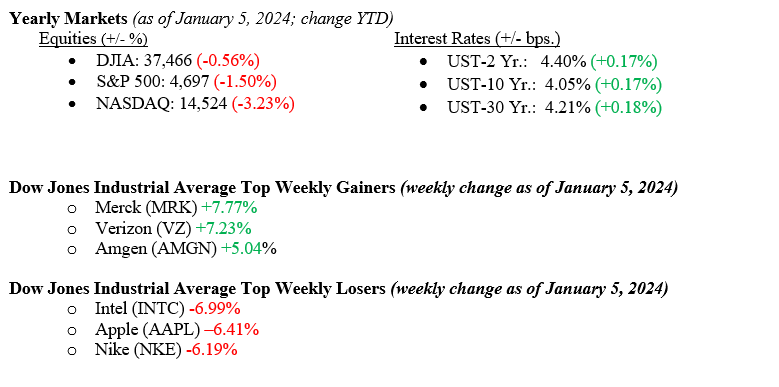

We all know that streaks are meant to be broken, and last week, we broke the nine-weeklong streak of positive weekly gains in the stock market. It was to be expected as early in the year, many movements take place that bring stocks down, such as the beginning of the year’s positioning after year-end tax-loss harvesting. Either way, all three major indexes started off 2024 in the negative, with the Dow Jones Industrial Average falling –0.65%, the S&P 500 Index falling –1.80%, and the NASDAQ falling –3.78%. Looking at the Top Gainers vs. Top Losers in 2024, it seems like the opposite of 2023, which is comical. Apple, the big winner in 2023, is now the biggest loser! Oh, what a few days make in the efficient stock market. Articles and pundits everywhere are already talking about the end of Apple. We will keep watching the data. In the fixed-income markets, bonds also sold off last week, with the 10-year U.S. Treasury increasing by +0.17% to end the week at 4.05%. The yield curve (the slope of the line between 2-year yields and 10-year yields) remains inverted as it has been for over a year – with nary a recession in sight.

U.S. Economy

Last week saw an unexpected pop in the labor market, with Nonfarm payrolls increasing by 216,000 (higher than economist expectations) and the unemployment rate holding steady at 3.7%. This pair of data points set the stage for 2024, where labor continues to fuel economic expansion. Moreover, the Fed’s long sought-after “Goldilocks Soft-Landing” looks like a real possibility. The dramatic rise in interest rates over the past two years to slow inflation has not slowed the economy so much that we rolled into a recession. While this is good news for the economy, we must state that rate hikes take a long time to impact the economy, and we could still see some impacted slowdown ahead as we move forward. When cost-cutting is needed due to a slowdown in a service-based economy, the first thing to cut is jobs.

Policy and Politics

Washington gets back to work this week (we say that with all the best intentions and not sarcasm), and the first item on the agenda will be funding the government before a partial shutdown on January 19, 2024. Each side will try to tie funding the government to border security and aid for Israel and Ukraine. With the billions of dollars flowing out of the U.S. for wars, it is hard not to feel the pressure on our own budget. Holding funds for our government to operate hostage because of funds desired for foreign operations seems anathema, but we are investors, not politicians. Of course, next week is the Iowa Caucus (January 15), and the week after that (January 23) is the New Hampshire Primary. We will then be moving into the full presidential election cycle.

What to Watch This Week

- U.S. Inflation Rate for Dec 2023, released 1/11, prior rate 3.14%

- U.S. Consumer Prince Index Ex Food & Energy for Dec 2023, released 1/11, prior 4.01%

- U.S. Initial Claims for Unemployment for week of Jan 6, 2024, released 1/11, prior 202,000.

- 30-year Mortgage Rate for week of Jan 11, 2024, released 1/11, prior 6.62%

- U.S. Producer Price Index Ex Food & Energy for Dec 2023, released 1/12, prior 1.97%

One week does not make a year or a market. Last week’s returns were attributed to positioning and the prior year’s tax loss harvesting. It is comical to see the economic press turn on Apple as fast as they did – from darling to dud in 5 days. From personal experience, the results received from Apple products like the iPhone, iTunes, and Apple TV+ are still positive in a meaningful way. As Fed Chairman Jay Powell continues to navigate the rate path in 2024, it is evident that we are not in the “pivot” stage where the next move from the Fed in rates is down. Of course, the timing of rate cuts is the real question. Markets are pricing in a March 2024 rate cut, and we think that may be a little too soon, given the economy’s continued strength, especially in the labor market. We will watch the data, pay attention to corporate earnings reports, and follow the news regarding world events and major elections. Reach out to your advisors at Valley National Financial Advisors for questions or help.