. The ISM services index for July barely held above growth territory at 50.1, showing signs of slowing demand and softer hiring. Meanwhile, initial jobless claims ticked up to 226,000, and earlier employment gains were revised lower, hinting at some cooling in the jobs market. Overall, while productivity and trade data offered some good news, softer services activity and labor revisions suggest the economy may be losing momentum heading into late summer.

Policy and Politics

- Another victory for Trump’s foreign policy came later in the week. In a rugged section of the South Caucasus sits a possibly vital commerce path—one that borders multiple political hotspots, sparking numerous clashes across eras, even into modern times. And it’s soon to be titled after Donald Trump. Its fresh abbreviation, revealed Friday in Washington, is TRIPP (the Trump Path for Global Harmony and Wealth), a component of a larger pact designed to resolve the enduring dispute between ex-Soviet countries Azerbaijan and Armenia. The path will traverse Armenia, connecting Azerbaijan’s mainland to an Azerbaijani pocket adjacent to Turkey to the west. Armenia had earlier opposed a passage route as an infringement on its territory, but a U.S.-supported transit and connection link ultimately surmounted its resistance.

- There are “substantial harmony benefits” from an accord between Azerbaijan and Armenia — which have battled frequently over generations, including twice lately — according to a Bloomberg Economics review. The Trump government has promoted the accord, sealed at a White House gathering with Armenian leader Nikol Pashinyan and Azerbaijani chief Ilham Aliyev, as a blow to Russia and Iran.

- TRIPP — alternatively called the Zangezur Passage by Turkey and Azerbaijan — adds to an expanding array of conveyance choices linking resource-abundant Central Asia and Europe. The potential financial victor could be Turkey, whose commercial ties with Armenia have been closed since the 1990s. Whether it will produce the wider advantages Washington foresees is uncertain, since it will demand ongoing involvement well past Friday’s events to create a larger political effect.

Economic Numbers to Watch This Week

- U.S. NFIB optimism index for July 2025, previous 98.6

- U.S. Consumer price index for July 2025, previous 0.3%

- U.S. Core CPI for July 2025, previous 0.2%

- U.S. Monthly federal budget for July 2025, previous $244.0 billion surplus

- U.S. Initial jobless claims for the week of August 9, 2025, previous 226,000

- U.S. Producer price index for July 2025, previous 0.0%

- U.S. Core PPI for July 2025, previous 0.0%

- U.S. Retail sales for July 2025, previous 0.6%

- U.S. Retail sales minus autos for July 2025, previous 0.5%

- U.S. Empire State manufacturing survey for August 2025, previous 5.5

- U.S. Import price index for July 2025, previous 0.1%

- U.S. Consumer sentiment (prelim) for August 2025, previous 61.7

Looking ahead, markets will be focused this week on key economic data, including inflation, retail sales, and consumer sentiment, all of which could shape expectations for Fed policy. While most companies have already reported earnings, results from names like John Deere, Applied Materials, Cisco, and Circle Internet Group are still on deck. U.S. stock indexes are hovering near record highs after a strong July, but lingering uncertainty around inflation, tariffs, and policy direction is keeping investor sentiment in check. All eyes will also be on the anticipated Trump-Putin meeting, with hopes it could lead to progress toward a ceasefire in the Ukraine-Russia conflict. As always, at Valley National Financial Advisors, we’re watching developments closely and encourage clients to reach out with any questions about how current conditions may impact their financial plans.