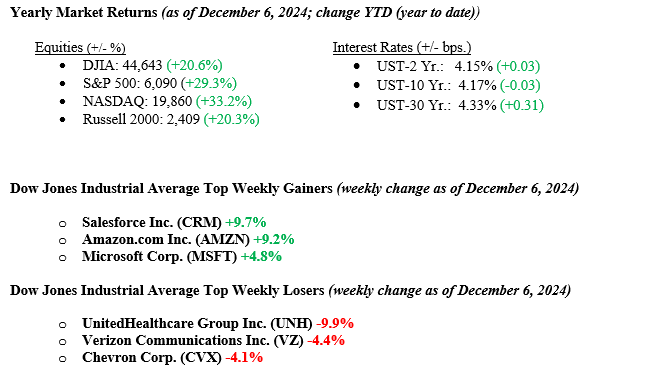

The NASDAQ rose 3.4% for the week, while the S&P 500 gained 1.3%, driven by a strong performance in the Consumer Discretionary sector, which increased by 4.6%. The Dow ended the week down 0.5% after reaching a record high earlier. The labor market strengthened in November with 227,000 new jobs, surpassing economist’s expectations. Growth stocks continue to outperform value stocks, continuing their year-to-date dominance. Consumer sentiment rose to its highest level since May. Additionally, signs of economic growth were reflected in positive new order data from the ISM manufacturing and services PMIs, indicating expansion in November. Communication services led sector earnings growth in Q3, and inflation data due this week will provide more insight for the Fed ahead of its December meeting. In the bond market, Treasury yields fell sharply; the 10-year yield closed around 4.17% on Friday, down from 4.42% the previous week.

U.S. & Global Economy

Economic data released last week showed mixed results but indicated solid economic momentum overall. The S&P final U.S. manufacturing PMI for November was slightly above expectations at 49.7, while the services PMI dipped to 56.1, just shy of expectations. Construction spending for October rose by 0.4%, surpassing the forecasted 0.2%. Job openings in October were higher than expected at 7.7 million, while ADP reported a weaker-than-expected 146,000 jobs added in November. The ISM services index for November also fell short, coming in at 52.1, below the 55.6 anticipated. Factory orders for October rose by 0.2%, meeting expectations. On the labor front, weekly jobless claims were slightly higher than expected at 224,000, but the U.S. employment report for November showed stronger-than-expected job growth, with 227,000 jobs added. However, the unemployment rate ticked to 4.2%, slightly above the expected 4.1%.

Policy and Politics

As we approach 2025, several key geopolitical risks will continue to shape the global landscape. The latest issue is the overthrow of the Assad Regime in Syria. The Assad Family has held a terrorist-level dictatorship in Syria for over fifty. With limited help offered by neighboring Iran or Russia, the results of this latest issue have yet to be worked out. The ongoing war in Ukraine remains a significant concern, with nearly 80% of U.S. institutional investors believing it will persist into the new year. In the Middle East, instability continues, particularly with the Gaza conflict threatening to spill over into broader regional unrest. Meanwhile, a growing alliance between Russia, North Korea, and Iran could further destabilize global markets and economies. Tensions in the South China Sea also show signs of escalating, raising concerns over territorial disputes. Additionally, U.S.-China relations are deteriorating, with investors increasingly wary of China due to regulatory uncertainties and a declining risk perception, which may lead to shifting global trade patterns and realignments in supply chains. However, the presidential leadership change and fresh diplomatic strategies could offer hope for de-escalation and a more stable geopolitical environment in the years ahead.

Economic Numbers to Watch This Week

- U.S. NFIB (small business) optimism index for November 2024. The prior reading was 93.7.

- U.S. Consumer Price Index for November 2024. The prior reading was 0.2% month over month.

- U.S. Core CPI for November 2024. The prior reading was 0.3% month over month.

- U.S. Initial Jobless Claims for the week of Dec 7, 2024. The prior report was 224,000.

- U.S. Producer Price Index for November 2024. The prior reading was 0.2% month over month.

- U.S. Core PPI for November 2024. The prior reading was 0.3% month over month.

The S&P 500 has delivered an impressive 29% total return year-to-date, accompanied by low equity market volatility. This strong performance has been driven by a favorable macro backdrop of solid economic data, the beginning of a Fed rate-cut cycle, and the resolution of election uncertainty. For the week ahead, the consumer and producer price reports will be key data points ahead of the Fed’s final interest rate decision of the year on December 18. Expectations are for a 0.3% monthly rise in consumer prices, pushing the year-over-year CPI to 2.7%, while core CPI is expected to remain steady at 3.3%. The slowing pace of inflation over the past three months and the strong economy suggest the Fed is unlikely to accelerate rate cuts beyond the 25-basis point cut expected next week at the FOMC meeting. Wall Street forecasts a 14% earnings growth for the S&P 500 in 2025, which should help support higher stock prices next year. However, we will remain vigilant in our research to identify any signs that earnings may fall short of these expectations. If you have any questions or need further insights, please contact your advisor at Valley National Financial Advisors.