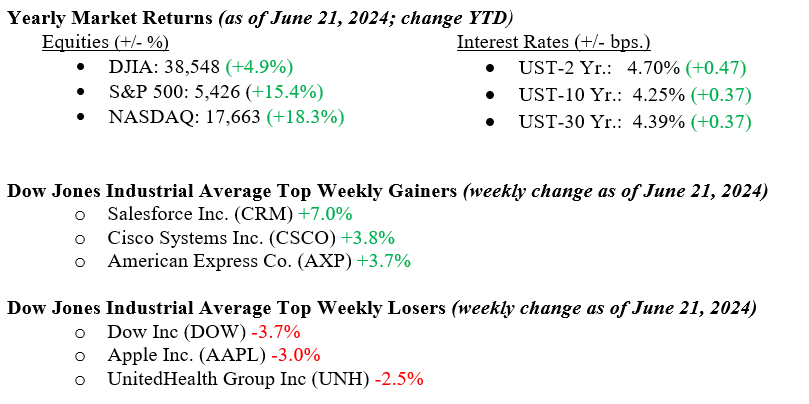

Last week, stocks saw modest signs of broadening and rotation in the market, with value stocks outperforming growth shares and the Dow Jones Industrial Average and S&P 500 indexes outperforming the Nasdaq Composite. Consumer discretionary was the top-performing sector last week, increasing by 2.5%. The popular information technology sector produced the poorest returns, losing 0.7% for the week. Oil prices rose last week to $80.73 per barrel despite the International Energy Agency reporting expectations for unchanged demand in 2024 and modestly lower demand in 2025. A mixed bag of economic data releases resulted in the 10-year U.S. Treasury bond closing out the week largely unchanged at 4.25%.

U.S. & Global Economy

Existing home sales and retail sales were reported last week. The U.S. housing market is grappling with declining sales of existing homes, marking a third consecutive monthly decrease likely influenced by higher mortgage rates, which currently average 6.87% for a 30-year fixed-rate mortgage. Meanwhile, retail sales in May only saw a marginal increase of 0.1%, following a decline in April, contrasting with stronger gains earlier in the year. This marginal increase may suggest that the consumer is finally growing a bit tired after a years-long post-pandemic spending spree. Higher borrowing costs and higher prices are slowing the consumption-based U.S. economy.

Policy and Politics

The first presidential debate is scheduled for this Thursday, June 27th. Prediction markets imply slightly higher odds of a Trump presidency than a Biden presidency, with the probability of a Republication sweep (42%) almost twice the odds of a Democratic sweep (22%)

Trump’s proposed tariffs have recently become a hot topic. A 10% levy on all imports and a 60% tariff specifically targeting Chinese imports could pose challenges for stocks heavily reliant on international revenue. The prospect of retaliatory tariffs and increased geopolitical tensions add to these concerns. Furthermore, companies relying on international suppliers may encounter difficulties if tariffs are implemented.

Economic Numbers to Watch This Week

- U.S. Consumer Confidence Index for May 2024, prior 102.

- U.S. U.S. New Home Sales for May 2024, prior 634,000.

- U.S. Weekly Initial Jobless Claims for the week of June 22, 2024, prior 238,000.

- U.S. Durable-goods orders for May 2024, prior 0.6%.

- U.S. U.S. Pending home sales for May 2024, prior –7.7%.

- U.S. PCE Index for May 2024, prior 0.3%.

- U.S. Core PCE index for May 2024, prior 0.2%.

- U.S. Consumer sentiment for June 2024, prior 65.6.

The Federal Reserve’s strategy for achieving a smooth economic landing is progressing as planned, buoyed by a continued decline in inflation readings across the board. Consumer spending, a key driver of economic activity, is easing from its robust pace, signaling a potential moderation in GDP growth. Coupled with subdued inflation, this will likely encourage the Fed to initiate interest rate cuts later this year. Market sentiment indicates a 60% likelihood of a rate reduction in September, followed by another cut, possibly in December. Whether these cuts happen once or twice in 2024, they are seen as the initial steps in a broader effort to normalize interest rate policy over the coming years. Anticipated lower interest rates in the latter part of the year could offer vital support not only to the housing market but also to smaller businesses that are particularly sensitive to the current high cost of capital. Lower interest rates will also be a natural boost to small-capitalization stocks, which thus far have not participated in the 2024 market rally. We continue to watch closely for any risks or developments that could disrupt the economy’s current glide path. Please contact your advisor at Valley National Financial Advisors with any questions.