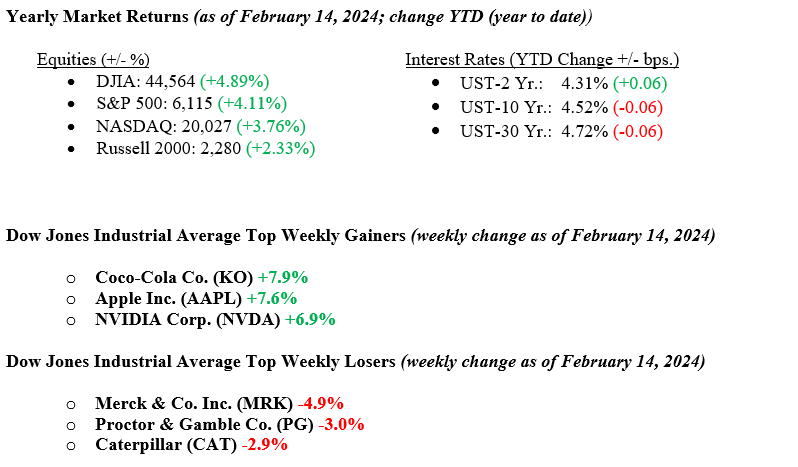

Equity markets came back from the previous weeks’ losses with gains across the board as each major index moved higher. The NASDAQ rose +2.6%, the S&P 500 Index rose 1.5%, while other indexes rose modestly. The fourth-quarter 2024 earnings season has concluded, with most major companies surpassing analysts’ expectations, posting an average growth of 16.9%. Thus far in 2024, economic strength, strong earnings, and an “America First” policy from Washington continue to drive markets higher. While new tariffs and other executive orders from the White House add uncertainty to the markets, we believe that economic strength and a healthy labor market will offset uncertainty. A worse-than-expected inflation report later in the week, coupled with Fed Chairman Jay Powell’s hawkish comments about a pause in further interest rate cuts, allowed the Treasury markets to sell off by the end of the week. The 10-year U.S. Treasury bond yield ended at 4.52%, seven basis points higher than the previous week.

U.S. & Global Economy

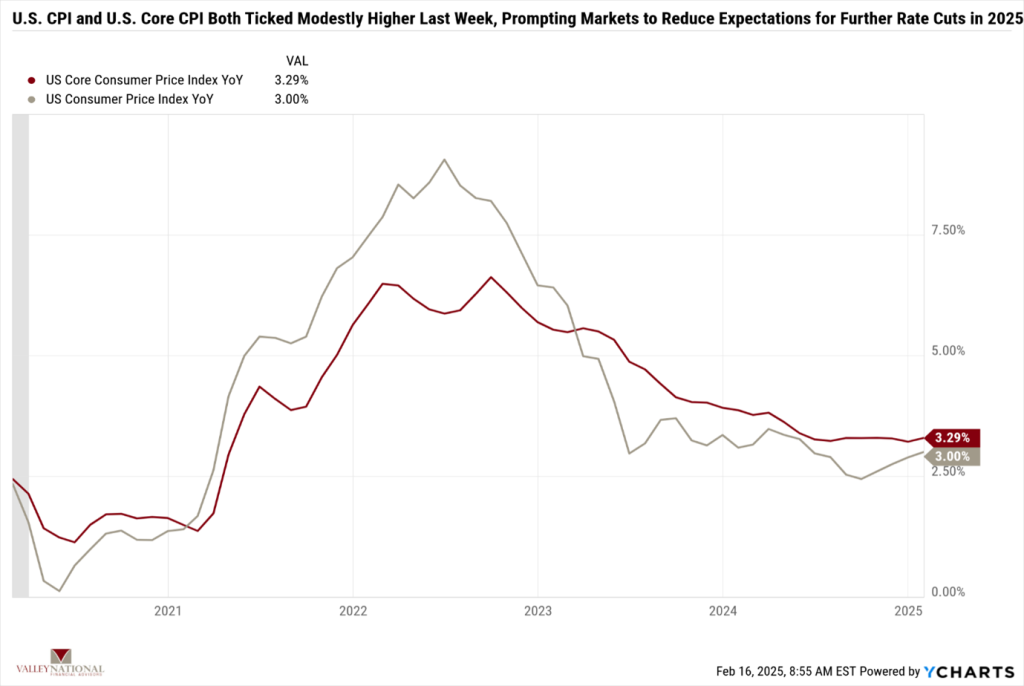

Federal Reserve Chairman Jay Powell testified on the Hill last week. While his commentary around the economy was favorable, his comments about inflation spooked the markets as investors took away his message that further rate cuts in 2025 would be data-dependent and based firmly on inflation abating. On Wednesday, two inflation indicators were released, and both surprised economists by moving slightly higher. See Chart 1 below from Valley National Financial Advisors and Y Charts showing US CPI and US Core CPI both ticking modestly higher month-over-month. The latest figures for this week indicate that the economy continues to perform well. Consumers are in a solid financial position, with year-over-year retail sales reflecting consistent growth. Spending intentions are rising, with the Atlanta Fed’s GDP forecast for the first quarter projected at 2.3%, while the Dallas Fed’s weekly GDP estimate stands at 2.5%. While we are closely watching the potential effects of trade tensions, there are currently no indications that they are negatively impacting incoming economic data.

Policy and Politics

Last week, President Trump introduced “Reciprocal Tariffs” on any country that imposes tariffs on U.S. trade. While on the surface, this seems straightforward, nothing with trade policy is ever easy nor quickly enacted. With the 25% proposed tariffs on Mexico and Canada, we saw they were postponed for 30 days to allow for “negotiations.” We also believe that President Trump uses the threat of large tariffs to get all parties to the negotiating table. The uncertainty that tariff talk brings to the economy is real, and we will continue to monitor all forces going forward.

Economic Numbers to Watch This Week

- U.S. Building Permits for January 2025, prior level 1.483M

- U.S. Housing Starts for January 2025, prior level 1.499M

- U.S. Initial Claims for Unemployment Insurance for week of Feb 15, 2025, prior 213,000.

- U.S. Existing Home Sales for January 2025, prior level 4.24M

- U.S. Index of Consumer Sentiment for February 2025, prior level 67.8

Week-to-week, we profess our standard thesis of staying invested long-term and keeping your financial plan updated and accurate. Nothing has changed, and markets are telling us a similar story of economic strength, stable consumer spending, manageable debt levels, and healthy confidence. Even global turmoil has abated with a cease-fire in the Middle East and Russia and Ukraine hinting at cease-fire talks. Escalation in either war would be a negative, but truce talks are always a positive. If you have any questions or need more information, feel free to reach out to your advisor at Valley National Financial Advisors.