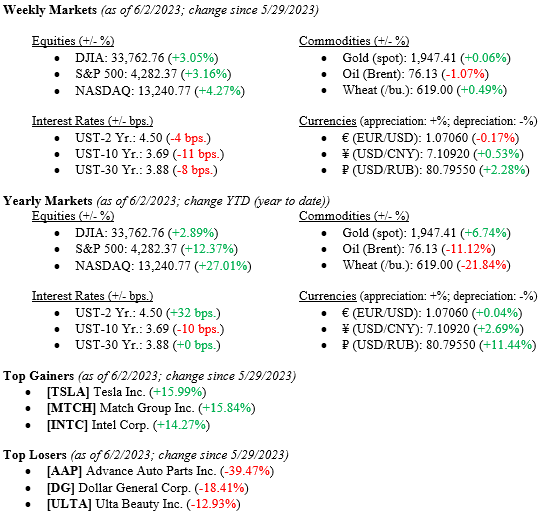

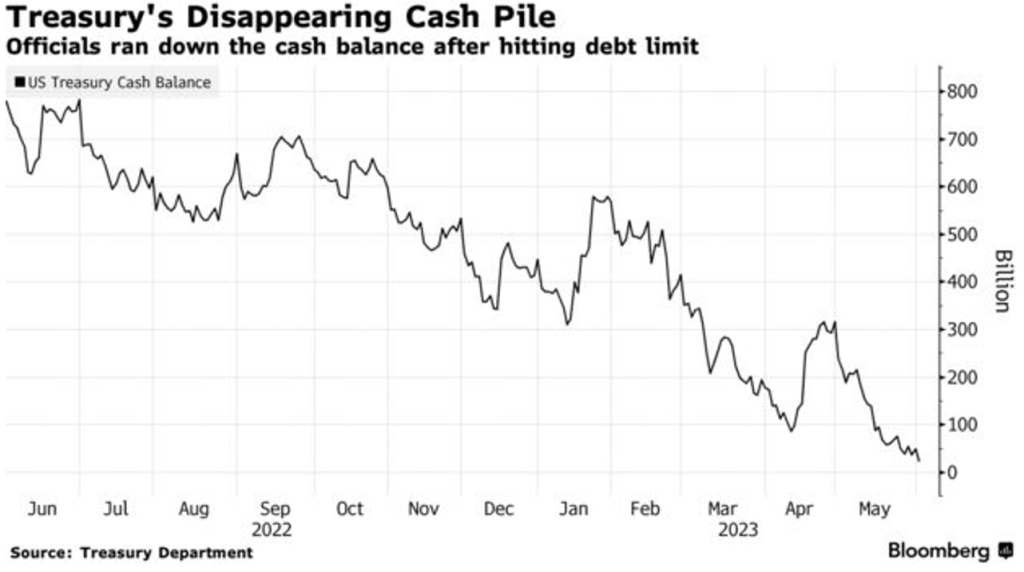

Major equity indices gained on the week overall, with the Dow up 3.05%, the S&P gaining 3.16%, and the NASDAQ up 4.27%. These positive moves came after the U.S. House and Senate each passed bills for the suspension of the debt ceiling until January 1st, 2025. Pres. Biden signed the bill on Saturday and allowed the Treasury to begin rebuilding its cash reserves, which recently dropped below $23 billion. Treasury bonds saw a slight rally, with yields on the 2Y, 10Y, and 30Y falling by 4 bps., 11 bps., and 8 bps., respectively.

Economy

The United States House and Senate each passed bills for the suspension of the debt ceiling last week, with President Biden signing it into law on Saturday. The ceiling was suspended until January 1st, 2025, pushing the issue off until after the election and leaving it for Congress to grapple with. This will allow the Treasury Department to begin issuing new debt again and rebuilding its cash reserves. Since it hit the debt ceiling in mid-January, the Treasury has been using emergency funds to pay debt obligations. Cash reserves dropped to $23 billion on June 1st.

Saudi Arabia announced that it will cut oil production by 1 million barrels per day, bringing its production to the lowest level in years. After the announcement, WTI (West Texas Intermediate) futures jumped 5% and are now trading around $74 per barrel (as of writing this). For reference, oil prices in New York dropped 11% in May as concerns over demand took hold. This leaves Saudi Arabia sacrificing market share to stabilize the market while other OPEC+ members maintain their production cuts through the end of 2024.

What to Watch

- Monday, June 5th

- U.S. Retail Gas Price at 4:30PM (Prior: $3.684/gal.)

- Thursday, June 8th

- 30 Year Mortgage Rate at 12:00PM (Prior: 6.79%)

With the debt ceiling issue solved until 2025, the markets will now focus on the outcome of next week’s FOMC (Federal Open Market Committee) meeting (June 13 – 14). Fed Funds Futures are pricing in a 75% chance of pause in rate hikes, which would signal an end to the current rate hike cycle. Markets may view this move as a positive action. However, we believe the language coming out of the meeting will be more important than the actual interest rate move, so pay attention to Chairman Powell’s press conference. As noted above, equity indexes are higher year-to-date, especially the tech-heavy NASDAQ, which is up +27.0% year-to-date. Certainly, the NASDAQ represents the riskiest of equity indexes, and we always stress diversification when investing, and given that all major indexes are showing positive returns year-to-date, we also always stress the importance of staying investing and keeping to a long-term plan. That plan is working well this year. Reach out to your professional advisor at Valley National Financial Advisors for assistance or questions.