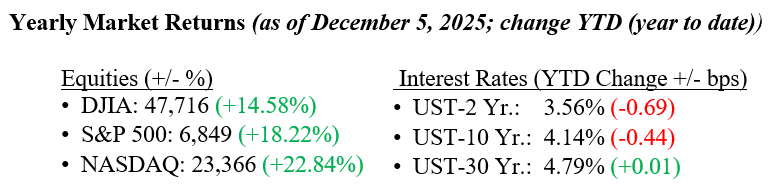

Equities ended the week just shy of all-time highs, fueled by widespread confidence that the Federal Reserve will deliver a 25-basis point rate cut at its meeting this week. The CME Fed Watch Tool is pricing in an 86% chance of a rate cut. In our opinion, markets are reacting to the dual prospect of lower interest rates and tax cuts in the coming year. Lower borrowing costs and the anticipated tax relief are expected to reignite growth, which we believe outweighs ongoing concerns about softening employment trends and unpredictable trade policies. That optimism drove major indexes to new peaks on Friday: The S&P 500 rose 0.2%, the Nasdaq advanced 0.3%, and the Dow Jones Industrial Average increased 0.2%. The 10-year Treasury yield rose 10 basis points last week, closing at 4.14%.

U.S. & Global Economy

- An article in Bloomberg on December 7, 2025, noted that “the real economy seems to be doing just fine.” India’s GDP grew 8.2% over the past year, and the OECD expects another 6.2% growth in 2026, along with positive growth forecasts for every other major region. If the global economy can remain resilient even in the face of Trump’s tariffs—the largest trade shock since World War II—that signals strong underlying momentum and remarkably solid fundamentals. Together, these trends highlight that global economic strength extends well beyond the United States, supporting the view that continued global expansion is underway.

Policy and Politics

- This week saw continued diplomatic pushes toward a potential Russia-Ukraine ceasefire, with Ukrainian delegates holding a third round of talks with U.S. officials in Florida even as Russia launched a large overnight barrage of drones and missiles across multiple Ukrainian regions and Kyiv intensified naval-drone strikes on Russian energy vessels. In trade policy, Washington moved forward with plans to maintain select tariff exclusions to stabilize supply chain pressures heading into the year-end. Tensions with Venezuela also remained elevated after President Trump’s declaration that its airspace was “closed,” spurring Venezuela’s temporary suspension of several flight permissions and adding to broader regional uncertainty.

With only a handful of trading days left in the year, there is not much time for either a Santa Rally or a Scrooge Sell-off. With that in mind, we maintain our long-term investment conviction, advising investors to look past near-term volatility and focus on the structural tailwinds. The OBBBA (One, Big, Beautiful Bill Act) will be a major catalyst for 2026, set to fuel capex-driven spending through permanent tax cuts and generous business deductions. The economy is fundamentally sound; the labor market, while slightly cooler, remains healthy, banks are well-capitalized, and corporate earnings are seeing solid growth. While the housing sector remains soft, we anticipate that lower interest rates will provide a boost to home sales and affordability in 2026. Ultimately, the resilience of the high-end consumer and broadening EPS growth will keep markets mostly calm, offsetting the risk of a “K-shaped” consumer divergence. As always, please reach out to your financial professionals at Valley National Financial Advisors with any questions or comments.

Economic Numbers to Watch This Week

With the government shutdown now resolved, economic data is beginning to flow again, though it remains uncertain which reports will be released and on what timeline.

- U.S. NFIB Small Business Optimism Index for November, prior 98.2

- U.S. Job Openings (JOLTS) for October, prior 7.2 million

- U.S. Employment Cost Index for Q3, prior 0.9%

- U.S. FOMC Interest-Rate Decision – Fed Chair Powell Press Conference

- U.S. Initial Weekly Jobless Claims for the week of December 6, prior 191,000

- U.S. Trade Deficit for September, prior –$59.6B