Watch Q4 Market & Economic Update with CIO William Henderson

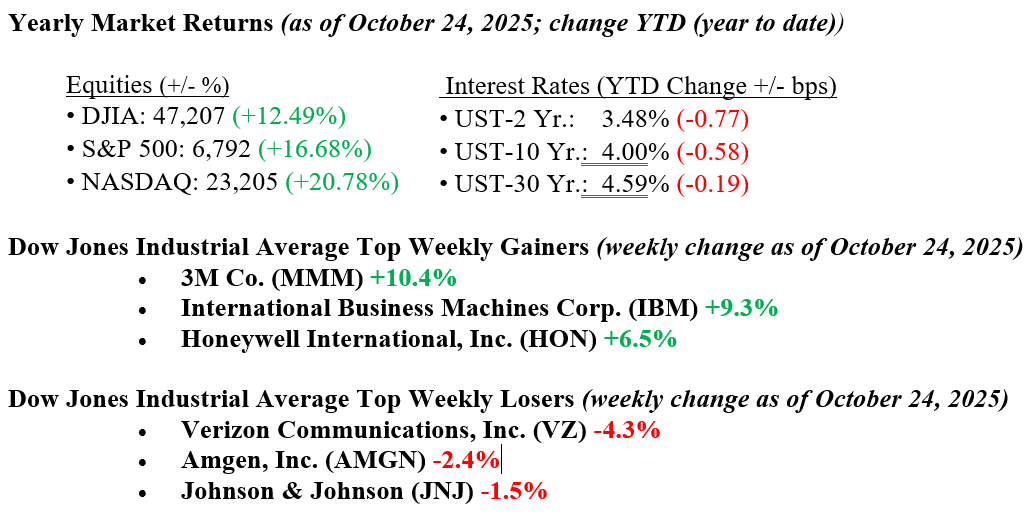

Equity markets continued their upward march as each major index rose about 2% last week, bringing year-to-date returns well into double-digit territory. Positive inflation reports showed that the U.S. CPI rose less than expected (+3.1%). As a result, markets have firmly priced in a rate cut at the next FOMC meeting (October 28–29), which is further good news for the stock market. Most companies are reporting better-than-expected earnings, demonstrating stronger resilience than many had feared and providing another key driver for higher stocks. U.S. Treasury yields moved very little on the news, with the 10-year yield falling one basis point on the week to 4.00%.

U.S. & Global Economy

- We continue to lack recent economic updates because of the ongoing government shutdown. Despite this, a few key data releases provided some insight into current trends. September’s existing home sales came in at 4.06 million, matching expectations and slightly above August’s 4.0 million, suggesting some stabilization in housing activity. Inflation data showed further cooling, with the headline CPI rising 0.3% versus the expected 0.4%, and the core CPI increasing just 0.2% compared to 0.4% in the prior month. The odds of a rate cut at this week’s Fed meeting stand at nearly 100%, reflecting growing confidence that monetary policy will continue to ease soon. Overall, last week’s earnings releases and corporate commentary highlighted strong business performance, resilient consumer spending, and growing market expectations for potential Fed rate cuts as the labor market and broader data continue to send mixed signals.

Policy and Politics

- The ceasefire between Hamas and Israel is holding for now, but tensions are still high as both sides accuse each other of violating the truce. After talks with President Putin broke down, the U.S. slapped new sanctions on major Russian oil companies, sending oil prices up about 5%. Meanwhile, all eyes are on the upcoming Trump-Xi summit, which could signal a step toward easing U.S.-China trade tensions. In North America, the U.S. added new tariffs on Canadian imports, adding some strain to an otherwise steady trade relationship. Tensions are also rising with Venezuela as Washington reinstated sanctions on the country’s oil sector and accused President Maduro’s government of election interference and involvement in drug trafficking, drawing sharp criticism from Caracas and adding uncertainty over future energy cooperation.

In the week ahead, we will remain focused on the Federal Reserve meeting, with investors widely expecting a rate cut. Markets will also be looking closely for any guidance on future policy moves. Mega-cap tech earnings from Microsoft, Meta, Amazon, and Apple will also take center stage, with particular focus on capital expenditure plans and AI-related investments. Additionally, earnings from key financial services companies, such as Visa and Mastercard, will provide fresh insights into consumer spending trends. Beyond this, attention will remain on Washington for any signs of progress in resolving the ongoing government shutdown as well as anticipation building around President Trump’s upcoming meeting with China’s President Xi.

Economic Numbers to Watch This Week (Data subject to delay if government shutdown continues)

- U.S. Durable Goods Orders for September 2025, previous 2.9%

- U.S. S&P Case-Shiller Home Price Index (20 Cities) for August 2025, previous 1.8%

- U.S. Consumer Confidence for October 2025, previous 94.2

- U.S. Pending Home Sales for September 2025, previous 4.0%

- U.S. Initial Jobless Claims for the week ending October 25, 2025, previous N/A

- U.S. GDP for Q3 2025, previous 3.8%

- U.S. Personal Income for September 2025, previous 0.4%

- U.S. Consumer Spending for September 2025, previous 0.6%

- U.S. Personal Consumption Expenditures (PCE) Index for September 2025, previous 0.3%

- U.S. Federal Reserve Meeting / Rate Decision for October 29, 2025