Check out Looking Ahead: Seven Investment Themes for 2026 where Bill Henderson, Chief Investment Officer, highlights the key themes shaping the investment landscape as we close 2025. With diversified asset classes boosting portfolios, AI investments driving growth, and evolving monetary policies, investors must remain disciplined and focused on long-term strategies amidst economic and political developments.

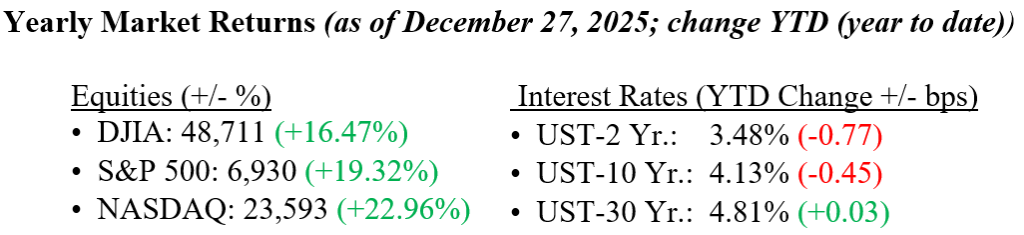

Patient investors were rewarded again as U.S. stocks finished the holiday-shortened week modestly higher. The S&P 500, Dow, and Nasdaq each gained about 1%, continuing broad strength across major indexes. Despite light trading volume post-Christmas, the indexes remain near record levels, with year-to-date returns showing strong double-digit performance, particularly in the tech-heavy Nasdaq. Upbeat economic data and continued investor enthusiasm for AI-focused technology stocks supported the week’s gains. Rate cut odds for January fell after stronger-than-expected economic data, but future markets continue to price in lower interest rates in 2026 as optimism around eventual Federal Reserve easing persists. Treasury yields remained relatively stable late in the week, with the 10-year note holding near 4.13%, underscoring sustained investor confidence as 2025 rolls to a lucrative end of the year.

U.S. & Global Economy

- Economic data released last week painted a generally resilient picture of the U.S. economy, with GDP growing at a faster-than-expected 4.3% annualized pace in the third quarter, largely driven by strong consumer spending. In contrast, October durable goods orders fell more than forecast due to a decline in transportation equipment, though core orders excluding defense and aircraft continued to rise, signaling steady business investment. While consumer confidence weakened further in December, the softer sentiment has not aligned with recent retail sales activity, underscoring the idea that what consumers do often matters more than what they say. Labor market data remained relatively firm, with weekly jobless claims falling but continuing claims edging higher. Taken together, the data supports a relatively optimistic outlook for the U.S. economy heading into 2026.

Policy and Politics

- Global geopolitical tensions remained elevated last week as U.S. foreign policy actions and diplomatic engagement unfolded on multiple fronts. Attention centered on Venezuela after President Trump announced a sweeping naval blockade intended to curb sanctioned oil exports, raising the risk of maritime confrontations and further straining relations with the Maduro regime. In Eastern Europe, the Ukraine conflict continued to evolve along both military and diplomatic lines; Ukrainian forces carried out additional high-tech naval operations against Russian assets while Russia stepped up strikes on Ukraine’s energy infrastructure. Against this backdrop, President Trump met with Ukrainian President Volodymyr Zelenskyy in a high-profile discussion aimed at assessing the path toward a potential ceasefire and future U.S. support, underscoring renewed diplomatic momentum despite ongoing fighting.

Markets enter year-end from a position of strength, rewarding investors who stayed the course in 2025, with solid double-digit equity gains and improving market breadth. Looking ahead to 2026, the backdrop remains constructive: corporate earnings are expected to continue to grow at low double-digit rates, AI-driven productivity gains continue to support longer-term expansion, and the prospect of Federal Reserve rate cuts adds a potential tailwind for both risk assets and the broader economy. While challenges remain, including a gradually cooling labor market, elevated valuations, and lingering inflation pressures, the combination of steady growth, easing monetary policy, and strong corporate fundamentals points to a favorable, though more measured, environment for investors who maintain discipline and a long-term perspective. As always, please reach out to your financial professionals at Valley National Financial Advisors for questions or comments.

Economic Numbers to Watch This Week

- U.S. Pending Home Sales YoY for November 2025, prior -0.39%

- U.S. Federal Reserve Meeting Minutes released from the Dec 9-10 meeting

- U.S. Initial Jobless Claims for the week of December 27, prior 214,000