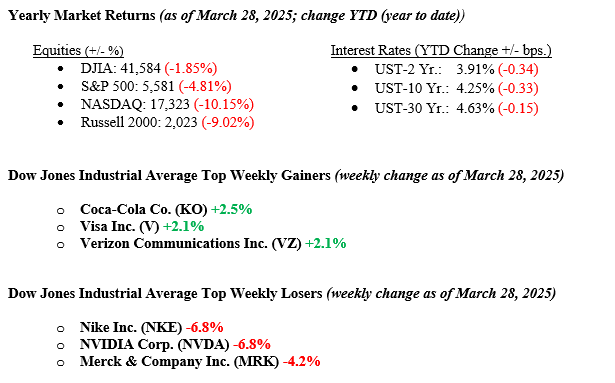

Markets experienced a broad decline last week, with the Dow Jones Industrial Average slipping 1%, while the S&P 500 and Russell 2000 fell by 1.5% and 1.65%, respectively. The Nasdaq saw the steepest drop, down 2.4% for the week. The sell-off was fueled by the announcement of a 25% tariff on all non-U.S.-made autos and parts, which sparked concerns about inflationary pressures and potential disruptions in global supply chains. Fresh consumer sentiment data signaled weaker consumer confidence, while a core PCE inflation reading came in higher than economists had expected, deepening concerns about the Fed’s future rate cut plans. As a result, sectors sensitive to economic conditions, such as consumer discretionary and industrials, underperformed, while defensive sectors like utilities and healthcare showed relative strength. These factors created a cautious investor outlook, with elevated volatility weighing on stocks across various sectors. The 10-year U.S. Treasury bond yield closed out the week at 4.26%, six basis points lower than the previous week.

U.S. & Global Economy

Markets saw mixed economic data last week, contributing to a cautious investor outlook. While consumer sentiment showed signs of weakening, with inflation expectations rising to a 30-year high, there were positive signs in other areas. The S&P flash services PMI for March came in well above expectations, signaling strong growth in the services sector, while durable goods orders rose by 0.9%, outperforming expectations. The labor market remained resilient, with jobless claims coming in slightly better than expected, and Q4 GDP growth revised upward to 2.4%. However, concerns about inflation persisted, with the core PCE index rising by 0.4%, which was higher than expected. Despite this, although slower this year, consumer spending remains closely tied to healthy wage growth and employment levels, providing modest reassurance. While inflation and geopolitical uncertainties continue to contribute to market volatility, the broader economic picture suggests that there is still strength in key areas, helping to temper more pessimistic outlooks.

Policy and Politics

On March 26, President Trump announced a 25% tariff on all foreign car imports, set to take effect this week. This move aims to reduce reliance on foreign-made vehicles and boost domestic manufacturing. In response, the European Union and Canada announced retaliatory tariffs on U.S. goods, including boats, motorbikes, and household appliances, starting April 1. Looking ahead, President Trump has designated April 2 as “Liberation Day,” during which new “reciprocal” tariffs matching those of other countries will be unveiled.

The U.S. has continued to play a significant role in both the Russia-Ukraine and Israel-Hamas conflicts. President Trump voiced frustration with Russian President Putin over the ongoing war, threatening to impose secondary tariffs on Russian oil if Moscow continues to obstruct peace efforts while calling for a 30-day ceasefire, which Russia partially agreed to, halting attacks on Ukrainian energy infrastructure. On the Israel-Hamas front, U.S. envoy Adam Boehler engaged in direct talks with Hamas, marking a shift in U.S. policy by negotiating the release of American hostages and exploring a broader peace agreement. This was a significant departure from the U.S.’s previous stance of not directly engaging with Hamas. Additionally, Israel coordinated with the U.S. before launching airstrikes on Gaza, displaying close military collaboration between the two nations.

Economic Numbers to Watch This Week

- U.S. S&P final U.S. manufacturing PMI for March 2025. Previously 49.8%.

- U.S. ISM manufacturing for March 2025. Previously 50.3%.

- U.S. Job openings for February 2025. Previously 7.7 million.

- U.S. Auto Sales for March 2025. Previously 16 million.

- U.S. ADP employment for March 2025. Previously +77,000.

- U.S. Weekly jobless claims for March 29, 2025. Previously +224,000.

- U.S. S&P final U.S. services PMI for March 2025. Previously 54.2

- U.S. ISM Services for March 2025. Previously 53.5.

- U.S. Employment report for March 2025. Previously +151,000.

- U.S. Unemployment rate for March 2025. Previously 4.1%.

This week, all eyes will be on employment-related data, starting with the U.S. job openings report for February, followed by the ADP employment report for March, and weekly jobless claims. The highly anticipated March employment report, including the unemployment rate and job growth figures, will be key in assessing the impact of recently announced government job cuts. At the same time, investors will be closely watching for continued news flow on trade policy, particularly the reciprocal tariffs set to be announced on April 2nd, which could add further market volatility. While near-term uncertainties persist, the long-term outlook remains bright. The U.S. continues to benefit from a healthy employment picture, with corporate earnings expected to grow at a solid pace this year. The Federal Reserve stands ready to adjust rates if necessary to sustain economic growth, and the administration is likely to pivot toward pro-growth initiatives like lower taxes and reduced regulation in the future. If you have any questions or need more information, contact your advisor at Valley National Financial Advisors.