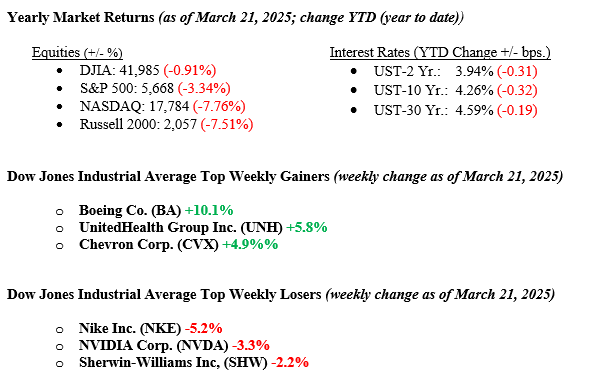

The U.S. stock market delivered a modestly positive performance, snapping a multi-week losing streak as volatility eased. The S&P 500 rose approximately 0.5%, while the Dow Jones Industrial Average gained 1.2%, buoyed by resilience in blue-chip stocks. The Nasdaq Composite edged up 0.2%, with tech stocks showing late-week strength, and the Russell 2000 climbed 0.6%, reflecting a rebound in small-cap sentiment. Overall, energy, financials, and healthcare were the best-performing sectors, while utilities and materials lagged. Key drivers for the week included easing concerns over tariffs after the Trump administration suggested possible exemptions. In addition, the Federal Reserve decided to keep rates steady while acknowledging economic uncertainty and the potential for persistent inflation. Despite this, the market reacted positively to Federal Reserve comments that rate cuts are still on the table for later this year. The 10-year U.S. Treasury bond yield closed out the week at 4.26%, six basis points lower than the previous week.

U.S. & Global Economy

Overall, the economy is slowing slightly from its above-trend pace but with continued strength in key areas like employment and manufacturing. This week’s economic data showed mixed results. U.S. retail sales for February grew by 0.2%, below the expected 0.6%, while sales excluding autos rose 0.3%, matched expectations. The Empire State manufacturing survey for March dropped sharply to -20.9, much worse than the expected -1.8. On the housing front, February’s housing starts surged to 1.50 million, surpassing the forecast of 1.38 million, while building permits reached 1.46 million, slightly above expectations. Additionally, the recent uptick in weekly mortgage applications is a positive sign. We’re hopeful for a stronger spring selling season this year. Import prices rose 0.4%, as expected. Jobless claims for the week of March 15 were 225,000, slightly above the forecast of 220,000. Meanwhile, the Philadelphia Fed manufacturing survey and existing home sales underperformed expectations, with 10.0 and 3.95 million readings, respectively. Lastly, leading economic indicators fell by 0.2%, missing the forecast of a 0.3% gain.

Policy and Politics

Overall, the economy is slowing slightly from its above-trend pace but with continued strength in key areas like employment and manufacturing. This week’s economic data showed mixed results. U.S. retail sales for February grew by 0.2%, below the expected 0.6%, while sales excluding autos rose 0.3%, matched expectations. The Empire State manufacturing survey for March dropped sharply to -20.9, much worse than the expected -1.8. On the housing front, February’s housing starts surged to 1.50 million, surpassing the forecast of 1.38 million, while building permits reached 1.46 million, slightly above expectations. Additionally, the recent uptick in weekly mortgage applications is a positive sign. We’re hopeful for a stronger spring selling season this year. Import prices rose 0.4%, as expected. Jobless claims for the week of March 15 were 225,000, slightly above the forecast of 220,000. Meanwhile, the Philadelphia Fed manufacturing survey and existing home sales underperformed expectations, with 10.0 and 3.95 million readings, respectively. Lastly, leading economic indicators fell by 0.2%, missing the forecast of a 0.3% gain.

Economic Numbers to Watch This Week

- U.S. S&P flash services PMI for March 2025. Previous reading 51.0.

- U.S. S&P flash manufacturing PMI for March 2025. Previous reading 52.7.

- U.S. Consumer confidence for March 2025. Previous reading 98.3%

- U.S. New Homes Sales for February 2025. Previous number 657,000.

- U.S. Durable Goods Orders for February 2025. Previous reading 3.2%

- U.S. Initial jobless claims for the week of March 22, 2025. Previous number 223,000.

- U.S. PCE Index for February 2025. Previous reading 0.3%.

- U.S. Core PCE Index for February 2025. Previous reading 0.3%

Next week, investors will focus on key economic data releases and global developments as sentiment remains fragile ahead of the April 2 reciprocal tariff announcement. In the U.S., new home sales, the Fed’s PCE inflation gauge, and jobless claims will offer insights into the economy and inflation, while the March S&P U.S. services and manufacturing PMI readings will provide an update on recent business activity. Earnings results from key consumer companies, including KB Home, Dollar General, and Lululemon, will also be important to watch for signals about the condition of the U.S. consumer. Trade concerns are growing as the Trump administration finalizes its tariff-heavy trade policy, with unclear details keeping volatility high. Despite this, healthy private sector job growth, rising corporate profits, and a Fed that’s eager to lower rates could help prevent the current pullback from worsening. Still, diversification is important as market leadership shifts and further market corrections remain possible. If you have any questions or need more information, contact your advisor at Valley National Financial Advisors.