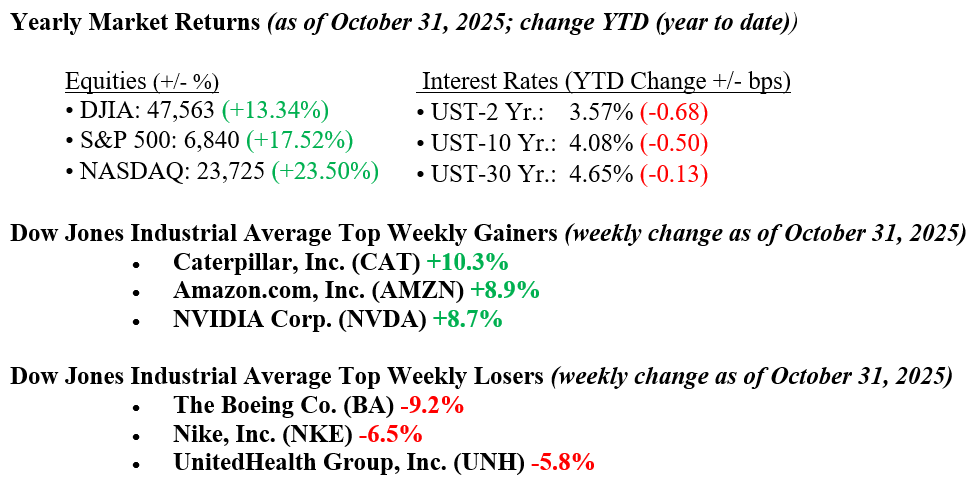

Equity markets extended their winning streak last week, with the major indexes gaining between 1% and 2% and logging in a sixth consecutive month of advances. Year-to-date returns (see figures below) remain solidly in double-digit territory, led by the tech-heavy NASDAQ, which is up 23.5% year-to-date in 2025. Although the Federal Reserve cut interest rates by 25 basis points at its two-day meeting, Chair Jay Powell expressed skepticism that additional cuts are imminent, instead emphasizing a data-dependent approach. For once, the market appears less preoccupied with the Fed’s next move and more focused on improving fundamentals, rising earnings, tighter cost controls, and the early payoff from AI-driven efficiencies. The bond market, by contrast, showed little enthusiasm for the Fed’s decision; the 10-year U.S. Treasury yield rose just eight basis points to end the week at 4.08%.

U.S. & Global Economy

- We continue to lack recent economic updates as the ongoing government shutdown has delayed nearly all data releases. Last week, the FOMC concluded its two-day policy meeting and lowered interest rates by 25 basis points, a move widely anticipated by Wall Street traders and economists. A brief press conference held by Chairman Powell after the meeting ended with a muted point expressing “doubt” about future rate cuts, instead emphasizing the importance of watching incoming data as a guide for future actions. On Tuesday, one of the few available reports, the Conference Board’s Consumer Confidence Index, showed that sentiment weakened slightly in October, falling to 94.6 from an upwardly revised 95.6 in September. The October reading was above the 93.2 that economists were expecting.

Policy and Politics

- While the U.S. Congress continues its stalemated shutdown, to expand U.S. economic influence abroad, President Trump concluded a prominent trip through Asia with the signing of mutual trade agreements with Malaysia, Cambodia, Thailand, and Vietnam. These deals encompass enhanced prospects for American exports, the elimination of duties on specific Southeast Asian products, and improved access to critical mineral resources, in addition to notable advancements in major trade agreements with South Korea and Japan, amounting to hundreds of billions in value. During the APEC summit in South Korea, President Trump further sought to ease strains with China by reducing specific tariffs on goods from Beijing, in exchange for greater U.S. market access for agricultural products. He intensified measures to curb the production of fentanyl-synthesizing precursors.

Earnings expectations continue to rise, with Wall Street analysts steadily increasing their forecasts. As of Friday, market strategists estimated that companies in the S&P 500 delivered average profit growth of 10.7% for the third quarter, according to FactSet data, a solid improvement from the 8.0% growth expected at the start of earnings season. Markets have rallied this year on the back of that earnings strength, increased capital spending on AI, and improved operating efficiencies. Since “Liberation Day” in April, the move across both equities and bonds has been remarkable, underscoring once again that staying the course, rather than reacting to short-term volatility, continues to reward the patient and disciplined investor. As always, please reach out to your financial professionals at Valley National Financial Advisors for questions or comments.

Economic Numbers to Watch This Week (Data subject to delay if government shutdown continues)

- U.S. Job Openings: Nonfarm for September, prior 7.227M

- U.S. Trade Balance on Goods and Services for August 2025, prior -$78.31B

- U.S. Durable Goods Orders MoM for August 2025, prior -2.76%

- ADP Employment Change for October 2025, prior -32,000

- ADP Median Pay YoY for October 2025, prior 4.50%

- U.S. Productivity for Q3 2025, prior 3.30%

- U.S. Labor Force Participation Rate for September 2025, prior 62.30%

- U.S. Nonfarm Payrolls for September 2025, prior 22,000

- U.S. Unemployment Rate for September 2025, prior 4.30%

- U.S. Index of Consumer Sentiment for November 2025, prior 53.60