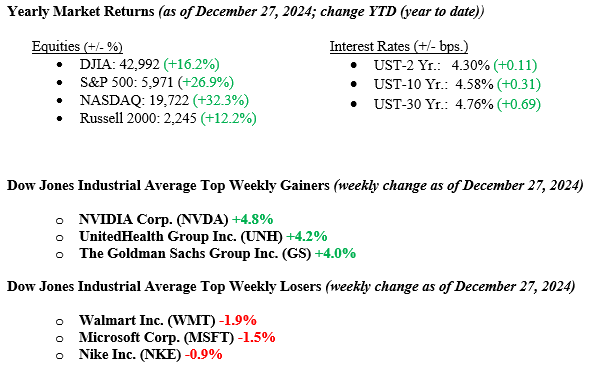

Major market indexes snapped a weeks-long losing streak as each ended higher last week. The Dow Jones Industrial Average increased by +0.35%, the S&P 500 by +0.67%, and the NASDAQ moved higher by +0.76%. Notwithstanding last week’s move, the major market indexes have all returned double-digit numbers for the year (see numbers below). Last year, we saw earnings and the U.S. consumer carrying the economy for most of the year, with the Fed adding tailwinds in September by cutting interest rates as inflation continued to fall. Throughout the year, bond yields traded in a range (4.00% – 4.70%) that allowed investors to collect nearly risk-free yields on fixed-income holdings. As the year ends, we need to set expectations for 2025, and investors should recognize that 2024 ends two years of very good returns for persistent and prudent investors. The 10-year U.S. Treasury bond ended the week at 4.58%, up one basis point from the previous week.

U.S. & Global Economy

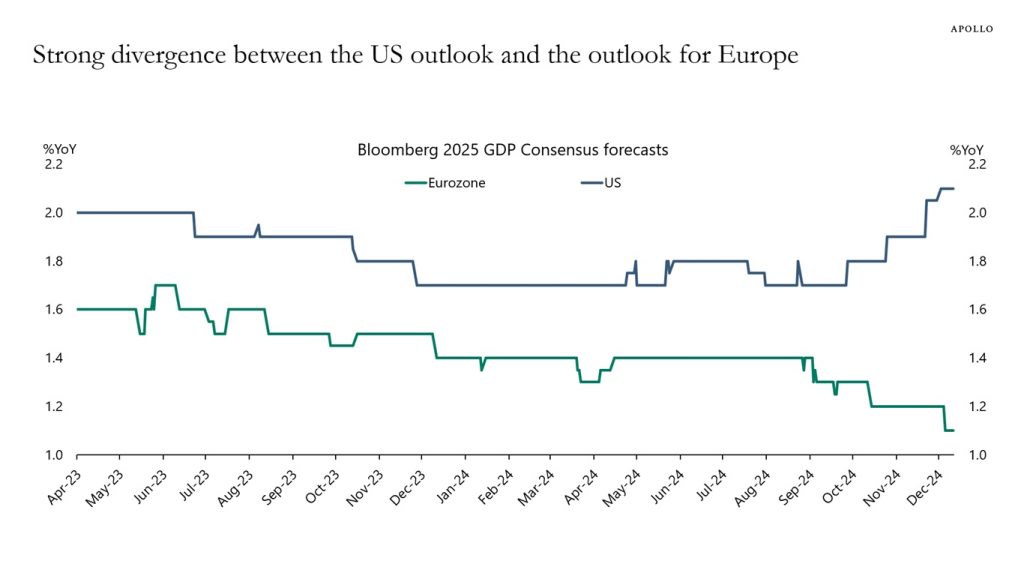

- There is further evidence that the United States continues to do well economically while other parts of the global economy struggle. See Chart 1 below from Apollo Global & Bloomberg showing the “decoupling” of the U.S. Economy vs. Europe. This decoupling is growing wider and is expected to continue such a path as further actions like cutting taxes in the U.S., lessening regulator constraints, and moving to onshore manufacturing impact the U.S. economy.

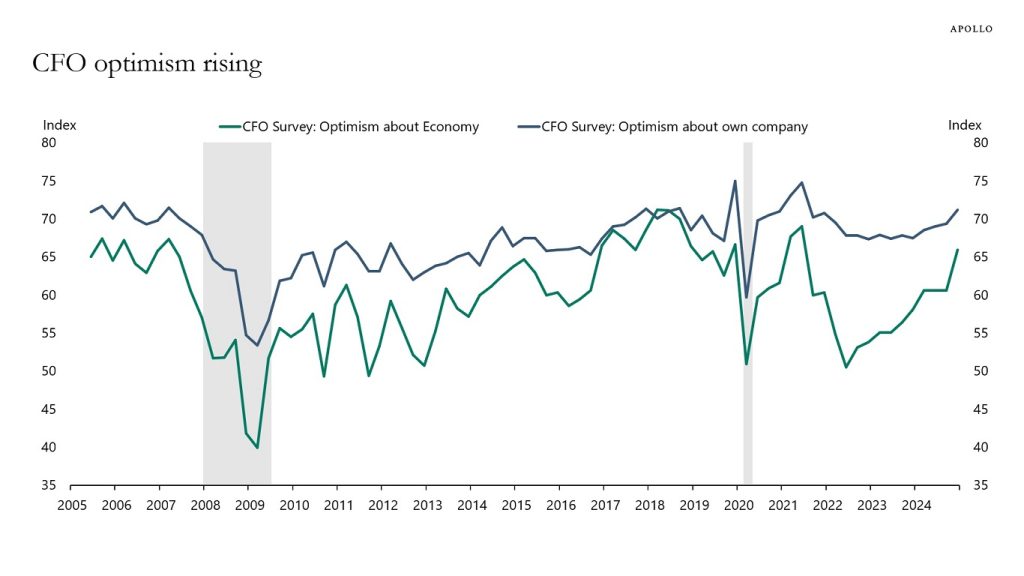

- Chart 2 from Apollo Global shows a survey of U.S. Corporate CFOs. The survey shows rising CFO optimism about the broader economy and their company’s earnings outlook. The combination of decoupling economies and strong optimism suggests that the outlook for 2025 remains U.S.-centric, and we expect this to continue, especially during President Trump’s first two years, as there remains a solid majority in the U.S. House, Senate, and Executive Branch.

Policy and Politics

- Washington was on a holiday break last week, resulting in a slower news cycle. The list below highlights key geopolitical risks we will closely monitor in 2025.

- US-China Tensions: Ongoing rivalry between the U.S. and China, especially over trade, technology, and Taiwan, could disrupt global trade and markets.

- Russian-Ukraine War: The conflict in Ukraine could escalate, impacting energy prices and causing economic instability, particularly in Europe.

- Middle East Instability: Tensions in the Middle East, especially with Iran and Israel, might disrupt global oil supplies and create broader regional instability.

- European Political Uncertainty: Rising populism and nationalist movements in Europe could challenge EU unity, affecting trade and economic cooperation.

Economic Numbers to Watch This Week

- U.S. Initial Claims for Unemployment Insurance for the week of Dec 28, prior level 219,000.

- U.S. Construction Spending for November, prior 0.4%

- U.S. ISM manufacturing for December 2024, prior 48.4%

As we look ahead to 2025, the following key themes and economic factors are expected to be central points of focus for investors:

- AI Advancements: With continued investment in artificial intelligence, the question remains—will new applications emerge that drive greater efficiency and growth for Corporate America?

- Trump’s Return: As Donald Trump re-enters office, his policies may create new economic opportunities and introduce market risks and uncertainties.

- Infrastructure Spending: Government investments in infrastructure, particularly energy grids, are expected to stimulate growth in the construction and energy sectors.

- Interest Rates and Inflation: While the Federal Reserve aims to lower interest rates, the economy’s stronger-than-expected performance in 2024 creates uncertainty about the timing and extent of rate cuts. This could result in higher rates for extended periods, influencing borrowing costs and inflation trends, which will continue to shape the broader economy and financial markets.

- Housing Market: A balanced housing market is crucial for a healthy economy. If rates decrease, affordability may improve, helping to balance supply and demand, though uncertainty around rate cuts and inflation could still pose challenges.

- Cryptocurrency: The popularity of digital currencies like Bitcoin is growing, but the market remains highly speculative, with significant risks and uncertainties.

- Global Trade and Politics: Ongoing trade tensions and geopolitical risks will continue to affect global markets, requiring investors to stay vigilant and adaptable.

If you have any questions or need further insights, please contact your advisor at Valley National Financial Advisors.