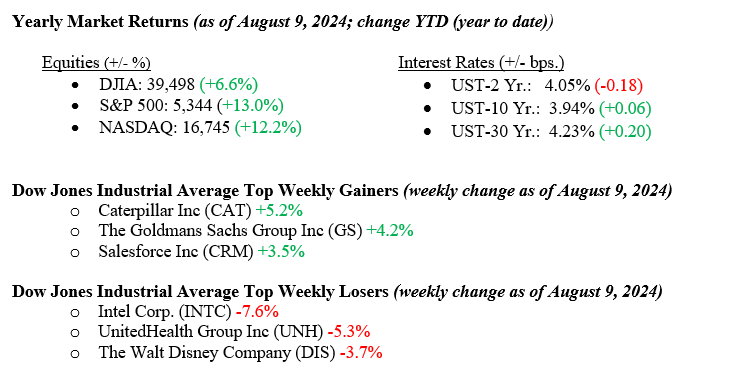

In a turbulent trading week, major U.S. indexes ended mostly lower. Monday started with a sharp sell-off driven by concerns over a potential U.S. economic downturn, exacerbated by the unwinding of yen carry-trades after the Bank of Japan’s recent rate hike and hawkish stance. However, as the week progressed, economic worries eased with robust U.S. services data and a drop in jobless claims fueling a rally that nearly recovered Monday’s losses. After navigating through high volatility, the S&P 500 finished essentially unchanged for the week. The Nasdaq index reduced its losses to -0.35%, and the Dow Jones Industrial Average ended -0.8% lower. Despite the sudden surge of fear that struck the markets early in the week, we believe continued economic expansion is far more likely than recession. For the week, the 10-year U.S. Treasury bond yield rose 14 basis points, closing Friday at 3.94%.

U.S. & Global Economy

Last week’s limited economic data releases presented a slightly brighter outlook. The ISM services index notably recovered, rising to 51.4 in July from a disappointing 48.8 in June. This improvement was primarily fueled by gains in business activity, new orders, and employment. Furthermore, initial jobless claims saw a slight decline for the week ending August 3, although continuing claims did not follow the same encouraging trend.

This week, investors will receive new data on inflation with the Consumer Price Index and Producer Price Index reports. Additionally, reports on retail sales, consumer sentiment, and housing starts will provide further clues about the economic landscape.

Policy and Politics

Over the past week, major global conflicts have seen significant developments. In Eastern Europe, Ukraine has launched an important military operation into Russia’s Kursk region, the largest since the full-scale invasion began. This has led to increased Russian security measures and retaliatory strikes on Kyiv. Meanwhile, Iran continues to provide military equipment to Russia, strengthening their alliance. In the Middle East, tensions between Israel and Gaza remain high, with Hamas calling for a ceasefire while Israeli military actions persist.

Recent updates on the U.S. presidential election reveal that Kamala Harris has made significant strides in national polls since officially joining the race. The latest average shows a contested race, with Harris at 47% and Trump at 48%. The race remains too close to call, but the premise remains that a small segment of five “Battleground States” will determine the election outcome.

Economic Numbers to Watch This Week

- U.S. Producer Price Index YoY for July, prior 2.63%

- U.S. Core Producer Price Index YoY for July, prior 3.00%

- U.S. Consumer Price Index YoY for July, prior 3.97%

- U.S. Core Consumer Price Index YoY for July, prior 3.28%

- U.S. Initial Claims for Unemployment Insurance for the week of August 10, 2024, prior 233,000

- U.S. Index of Consumer Sentiment for August, prior 66.40

Last week’s market swings sparked worries about a possible more considerable economic downturn. While volatility might continue due to upcoming inflation reports and ongoing geopolitical issues, the overall economic situation looks more stable than the initial drop suggested. The U.S. economy is growing more slowly than in recent years. This slower growth aligns with the Federal Reserve’s goal of cooling down an overheated economy. We believe the economy is shifting to a more balanced growth phase. We will monitor all incoming data points for signs of emerging weakness, whether at the micro or macro level. Please contact your advisor at Valley National Financial Advisors with any questions.