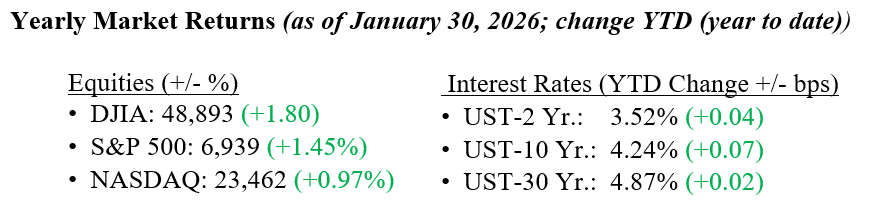

U.S. equity markets pushed higher early in the week, with the S&P 500 briefly hitting 7,000 as strong tech and AI-driven earnings momentum drove markets higher. Big Tech results mostly came in ahead of expectations, with AI capex and monetization the main themes, though Microsoft sold off after earnings amid heavy spending, margin pressure, and slower Azure growth, which took some shine off solid headline results. Tesla leaned further into the AI narrative, announcing a pause in production of select vehicles to shift resources toward the development of humanoid robots. Markets took the Fed’s rate decision in stride, with policymakers holding steady and sticking to a patient, data-dependent message. Oil stood out, rallying more than 7% to around $66 per barrel as tensions in Iran and the broader Middle East remained elevated. On the policy side, a deal to avert a government shutdown helped calm near-term nerves, while Mastercard pointed to resilient consumer spending with little sign of a broad pullback despite higher rates. Elsewhere, GM’s CEO warned of a “very slippery slope” as Canada opens the door to low-cost Chinese EV imports, underscoring rising trade and competitive pressures heading into February. The 10-year Treasury yield remained unchanged, closing the week at 4.24%.

U.S. & Global Economy

- Last week, investors worked through a heavy batch of delayed economic data and the Fed’s latest policy update. Early in the week, stronger-than-expected durable goods orders pointed to solid underlying demand, though sentiment softened after January consumer confidence fell well short of expectations. The Fed held rates steady, as expected, with Chair Powell emphasizing continued progress on inflation while signaling patience on the timing of eventual cuts. Labor market data remained steady, with jobless claims holding near recent lows, while producer inflation came in a bit hotter than expected, keeping some pressure on rates. Outside of the data, Amazon announced roughly 16,000 white-collar layoffs, while Tesla reinforced its pivot away from autos and toward humanoid robots and AI initiatives. Together, those developments have renewed focus on how AI and robotics could reshape long-term employment trends, an area investors will be watching closely in the months ahead.

Policy and Politics

- The all-important FOMC meeting was held last week, and at this January’s policy meeting, the Federal Reserve opted to leave interest rates unchanged, keeping the policy range steady. Officials struck a more constructive tone on economic conditions, noting continued expansion supported by steady household spending and increased business capital investment. Although employment growth has softened, the Committee acknowledged signs of greater balance in the labor market while also recognizing that inflation pressures have yet to subside fully. Taken together, the updated messaging suggests a central bank that is increasingly comfortable remaining on hold following several rate reductions late last year. Recent inflation trends show a gradual improvement in the Fed’s preferred PCE price measure, helped by easing price pressures in service-related categories. That progress has been partly offset by firmer goods prices, reflecting the influence of tariffs and supply factors. As a result, inflation remains above the Fed’s long-term objective, with the pace of improvement slowing compared to earlier periods.

As we head into the first full week of February, investor focus shifts squarely to the labor market and another busy slate of high-profile earnings. Friday’s monthly jobs report will be the main macro event, as markets look to see whether recent softness in hiring carried into January after December payrolls disappointed. Leading into that, ADP employment, job openings, jobless claims, and ISM surveys will help shape expectations around growth momentum and Fed policy. On the earnings front, results from Google, Amazon, AMD, Palantir, Pepsi, and Philip Morris will offer insight into AI demand, cloud spending, consumer resilience, and pricing power. Auto sales data and consumer sentiment updates will add color on household demand, while comments from Fed officials, including Atlanta Fed President Raphael Bostic, will be watched for any shifts in tone. With rates still on hold and markets sensitive to growth signals, the balance between slowing employment and steady consumption remains the key theme to watch in the days ahead. As always, the team at Valley National Financial Advisors is here to help you navigate these developments and answer any questions you may have.

Economic Numbers to Watch This Week

- S&P Flash U.S. Manufacturing PMI for January 2026, prior 51.9

- ISM Manufacturing Index for January 2026, prior 47.9%

- U.S. Job Openings (JOLTS) for December 2025, prior 7.1 million

- S&P Final U.S. Services PMI for January 2026, prior 52.5

- ISM Services Index for January 2026, prior 54.4%

- ADP Employment Report for January 2026, prior 41,000

- U.S. Initial Jobless Claims for the week of January 31, 2026, prior 209,000

- U.S. Employment Report for January 2026, prior 50,000

- U.S. Unemployment Rate for January 2026, prior 4.4%

- U.S. Consumer Sentiment (Preliminary) for February 2026, prior 56.4