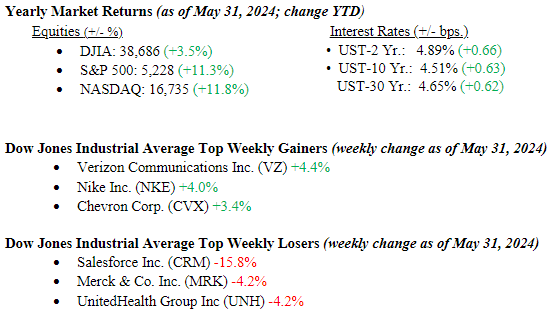

Last week, investors received a mixed basket of corporate earnings and economic data that pressured stocks across all major indexes. On the week, the S&P 500 index was down 0.5%, the Dow Jones Industrial Average was down 1.0%, and the Nasdaq Composite declined 1.1%. Despite the rough week, markets still posted overall gains for May. The S&P 500 advanced 4.8% in May, up 11.3% for the year. The Nasdaq Composite climbed almost 7% in May and is up 11.8% this year. The Dow Jones Industrial Average was up 2.1% in May and 3.5% for the year. The 10-year U.S. Treasury closed the week at 4.51%, five basis points higher than the previous week, as the markets once again digested the Fed’s latest mantra of “higher rates for longer.”

U.S. & Global Economy

Last week, we learned that first-quarter economic growth in the U.S. was weaker than initially reported. On Thursday, the revised GDP figures showed a 1.3% annualized growth rate, down from the initial estimate of 1.6% and significantly lower than the previous quarter’s 3.4% growth rate. Friday saw the U.S. Federal Reserve’s favorite inflation measure, the Personal Consumption Expenditures Price Index, hold steady at 2.7% year over year in April, consistent with March’s rate. Excluding food and energy, it remained at 2.8% for the third consecutive month. Despite steady progress, the reading still is above the 2.0% target rate set by policymakers. Also reported last week were pending home sales, which dropped to their lowest point in four years as potential buyers avoided the market due to 7% mortgage rates.

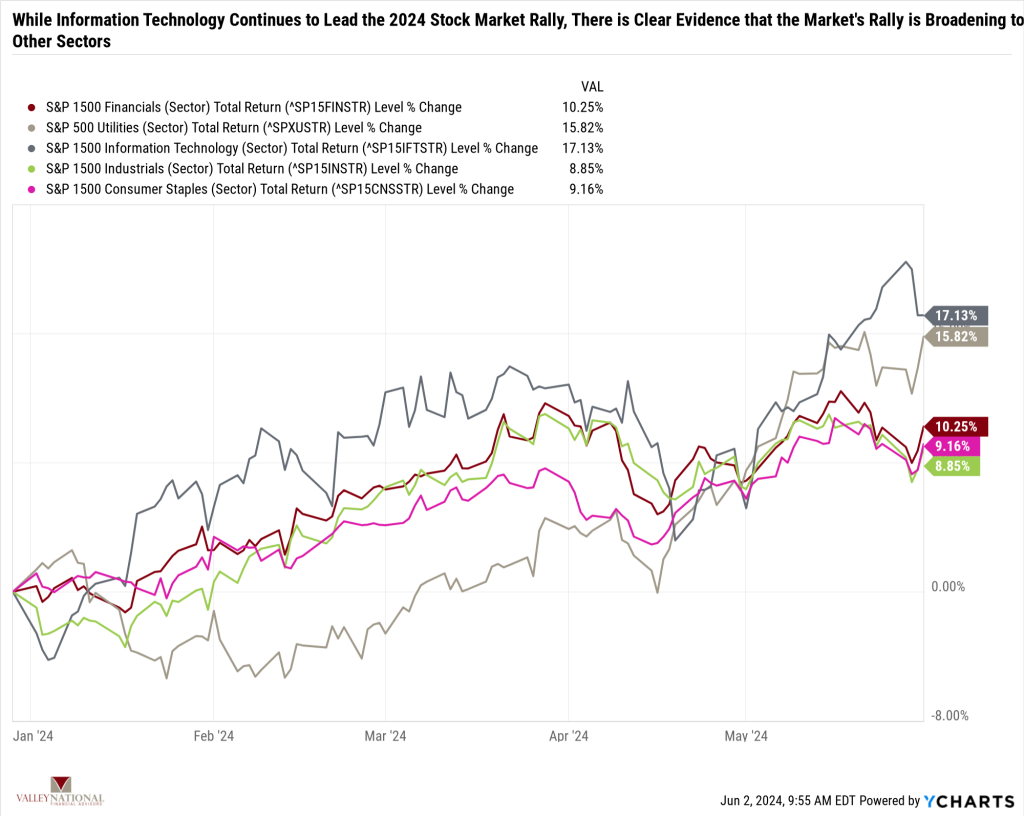

As mentioned above, equity markets were positive for May and year-to-date. Furthermore, as seen in Chart 1 below from Valley National Financial Advisors and Y Charts, the equity returns have broadened beyond just the technology sector, which was the leading sector for most of 2023. While still leading in 2024, other sectors, such as utilities and financials, are also showing positive returns thus far in the year. A healthy market is one that shows broad depth and breadth across sectors rather than concentrated in only one or two.

Policy and Politics

While the global conflicts within Ukraine/Russia and Israel/Hamas show no signs of abating, thankfully, there has not been any spillover into the greater regions such as Europe or the Middle East. Further, support for Ukraine from the broader international community and Israel from the U.S. is not waning either.

President Biden trails former President Trump by about one percentage point in national polling and by around two percentage points in the swing states that would currently provide the winning electoral vote. On Friday, a jury in New York found former President Trump guilty in the “hush money” case. This outcome was largely expected and did little to slow President Trump’s quest for a second term.

Economic Numbers to Watch This Week

- U.S. Job Openings: Total Nonfarm for April 2024, prior 8.488M

- ADP Employment Change for May 2024, prior 192,000.

- U.S. Recession Probability for April 2024, prior 58.3%.

- U.S. Nonfarm Payrolls MoM for May 2024, prior 175,000

- U.S. Labor Force Participation Rate for May 2024, prior 62.7%.

- U.S Unemployment Rate for May 2024, prior 3.9%.

The trend of healthy overall earnings reports from corporate America continues. Friday’s upcoming monthly labor market report will reveal whether the trend of slowing job growth continued into May. Last week’s inflation report, while not a declining number, at least showed inflation remained unchanged in May when compared to May of 2023. We anticipate that ongoing indications of inflation easing will likely prompt the Fed to proceed with one or two rate cuts later this year, a move that would benefit both the economy and the markets overall. Please contact your advisor at Valley National Financial Advisors with any questions.