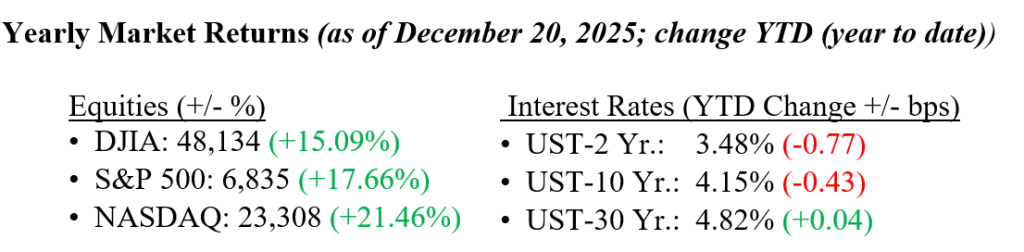

U.S. equity markets finished last week mixed, with the Dow Jones Industrial Average falling 0.6%, the Russell 2000 declining 0.9%, and modest gains elsewhere as the Nasdaq rose 0.5% and the S&P 500 edged up 0.1% for the week. Despite a weak start, markets reversed course later in the week, supported in part by an encouraging inflation report and strong earnings from semiconductor manufacturer Micron Technology, which helped improve sentiment around AI-related stocks. As of Friday’s close, both the Dow and the S&P 500 remain about 1.5% below their all-time highs, while the Nasdaq is less than 3% off its record, suggesting that investor confidence remains relatively strong as markets continue to look past near-term uncertainties. Even with some hawkish commentary from Federal Reserve officials, cooling CPI data has led futures markets to price in at least two rate cuts in 2026, with expectations that easing could begin in the first half of the year. The 10-year Treasury yield fell three basis points last week, closing at 4.15%.

U.S. & Global Economy

- Last week’s economic data provided mixed signals about the U.S. economy, as job growth improved but signs of slowing persisted. Employers added 64,000 jobs in November, beating expectations and rebounding from October’s decline, which was largely tied to temporary federal government job losses, while gains were led by health care and construction. At the same time, the unemployment rate rose to 4.6%, the highest level in more than four years. Inflation data later in the week showed a cooler reading, with the headline CPI rising 2.7% year over year and core inflation slowing to 2.6%, the lowest level since early 2021, helped by softer shelter costs. However, the inflation report came with an important caveat as the government shutdown limited data collection and required the BLS to make assumptions about October prices, which may have made the cooling in inflation, particularly shelter costs, appear better than it truly was. Meanwhile, business activity showed signs of slowing as December PMI data fell to a six-month low, reflecting softer growth and more cautious hiring.

Policy and Politics

- Global tensions remained elevated as the U.S. took a more confrontational stance abroad. The week was dominated by Venezuela after Trump announced a total naval blockade aimed at halting sanctioned oil shipments, raising the risk of confrontation as clashes at sea were reported and the possibility of open conflict with the Maduro regime was left on the table. In Ukraine, the war shifted toward high-tech and diplomatic fronts as Ukrainian forces carried out a notable naval strike on a Russian submarine while tentative peace discussions emerged even as Russia intensified attacks on Ukraine’s power grid. Meanwhile, tensions with China resurfaced after the U.S. approved a record arms sale to Taiwan, straining an already fragile trade truce.

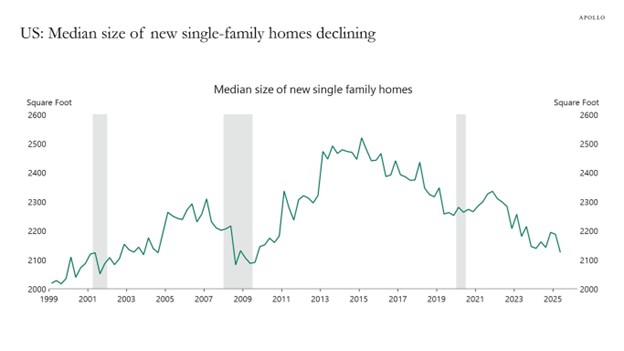

- President Trump continues to push for housing market reforms aimed at making homeownership more affordable and accessible. Mortgage rates are slowly coming down, but the current average 30-year rate of 6.21% remains high by recent historical standards. One way to make homes more affordable is by offering smaller homes, and that’s exactly what we’re seeing in the market. According to Apollo, the median size of new single-family homes in the U.S. has been shrinking since 2015. Looking ahead to 2026, we expect mortgage rates to continue a gradual decline, home sizes to stay smaller, and wages to grow, all of which could finally give the struggling housing market a boost.

This week, markets will focus on the delayed estimate of U.S. GDP for the third quarter, which is coming later than usual due to the government shutdown. After a solid 3.8% gain in the second quarter, investors will be looking for signs that economic growth is holding up or showing signs of slowing, which could influence sentiment and market positioning heading into the new year. Looking further into 2026, we remain cautiously optimistic. Strong earnings growth is expected to continue, and AI-driven productivity gains could provide an additional boost to the economy. Potential Fed rate cuts may also support markets, though risks persist from a cooling labor market, elevated equity valuations, and ongoing inflation pressures that could impact both consumer spending and corporate profits. Overall, while uncertainties persist, key economic and corporate factors indicate a positive yet measured growth environment next year. As always, please reach out to your financial professionals at Valley National Financial Advisors for questions or comments.

Economic Numbers to Watch This Week

- U.S. GDP for Q3 (delayed report), prior 3.8%

- U.S. Durable-Goods Orders for October (delayed report), prior 0.5%

- U.S. Consumer Confidence for December, prior 88.7, actual 91.7

- U.S. Initial Jobless Claims for the week of December 20, prior 224,000