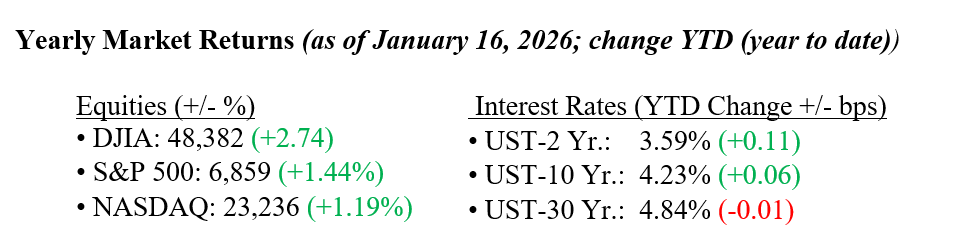

Markets were largely flat over the past week, with major indexes little changed, while small-cap stocks stood out, with the Russell 2000 gaining roughly 2%. Policy uncertainty in the U.S. continues to add noise with tariffs, funding deadlines, and broader political dynamics weighing on sentiment. Recent CPI and PPI reports came in largely in line with expectations, offering some relief even as inflation remains above the Fed’s long-term target. Bank earnings have been mixed but generally solid, supported by strong trading results, and management commentary suggests the economy is holding up better than feared with consumers continuing to spend and no major cracks emerging. The latest Beige Book echoed this view, pointing to improved growth, muted job creation, steady inflation, and a K-shaped consumer backdrop. Rounding out the week, strong results and upbeat guidance from Taiwan Semiconductor reinforced the view that AI-driven demand remains a powerful and durable theme. The yield on the 10-year U.S. Treasury note ended last week at 4.22%, six basis points higher than at year-end 2025.

U.S. & Global Economy

- This week’s economic data came in largely positive, reinforcing the view of a healthy underlying economic backdrop. Small business optimism edged higher, while retail sales surprised to the upside, suggesting resilient consumer demand despite tighter financial conditions. Inflation data were mixed but constructive, with headline CPI steady and core measures undershooting expectations, reinforcing the view that disinflation remains intact even as producer prices show modest firmness. Housing data were supportive, with both new and existing home sales exceeding forecasts, and labor market conditions remained tight as jobless claims fell below expectations. Manufacturing surveys from both New York and Philadelphia rebounded sharply into expansion territory, signaling improving momentum after prior softness. While month-to-month data continues to fluctuate, the broader picture points to a gradually stabilizing economy with improving growth prospects over the longer term.

Policy and Politics

- Policy and political developments continued to be a very active area over the past week, with several issues driving market and geopolitical attention. Tensions escalated in Iran as protests spread nationwide, with President Trump threatening potential U.S. airstrikes in support of demonstrators and Tehran warning that any U.S. action would trigger retaliation against Israel and regional U.S. targets. Friction also increased with key NATO allies after the administration announced new “Greenland tariffs” on several European nations, tied to opposition to a U.S. purchase of Greenland, raising concerns about further strain on trade and alliances. Domestically, uncertainty lingered as the Supreme Court again delayed a ruling on the legality of the administration’s global tariffs while relations between the White House and the Federal Reserve deteriorated further following a DOJ criminal probe into Fed Chair Jerome Powell, a move widely criticized as a threat to Fed independence. Adding to policy-driven volatility, Washington’s proposal to cap credit card interest rates pressured financial stocks early in the week and was a prominent topic on recent bank earnings calls, highlighting the continued influence of political risk on markets.

Looking ahead, the coming week is expected to be much like last week, with markets closely watching both fourth-quarter earnings and geopolitical developments. Investors will receive results from several high-profile companies, including Netflix, United Airlines, Johnson & Johnson, Halliburton, and Intel, which should provide further insight into corporate health and consumer trends. On the economic front, attention will remain on inflation, with the release of the Fed’s preferred gauge, the PCE index, for clues on price pressures. Continued geopolitical unrest could add to the recent volatility seen in oil prices, keeping risk sentiment elevated. Still, the market’s foundation looks solid, with low energy costs, slowing inflation, steady growth, and broadening earnings helping keep things stable even when headlines create swings. As always, please reach out to your financial professionals at Valley National Financial Advisors for questions or comments.

Economic Numbers to Watch This Week

- U.S. Initial Jobless Claims for the week of January 17, 2026, prior 198,000

- U.S. Gross Domestic Product (first revision) for Q3 2025, prior 4.3%

- U.S. Personal Income for November 2025 (delayed report), prior 0.4%

- U.S. Personal Spending for November 2025 (delayed report), prior 0.4%

- U.S. (PCE) Index for November 2025 prior 0.3%

- U.S. Core PCE Index for November 2025, prior 0.2%

- Consumer Sentiment (final) for January 2026, prior 54.0

- S&P Flash U.S. Services PMI for January 2026, prior 52.5

- S&P Flash U.S. Manufacturing PMI for January 2026, prior 51.8