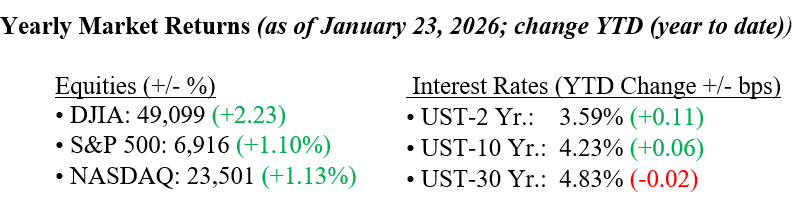

U.S. equity markets were a bit choppy last week, but swings remained in check, and major indexes ended with only modest losses. Midweek trading was driven by a brief Greenland tariff scare, which triggered the S&P 500’s largest one-day drop since October 2025. Most of those losses were quickly reversed after the White House signaled a change in direction, sparking a broad relief rally. Energy minerals and industrial services led sector performance, supported by accelerating AI capital spending and large fundraises from OpenAI and Anthropic that continue to drive demand for power and energy infrastructure. Tech and bank stocks rebounded later in the week. Oil prices started the week higher amid geopolitical tensions and tariff uncertainty, pushing WTI toward $61 per barrel, before easing into the weekend after President Trump signaled a potential reversal on a key position. Despite these headline-driven swings and cautious commentary from CEOs at Davos, an upward revision to Q3 GDP to 4.4% reinforced signs of domestic resilience heading into next week’s Fed meeting, where rates are widely expected to remain unchanged. The 10-year Treasury yield settled around 4.24% after briefly spiking earlier in the week.

U.S. & Global Economy

- Recent U.S. economic data show the economy holding up well, with GDP growth coming in stronger than initially reported, signaling that underlying momentum remains solid. Labor conditions stayed steady, layoffs remained low, and consumer sentiment improved from December, even as households continued to feel pressure from high prices. Inflation readings were largely in line with expectations, providing reassurance that price pressures are not reaccelerating. Business activity continued to expand, though at a more moderate pace, as higher costs and political uncertainty weighed on confidence. Housing remained a weak spot due to affordability challenges, while construction activity showed modest improvement. Overall, the data points to an economy that is still growing, driven by solid GDP and steady labor markets but gradually cooling, supporting expectations that the Federal Reserve will likely keep interest rates unchanged at its upcoming meeting.

Policy and Politics

- Policy and trade headlines drove a choppy week, with markets reacting quickly to shifting rhetoric and late-breaking developments. Early in the week, global equities sold off after renewed Greenland tariff threats sparked a flight to safe havens, though those concerns eased after President Trump walked back the rhetoric at Davos, helping fuel a midweek rebound. Attention also turned to Washington as the deadline for a proposed 10% cap on credit card APRs passed, with banks holding rates steady as the issue appeared to shift from executive pressure to a more measured legislative process. Political risk around the Fed eased after Supreme Court justices signaled skepticism toward efforts to remove a sitting Fed governor, reinforcing perceptions of central bank independence. Late in the week, new trade tensions surfaced with Canada following reports of a potential 100% tariff tied to its trade relationship with China, keeping headline risk elevated. Running alongside the policy noise, AI remained a dominant theme, with reports of massive funding plans and potential IPOs underscoring accelerating investment and growing focus on domestic energy and infrastructure needs.

As we enter the final week of January 2026, investors are turning their attention to a mix of monetary policy updates and earnings from the ‘Magnificent Seven’. Investors are bracing for the Federal Reserve’s first interest rate decision of the year on Wednesday. While a pause is widely anticipated, the subsequent press conference will be combed for clues regarding the 2026 rate path. The earnings spotlight intensifies as tech titans, including Microsoft, Meta, Apple, and Tesla, report results alongside financial heavyweights Visa and Mastercard, offering a critical progress report on the “AI super cycle” and the health of consumer spending. On the economic data front, updates on durable goods and the Producer Price Index (PPI) will provide further clarity on the trajectory of inflation. Despite the noise surrounding trade policy headlines and geopolitical shifts, the broader market narrative remains supported by resilient growth and expanding corporate profit margins. As always, the team at Valley National Financial Advisors is here to help you navigate these developments and answer any questions you may have.

Economic Numbers to Watch This Week

• U.S. Durable-Goods Orders for November 2025 (delayed report), prior -2.2%

• U.S. Consumer Confidence for January 2026, prior 89.1

• FOMC Interest-Rate Decision for January 28, 2026

• Fed Chair Powell Press Conference for January 28, 2026

• U.S. Initial Jobless Claims for the week of January 24, 2026, prior 200,000

• U.S. Factory Orders for November 2025 (delayed report), prior -1.3%

• U.S. Producer Price Index for December 2025 (delayed report), prior 0.2%

• U.S. Core Producer Price Index for December 2025, prior 0.2%