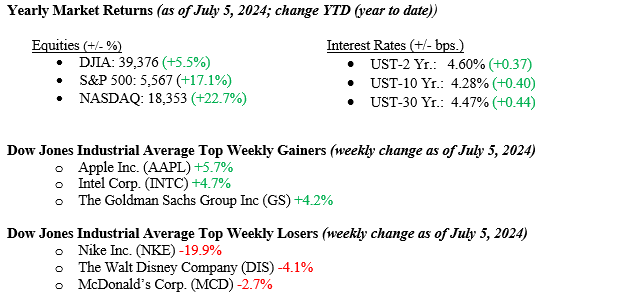

Major equity markets continued their upward trend last week. The NASDAQ gained 3.5% for the week, the S&P 500 gained 2.0%, and The Dow Jones Industrial Average gained 0.7%. Among S&P 500 companies, information technology was the best-performing sector (+3.9%), while Energy was the worst (-1.3%). It is worth noting that equity markets were up in every international and emerging market last week, with the strongest performance seen from France, where equity markets were up 3.8% for the week. Investors welcomed a report of weakening labor markets, anticipating that this would contribute to lower inflation and eventual rate cuts later this year. As a result, the 10-year Treasury yield fell eight basis points to end the week at 4.28%.

U.S. & Global Economy

Recent data shows moderation in key sectors of the U.S. economy: The ISM Services index for June was lower than expected at 48.8, indicating a contraction in non-manufacturing activity. Nonfarm job additions in June totaled 206,000, down from a revised lower figure of 218,000 in the previous month, while the unemployment rate rose from 4% to 4.1%, surpassing the Federal Reserve’s forecast of 4% for the year. Despite these trends, there are indications that inflationary pressures are easing: The ISM’s prices paid indexes, which signal potential inflation in goods and services, were lower than anticipated and near post-pandemic lows. Additionally, annual wage gains from the nonfarm jobs report fell to 3.9%, down from May’s 4.1% and marking the lowest level since the pandemic began.

It’s important to note that these current trends align closely with the Federal Reserve’s objectives. The job market remains healthy, showing signs of moderation without precipitous decline. Inflation is gradually decreasing, supporting ongoing economic growth.

Policy and Politics

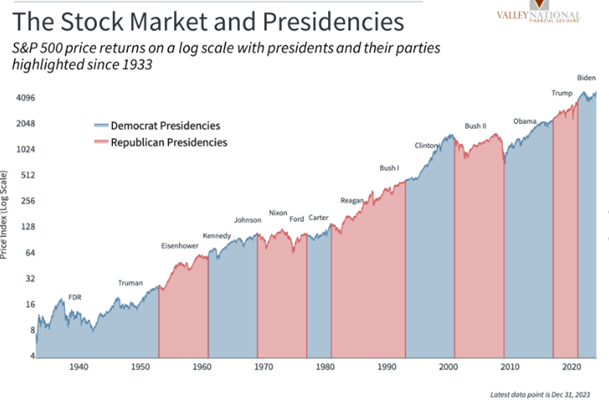

New York Times and Siena College recent polls revealed Donald J. Trump extending his lead over President Biden among likely voters to 49% versus 43%, marking Trump’s largest advantage in the current presidential race. The poll also raised concerns about whether President Biden, 81, was physically fit to hold office for another four years. On Sunday, multiple senior House Democrats told House Democratic leaders that President Biden should step aside as the party’s presidential nominee. President Biden campaigned in the critical swing state of Pennsylvania on Sunday despite these calls. The markets continue to shrug off election-related news, and the race is within the margin of error on polling and too close to call. It is important to note that the markets also tend to ignore who is in office and instead focus on the economy and growth. (See chart below showing the stock market returns)

NATO leaders will meet in Washington on Tuesday. The meeting is anticipated to focus on China’s Support for Russia’s War in Ukraine. President Biden and his election rival, Donald Trump, agree that China represents a significant security and economic threat to the United States and its allies.

Economic Numbers to Watch This Week

- U.S. Small Business Optimism Index, NFIB, for June 2024, prior 90.5

- U.S. Weekly jobless claims for the week of July 6th, 2024, prior 238,000

- U.S. Consumer price index for June 2024, prior 0.0%

- U.S. Core Consumer price index for June 2024, prior 0.2%

- U.S. Producer price index for June 2024, prior –0.2%

- U.S. Core Producer price index for June 2024, prior 0.0%

- U.S. Consumer sentiment (preliminary) for July 2024 prior 68.2%

Last week’s market focused on economic indicators like employment, services activity, and manufacturing data. Looking ahead, the market’s attention will shift to corporate earnings. Starting this week, major banks such as JP Morgan, Citi, and Wells Fargo will begin reporting their second-quarter results. While the technology sector is expected to show continued strong growth, the performance of cyclical sectors will be closely watched for signs of any slowdown amid recent economic signals suggesting potential weaknesses. The trajectory of corporate earnings growth will be critical for equities to continue their move higher, particularly as investors assess the Federal Reserve’s rate cut timeline and strategy for managing economic stability. Please contact your advisor at Valley National Financial Advisors with any questions.