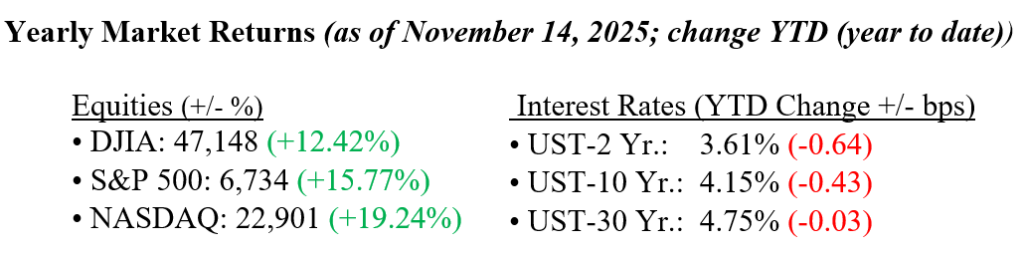

Equity markets were mixed last week, with the broader S&P 500 and Dow Jones Industrial Indexes closing higher while the tech-laden NASDAQ closed lower. Concerns about an AI bubble and overspend were top of mind with investors, while “old” economy stalwart stocks fared better. Furthermore, uncertainty about future rate cuts arose as Fed Chairman Jay Powell expressed skepticism about cutting rates due to the lack of economic data caused by the government shutdown. The CME Fed Watch Tool now indicates only a 50% probability of a December 10th rate cut, down from a 70% chance a week ago. Rate cuts are viewed as strong tailwinds for both stock and bond markets because they typically lower borrowing costs and encourage investment. The 10-year U.S. Treasury yield rose five basis points to end the week at 4.15%.

U.S. & Global Economy

- With the government shutdown now over, markets are awaiting long-delayed updates on key economic indicators, including retail sales, CPI and PPI inflation, and labor data. However, the White House has warned that the October jobs and inflation reports may never be released. This lack of fresh data has become a central concern for many Federal Reserve officials, who cite persistent inflation pressures and the risks of acting without reliable numbers make a December rate cut increasingly unlikely. The few economic indicators released last week offered mixed signals: the NFIB small-business optimism index for October held steady at 98.2%, while ADP’s four-week average of weekly employment fell sharply to –11.5k from +42k previously, reflecting growing uncertainty in the labor market.

Policy and Politics

- The Trump administration is considering reducing tariffs on key food imports such as coffee, beef, and bananas to help lower grocery prices. However, this move comes as the legality of Trump’s broader tariff program remains unresolved, with the Supreme Court currently reviewing whether he exceeded his authority under the International Emergency Economic Powers Act. Although lower courts have already ruled that the tariffs were likely unlawful, they allowed them to remain in place during the appeal process. A final decision is expected sometime in mid-2026. In parallel, tensions between the United States and Venezuela continue to rise, highlighted by the deployment of a U.S. aircraft carrier group in the Caribbean and increased Venezuelan military activity, further signaling a worsening security environment between the two countries.

Despite the ending of the government shutdown, markets enter the week still awaiting key economic data, with September jobs numbers expected this week, while October inflation and employment reports may never be released. Investors will also be closely watching NVIDIA’s earnings this week, as the company is expected to post strong results, but forward guidance and commentary about its largest customers, who account for nearly half of revenue, will likely drive market reactions. Overall, the week ahead will be focused on the combination of lingering data and uncertainty surrounding the Fed rate cut, as well as high-profile tech earnings that could influence sentiment, particularly amid growing concerns that the AI rally may be overextended. As always, please contact your financial professionals at Valley National Financial Advisors with any questions or comments.

Economic Numbers to Watch This Week

With the government shutdown over, economic data is starting to return, but it remains unclear which reports will be released and when.

- U.S. Empire State manufacturing survey for November, prior 10.7

- U.S. Home Builder Confidence Index for November, prior 37

- U.S. Business inventories for August, prior 0.2%

- U.S. Philadelphia Fed manufacturing survey for November, prior -12.8

- U.S. Employment Report for Sept, prior +22k

- U.S. Unemployment rate for September, prior 4.3%

- U.S. Existing home sales for October, prior 4.06 million

- U.S. S&P flash Services PMI for November, prior 54.8

- U.S. S&P flash Manufacturing PMI for November, prior 52.5

- U.S. Consumer sentiment (final) for November, prior 50.3