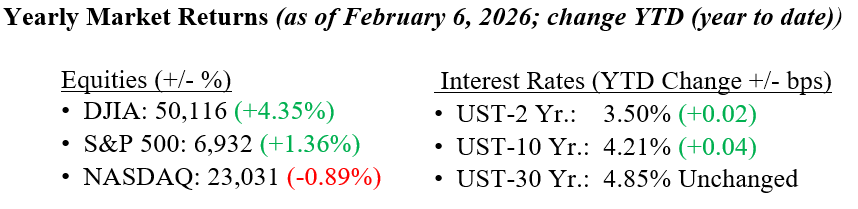

Last week, U.S. equity markets rebounded from Wall Street’s latest doomsday narrative, the so-called “SaaSpocalypse.” The selloff in the software-as-a-service sector reflected investor concerns about the long-term impact of AI on the SAAS industry, which we currently view as noise. An excellent Wall Street Journal article from Saturday (2/7/26), titled “The Road to Dow 50,000 Was Perilous,” echoes many of the points we’ve made here at TWC. It notes that markets have survived repeated “end-of-the-world” moments and have still gone on to reach new highs. No one can consistently predict when corrections will occur, making market timing extremely difficult. Investors also tend to be overly optimistic during booms and overly pessimistic during downturns, while long-term discipline has historically paid off. We would never argue that sell-offs don’t matter, but we have lived through the Crash of 1929, Black Monday, the dot-com bust, the Great Financial Crisis, the Flash Crash, and the COVID crash. Yes, they were all painful, but did the world end? Did “doomsday” arrive? No. Smart investors stayed the course and remained committed to their long-term investment plans. Full disclosure: Bull markets typically experience multiple 5–10% pullbacks along the way, and while we believe we are in a bull market, those risks are always present. The 10-year Treasury yield fell 3 basis points last week, closing at 4.21%.

U.S. & Global Economy

- During the week ending February 7, 2026, investors weighed resilient economic activity against persistent inflation and shifting expectations for Fed policy. Business investment trends remained constructive, with durable and core capital goods orders continuing to signal steady underlying demand. The University of Michigan’s latest reading showed consumer sentiment improving to 57.30 in February, rising for the third straight month in a row, though households still cited elevated prices and employment concerns as key risks.

- Federal Reserve Chairman Powell recently noted ongoing progress on inflation but emphasized a cautious, data-driven approach to potential rate cuts later in 2026. Labor conditions stayed relatively firm, as jobless claims hovered near historically low ranges, yet another upside surprise in producer prices kept pressure on yields and reinforced expectations for a choppy disinflation path. Meanwhile, corporate developments, including Amazon’s plan to cut an additional 16,000 white-collar roles, highlight continued restructuring tied to AI, keeping investors focused on the longer-term implications for employment, productivity, and growth.

Policy and Politics

- U.S. and global geopolitical strains stayed high in the week ending February 7, 2026, keeping energy markets nervous as headlines shifted day to day. Oil prices swung as investors weighed Iran-related risks, from military flare-ups to stalled nuclear negotiations, against episodes of diplomatic outreach that temporarily eased anxiety. Fears of possible interruptions to Middle East production and key shipping lanes continued to provide a floor for crude, even as talks in the region moved forward. Ongoing frictions around Russia’s sanctioned “shadow fleet” and stepped-up Western monitoring and enforcement added yet another source of uncertainty for global oil flows.

- In the U.S., Washington, D.C., remains dysfunctional, with each party threatening a shutdown or budget cuts. We hope much of this is simply posturing and dealmaking, and that, as in most years, things ultimately move forward, unfortunately, with taxpayers often footing the bill.

As the first full week of February unfolds, markets are still digesting evidence that the labor market has downshifted into a “low‑hiring, low‑firing” gear alongside a new wave of AI‑focused earnings. January’s early data, including softer private payroll gains from ADP, a further decline in job openings to their lowest level since 2020, and elevated layoff announcements, have reinforced the view that the labor market is cooling but not collapsing as we head into the official employment report later this week. Fed officials have echoed that mixed picture, with recent speeches emphasizing a labor market roughly in balance and a disinflation that is progressing but uneven, leaving policymakers cautious about the pace and extent of additional rate cuts. On the micro side, big tech companies continue to invest in AI at an extremely high pace, and we are encouraged by signs that companies across the economy are beginning to use AI to improve operational efficiency. With rates on hold and the inflation narrative giving way to a labor narrative, how investors reconcile softer hiring with still-reasonable consumer demand remains the key lens for interpreting incoming data and earnings surprises in the days ahead. As always, the team at Valley National Financial Advisors is here to help you navigate these developments and answer any questions you may have.

Economic Numbers to Watch This Week

- NFIB Small Business Optimism Index for January 2026, prior 99.5

- U.S. Retail Sales for December 2025, prior 0.6%

- Retail Sales (Ex-Autos) for December 2025, prior 0.5%

- U.S. Employment Report (Payrolls) for January 2026, prior 50,000

- U.S. Unemployment Rate for January 2026, prior 4.4%

- Initial Jobless Claims for week ending Feb. 7, 2026, prior 231,000

- Existing Home Sales for January 2026, prior 4.35 million

- Consumer Price Index (CPI) for January 2026, prior 0.3%

- Core CPI for January 2026, prior 0.2%