Last week, the Dow Jones, S&P 500, Nasdaq, and Russell 2000 finished slightly lower, dropping less than 1%. Markets started the week strong, driven by optimism around a major AI-related partnership announced between NVIDIA and OpenAI, which pushed stocks to fresh highs. However, sentiment became more cautious by Tuesday as concerns began circulating about a potential AI spending bubble forming. Adding to the pullback, recent commentary from Federal Reserve officials pointed to a more tempered approach to monetary policy easing than investors had anticipated. Fed Chair Jerome Powell also weighed in on Tuesday, noting in a speech that equities appear “fairly highly valued,” further dampening investor confidence. Sector performance was mixed for the week, with energy and utilities emerging as top performers while communication services and materials underperformed. Oil prices jumped nearly 5% in commodities as President Trump urged European Union nations to stop purchasing Russian oil and gas, adding geopolitical tension to energy markets. Treasury yields rose for the week, with the 10-year U.S. Treasury yields increasing two basis points to end the week at 4.17%.

U.S. & Global Economy

- A series of economic reports last week offered a mostly positive view of the U.S. economy, highlighting continued resilience across several key areas. Manufacturing activity surprised to the upside while new home sales surged well above expectations, suggesting strength in the housing market. Initial jobless claims came in lower than forecasted, reinforcing signs of a stable labor market. The third estimate of Q2 GDP was revised to 3.8%, indicating stronger-than-expected economic growth. Consumer spending and personal income rose in August, slightly beating expectations, and inflation remained under control with the core PCE index increasing by just 0.2%, which was in line with forecasts and cooler than the previous month. While service activity and existing home sales were slightly softer than anticipated, the overall data supports a cautiously optimistic economic outlook.

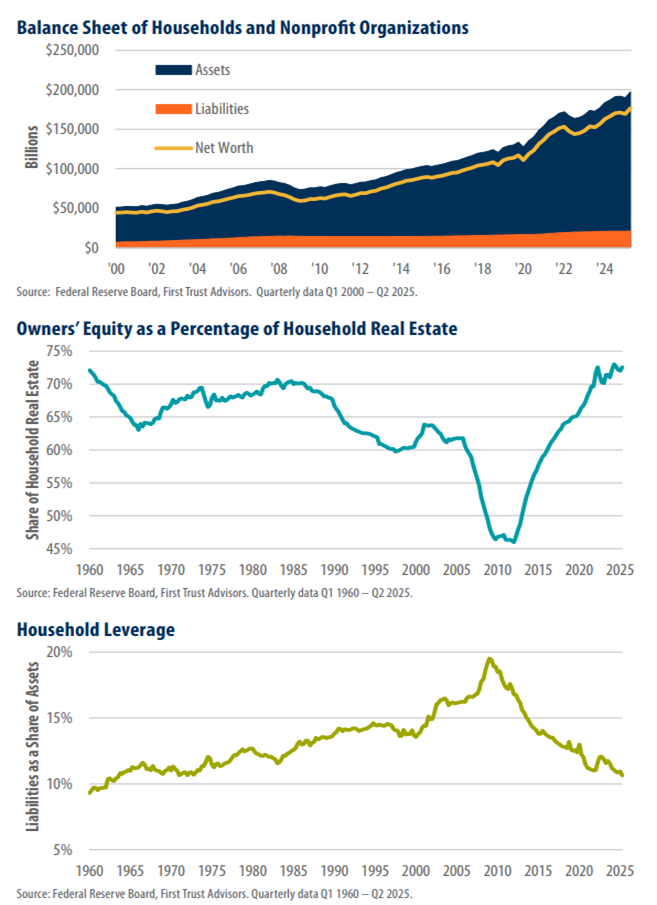

- Please see the charts below, highlighting the overall strength of the average U.S. household’s financial position. The first chart shows that household balance sheets remain healthy, with assets comfortably exceeding liabilities. The second chart illustrates the large amount of equity homeowners are currently holding, supported by sustained growth in housing prices. Finally, the third chart paints a positive picture of household leverage, with historically low debt levels relative to income. These charts point to a stable and resilient financial foundation for American households.

Policy and Politics

- In the U.S., Congress is working against the clock to pass a funding bill and avoid a potential government shutdown on October 1. Meanwhile, numerous Federal Reserve officials delivered speeches last week that struck a more cautious tone, casting doubt on the likelihood of interest rate cuts in the near term as inflation pressures persist. Internationally, the war in Ukraine continues without major shifts on the battlefield. While the conflict between Israel and Hamas remains ongoing, recent days have seen a relative decrease in large-scale violence amid continued diplomatic efforts.

This week’s focus is on the labor market, with key data releases including job openings, the ADP employment report, weekly jobless claims, and the highly anticipated U.S. employment report. Investors will be closely monitoring these figures to assess the job market’s health, particularly as several Federal Reserve officials have highlighted concerns about a potential slowdown in hiring. On the corporate front, earnings reports from Nike, Carnival, Paychex, and a closely watched quarterly update from Tesla will draw significant attention. Over the past six months, global corporations have announced trillions of dollars in new investments into U.S. manufacturing, technology, and infrastructure, initiatives that are likely to support job creation and provide a favorable tailwind for economic growth. As always, at Valley National Financial Advisors, we watch developments closely and encourage clients to reach out with any questions about how current conditions may impact their financial plans.

Economic Numbers to Watch This Week

- U.S. Job openings for August 2025, previous 7.2 million

- U.S. Consumer confidence for September 2025, previous 97.4

- U.S. ADP employment for September 2025, previous 54,000

- U.S. Construction spending for August 2025, previous -0.1%

- U.S. S&P final U.S. manufacturing PMI for September 2025, previous 52.0

- U.S. ISM manufacturing for September 2025, previous 48.7%

- U.S. Auto sales for September 2025, previous 16.1 million

- U.S. Initial jobless claims for the week ending September 27, 2025, previous 218,000

- U.S. Factory orders for August 2025, previous -1.3%

- U.S. Employment report for September 2025, previous 22,000

- U.S. Unemployment rate for September 2025, previous 4.3%

- U.S. S&P final U.S. services PMI for September 2025, previous 53.9

- U.S. ISM services for September 2025, previous 52.0