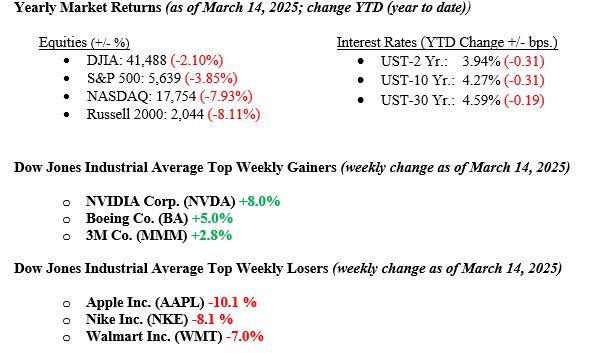

U.S. stock markets sold off across the board, with each significant market index falling over 2% for the week (Dow -3.1%, S&P 500 -2.3% & NASDAQ -2.4%). It would be easy to call this a market correction or drastic sell-off, but fear plays out in the trading pits and desks. When volatility spikes (the VIX, the CBOE Index of Market Volatility, hit 21.7 last week from 15.0 early in 2025), and uncertainty abounds from Washington, DC, everyone gets nervous, and nervous traders sell. Fear and greed are never reasons to invest or to sell, for that matter. Savvy investors have long-term plans and ignore the noise. It is hard to ignore the noise when stocks are loudly selling off each day, but the fundamentals of the U.S. economy remain healthy, and President Trump and U.S. Treasury Secretary Scott Bessent hopefully are playing the long game with tariffs, taxes, and budgets. We are barely three months into 2025, and indeed, it has been choppy, but savvy investors do not move on fear, and uncertainty will pass. Bonds continue to provide needed ballast to portfolios in the form of coupon interest, and with yields well off the zeroes we saw in 2020-22, investors are getting paid to own fixed income. The 10-year U.S. Treasury bond yield ended at 4.27%, four basis points lower than the previous week.

U.S. & Global Economy

Last week, U.S. consumer sentiment weakened to the lowest level since November 2022. The report from the University of Michigan showed that the early March reading for consumer sentiment fell to 57.9 from February’s reading of 64.7. The number was much lower than economists expected, but given all the sour news hitting tapes, it makes sense that consumers would naturally feel more anxiety over increasing inflation expectations and concerns over unemployment levels. The reality is that just last week, the U.S. Consumer Price Index and U.S. Core Consumer Price Index fell and were lower than expected. Further, the unemployment rate remains at a near-record low of 4.1%. Consumers have been swept up in all the talk about fear and uncertainty, showing their feelings about the economy going forward. In our opinion, consumers will quickly bounce back and feel better with an end to the tariff give-and-take and some certainty coming to the Ukraine/Russia war cease-fire.

Policy and Politics

Last week, the U.S. House and Senate passed a spending bill averting a feared government shutdown and funding the Federal budget through September 2025. This move allowed the Republicans to write the spending bill solely, and 10 Democrats from the Senate joined in to pass the bill onto President Trump for his signature. This week, the FOMC will meet on March 18-19 and decide the direction of interest rates. The CME Fed Watch Tool is currently pricing in a 98% chance that the Fed leaves rates unchanged at 4.25-4.50%. Perhaps, after Fed Chairman Jay Powell’s press conference, we will get further clarity and granularity about future rate movements. If the economy were to slow, there is plenty of room to move rates lower to stimulate the economy if needed.

Economic Numbers to Watch This Week

- U.S. Housing Starts for February 2025, prior level 1.366M

- U.S. Target Fed Funds Upper Limit for March 2025, current level 4.25-4.50%

- U.S. Initial Claims for Unemployment for the week of March 15, 2025, prior level 220,000

- U.S. Existing Home Sales for February 2025, prior level 4.08M

It has been a rough start to 2025 for U.S. equity markets; however, international equity markets are up, and bonds are providing needed ballast and income for balanced portfolios. For many years, we have stressed the importance of sticking to your investment plan and remaining a long-term investor. Markets always, always, always have sell-offs – every year, we see one on average of -10%, so this cycle is normal. What’s not normal is the self-generated uncertainty from Washington. We believe it will come to a lucrative conclusion for all parties, and in the end, growth will win out, and the U.S. economy will be the winner. Markets never go up in a straight line, but they generally go up – patience rewards the intelligent investor. If you have any questions or need more information, contact your advisor at Valley National Financial Advisors.