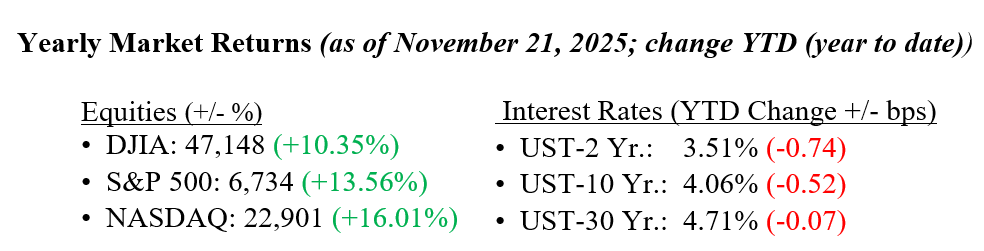

Major market indices have pulled back in recent weeks, with the S&P 500 and Nasdaq declining by more than 5% from their recent all-time highs. There are two primary reasons for this volatility. First, markets are adjusting to the likelihood that the Fed may not cut rates again in December. Second, some market observers suggest that the rapid growth in AI investment may indicate a bubble rather than a significant phase of corporate capital spending. Certainly, market volatility has increased, with the VIX Index at 26.4 as of November 20, compared to its long-term average of 18.3. This moderately elevated level reflects investor uncertainty, which is typical during periods of market adjustment. However, the VIX is still well below its April level of 52.3. Last week, while equity markets sold off, bond markets rallied with a small flight to quality trade. The 10-year U.S. Treasury yield fell nine basis points to end the week at 4.06%.

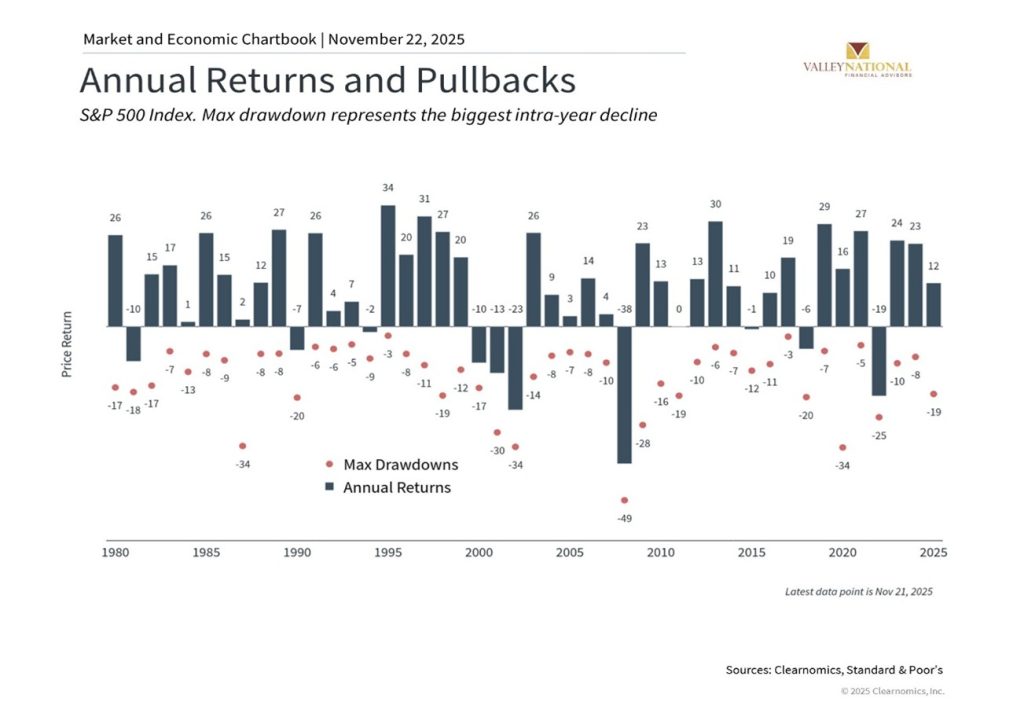

The chart below shows the performance of the stock market (bars) and the largest intra-year decline (dots) each year. The average year sees a stock market drop of -13.5%. However, most years still end in positive territory, averaging 9% gains. Volatility is a normal part of investing, and investors are often rewarded for being disciplined through short-term volatility.

U.S. & Global Economy

- With the government shutdown now resolved, the markets are poised for the release of postponed data on key indicators, including retail sales, CPI/PPI inflation, and labor market figures. Yet, the United States Department of Labor has signaled that the October employment and inflation reports may be permanently shelved, leaving a significant data gap. Many officials at the Federal Reserve are increasingly cautious, suggesting that without reliable benchmarks, the case for a December rate cut is weak.

- Last week’s available releases offer a mixed picture: the National Federation of Independent Business (NFIB) Small Business Optimism Index slid to 98.2 in October, down 0.6 points and marking the lowest level in six months. Meanwhile, the ADP Research Institute reported that private-sector employment grew by 42,000 jobs in October after two months of losses. While this rebound is a positive sign for the labor market, the gains were highly uneven; sectors such as education, healthcare, and trade experienced growth while professional/business services, as well as leisure/hospitality, continued to shed jobs. The unevenness adds to the Fed’s dilemma of gauging true labor-market strength amid incomplete data.

- In short, while activity appears stable, the reliability of the dataset is compromised, and the cautious tone from policymakers suggests markets should not yet assume easier policy ahead.

Policy and Politics

- The Trump administration is moving ahead with sweeping changes to food tariffs. As of November 13, 2025, it eliminated the 40% duty on certain Brazilian agricultural imports, including coffee, beef, sugar, and tropical fruits. This rollback is intended to ease consumer grocery-cost pressures ahead of the holidays. Still, the broader legality of the tariff program remains under scrutiny, as the Supreme Court of the United States prepares to evaluate whether President Trump exceeded his powers under the International Emergency Economic Powers Act. A final ruling is projected for mid-2026.

- On the security front, tensions between the Venezuela and the United States are escalating further: the Federal Aviation Administration issued a broad warning to airlines over Venezuelan airspace, citing “heightened military activity” and potential threats to civilian aircraft, while a full carrier strike group led by the USS Gerald R. Ford has been deployed into the Caribbean Sea, significantly expanding U.S. military presence near Venezuela’s coast. Together, these actions signal a strategic dual-track approach: economic relief through tariff relief for consumers and intensified regional security operations to pressure the Maduro regime, thereby raising the stakes for trade and geopolitical stability.

Despite the recent market volatility, year-to-date returns on cash, bonds, and stocks remain comfortably in “green” territory (see the numbers above). Volatility is a normal part of functioning financial markets. The U.S. economy continues to perform well, and economists expect a near 3.0% GDP growth rate for 2025. Further, capitalist countries around the world are also prospering and growing. While nothing is ever perfect, we are still experiencing an unemployment rate of 4.4%, a near-historic low, which represents a healthy and vibrant economy. Nvidia’s earnings were released last week, and while they beat EPS estimates, the excitement subsided quickly. In our opinion, markets that rely heavily on a single name are not healthy; instead, we prefer to see broadening earnings growth, and we are starting to see that in some companies beyond the tech sector. Stay focused on long-term results and a resilient financial plan. This week, we will see the Fed’s preferred gauge of inflation, the U.S. PCE Price Index, which will provide insight into the Fed’s next move on interest rates. As always, please get in touch with your financial professionals at Valley National Financial Advisors with any questions or comments.

Economic Numbers to Watch This Week

With the government shutdown over, economic data is starting to return, but it’s still unclear which reports will be released and when.

- U.S. Producer Price Index YoY for September 2025, prior rate 2.60%

- U.S. Core Producer Price Index YoY for September 2025, prior rate 2.83%

- U.S. PCE Price Index YoY for September 2025, prior rate 2.74%

- U.S. Core PCE Price Index YoY for September 2025, prior rate 2.91%

- U.S. Retail Sales for September, prior rate 0.6%

- U.S. Real GDP (revised) for 3Q 2025, prior level 3.80%

- U.S. Consumer Confidence for November, prior 94.6

- U.S. Initial Weekly Jobless Claims for the week of November 22, 2025, prior 220,000

- U.S. Durable-Goods Orders for September, prior 2.9%