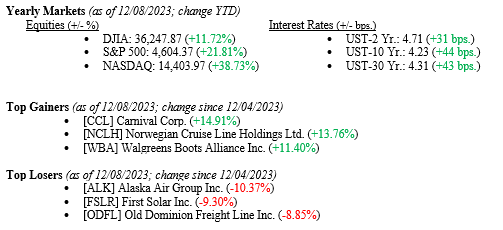

Equity markets added small gains across the major market indexes, pushing year-to-date returns higher again for another week (see year-to-date figures immediately below). Importantly, the Russell 2000 Index of Small Capitalization Stocks returned 1.00% for the week, pushing the year-to-date return to +8.36%. The move higher in small-cap stocks continues the much-needed broadening in this year’s stock market rally beyond the so-called “Magnificent Seven” mega-tech stocks. Last week, we saw a surprise in the number of new jobs added even as job openings continue to decline. We have a busy week ahead with the U.S. FOMC (Federal Open Market Committee) and European Central Bank meetings, a new U.S. Inflation Rate, and several key earnings reports. This week will be the last important week of information and data before the markets quiet down for the Christmas and New Year holidays.

U.S. Economy

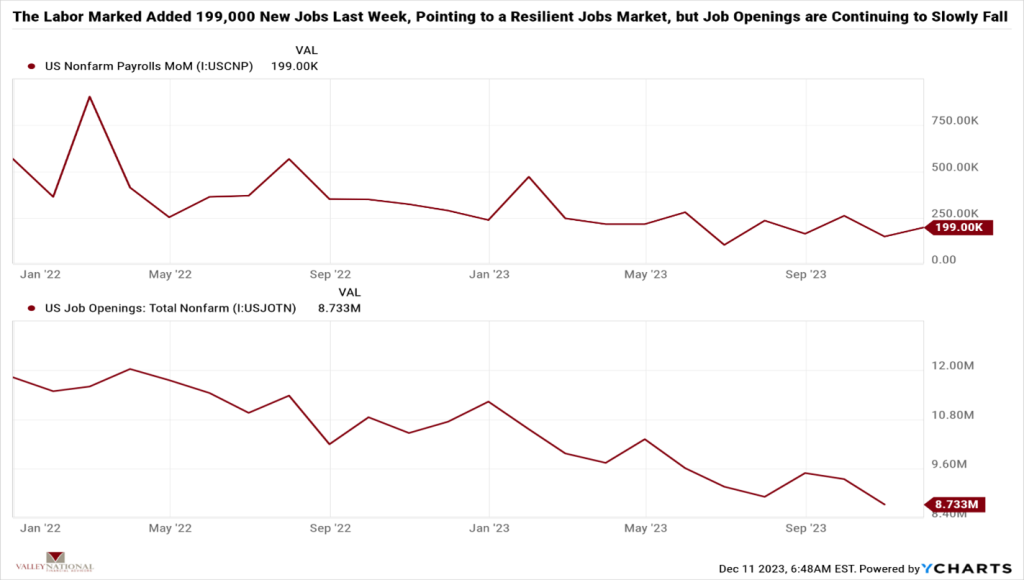

As mentioned above, the strong jobs report we saw last week showed that the U.S. economy continues to hum along nicely. The report showed 199,000 new jobs were created. Job Openings, meanwhile, continue to fall but remain robust. See Chart 1 below from Valley National Financial Advisors and Y Charts. The strong jobs reports and inflation still above 3%, rather than at the Fed’s target rate of 2.00%, show us that rate cuts by the Fed are still a long way off – at least, based on today’s data. Most economists have pushed off any talks of a recession now. In our opinion, the current stock market rally is based on the strong U.S. economy, especially when compared to economic growth in other developed countries, rather than the hope of interest rate cuts by the Fed. We track and follow data, just like the Fed. Federal Reserve Chairman Powell’s directive is not to worry about stock markets; it is, however, charged with maintaining full employment, targeting a 2% inflation rate, and assuring liquidity in the financial markets.

Policy and Politics

2024 is a Presidential Election year, and we will watch the developments there as the first quarter of 2024 primaries roll out. Washington is quiet now as many lawmakers will soon head home for the holidays. We like it when DC is on vacation. Global turmoil continues with two major but regional wars in Russia/Ukraine and Israel/Hamas. Our concerns would heighten if either regional conflict escalated into a larger war with more countries involved.

What to Watch

- U.S. Inflation Rate for Nov 2023, released 12/12/23, prior rate 3.24%

- U.S. CPI (Consumer Price Index) ex Food & Energy for Nov 2023, released 12/12/23, prior 4.03%

- FOMC Rate Decision and Chairman Powell’s Press Conference 12/13/23 current upper limit on Fed Funds Rate is 5.50%

- U.S. Job Openings for Nov 2023, released 12/15/23, prior 8.733MM Jobs.

We have twelve more trading days in 2023 and most Wall Street trading desks will get more thinly staffed each day. Thus far in 2023, we have enjoyed solid returns across all major market indexes. The broadest measure of the stock market, the Dow Jones Industrial Average, is up 11.7% year-to-date, the Bloomberg U.S. Aggregate Bond Index is up 2.66% year-to-date, inflation has fallen to 3.24% from 9.1% last year, jobs remaining plentiful in the U.S. and the consumer is spending especially this holiday season. 2023 has quietly but steadily produced a nice year for investors who stayed the course, ignored the noise, and stuck to their investment plan. Please reach out to your financial advisor at Valley National Financial Advisors for questions or help.