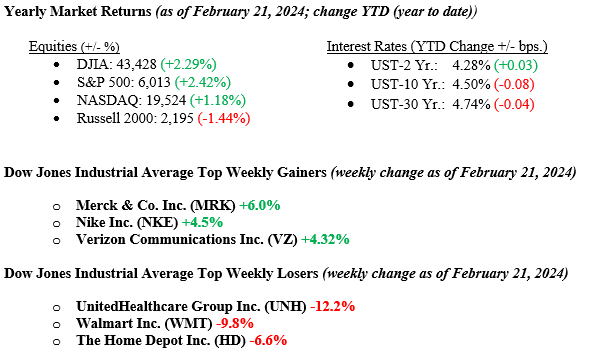

Stocks began the holiday-shortened week on a high note, reaching new all-time highs on Tuesday and Wednesday. However, a sharp sell-off on Friday followed economic reports revealing flat business activity growth in February and consumer sentiment for February, missing economist’s expectations. Geopolitical tensions and tariff news also dominated headlines, particularly regarding President Trump’s efforts to end the Russia-Ukraine conflict and his announcement of plans to impose additional tariffs on automobiles, pharmaceuticals, and lumber. The Dow Jones Industrial Average dropped 2.5%, while the S&P 500 and NASDAQ fell by 1.7% and 2.5%, respectively, for the week. The Russell 2000 saw the most significant decline, down 3.7%. Energy and communications were the strongest performing sectors for the week, while retail trade, commercial services, and health services lagged. The 10-year U.S. Treasury bond yield ended at 4.52%, seven basis points higher than the previous week.

U.S. & Global Economy

This week’s economic data presented a mixed picture. On the downside, the National Association of Home Builders reported a drop in its housing market index to 42 in February, the lowest in five months, citing uncertainty around tariffs, high mortgage rates, and housing costs. January housing starts declined nearly 10% from December to a seasonally adjusted annual rate of 1.37 million. S&P Global’s Composite Purchasing Managers’ Index (PMI) revealed a near stall in U.S. business activity, with services slipping into contraction territory. The University of Michigan’s Consumer Sentiment Index dropped nearly 10% in February, reflecting concerns about rising costs and tariff-induced price hikes. However, there was some positive news: CEO confidence hit a three-year high, with the Conference Board’s CEO Confidence Index rising 9 points to 60, the highest level since the first quarter of 2022. This uptick in CEO optimism suggests some hope for future economic growth.

Policy and Politics

Last week saw notable developments in both foreign and domestic policy. President Trump made a significant shift in U.S.-Russia relations by sending advisors to Saudi Arabia for direct talks with Russian representatives on the Ukraine conflict, a move that excluded Ukrainian and European officials, drawing criticism from Ukrainian President Zelenskyy. In a shake-up of military leadership, Trump dismissed the top U.S. general, the Secretary of Defense, and the Navy chief while announcing plans to reduce the Pentagon’s civilian workforce by 5-8%. On the domestic side, Trump signed an executive order to increase White House oversight of independent regulatory agencies, continuing efforts to reduce the size of the federal government. Meanwhile, Congress worked on budget resolutions, with Republicans in the House and Senate pursuing different approaches to tax reform and spending priorities.

Economic Numbers to Watch This Week

- U.S. Consumer Confidence for February 2025, prior level 104.1

- U.S. New Home Sales for January 2025, prior month sales were 698k

- U.S. Initial Claims for Unemployment Insurance for week of Feb 22, 2025, prior 219,000.

- U.S. Durable Goods Orders for January 2025, prior reading –2.2%

- U.S. PCE Index for January 2025, prior reading +0.3% Month over Month

This week, earnings reports from companies like Home Depot, NVIDIA, Dell, Intuit, and Salesforce will be in focus, along with critical economic data such as Durable Goods Orders and the Fed’s key inflation measure, the PCE index. Despite recent market challenges, major stock indexes remain close to their all-time highs, supported by healthy economic and corporate fundamentals. The S&P 500 is expected to see its best quarterly earnings growth in three years, with profits up 17% from last year—well above the 12% growth that was initially expected. It’s also encouraging that a broader range of companies, not just the tech giants, are posting solid results. If you have any questions or need more information, feel free to reach out to your advisor at Valley National Financial Advisors.