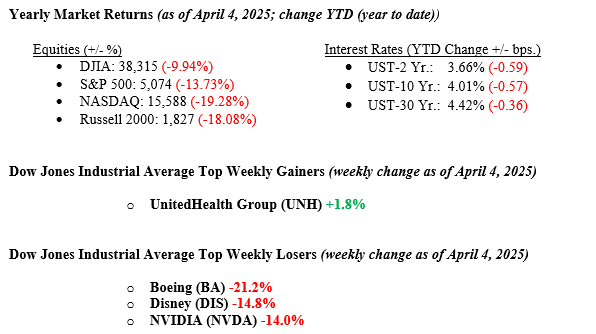

Markets experienced significant turbulence last week, with the Dow Jones Industrial Average declining 7.9%, the S&P 500 dropping 9.1%, and the Nasdaq Composite sliding 10%, marking their worst weekly performances since March 2020. The Russell 2000 also declined sharply, falling 9.8%. The sell-off was triggered by President Trump’s announcement of sweeping tariffs, which included a 10% baseline levy on all imports and higher targeted tariffs. The magnitude of these tariffs far exceeded economists’ expectations, amplifying fears of a potential global trade war and reigniting inflation concerns. In addition, the prospect of retaliatory tariffs from trading partners further added to investor uncertainty, deepening concerns about escalating tensions in global trade. Investor unease was also heightened by comments from the Federal Reserve Chairman, who signaled that the central bank was in no rush to change interest rates, sparking worries that the Fed might be slow to respond to the rapidly shifting economic landscape. Cyclical sectors such as technology and consumer discretionary were hit hardest, while defensive sectors like consumer staples and utilities showed some resilience. Meanwhile, the 10-year U.S. Treasury yield fell to 3.95%, down 31 basis points from the prior week, as investors flocked to safe-haven assets amid the escalating uncertainty.

U.S. & Global Economy

The data from last week reflects the U.S. economy as it stood in March, but it’s important to note that this information is backward-looking and could change due to the new uncertainty surrounding President Trump’s announced tariffs. These tariffs may impact trade and the economy, potentially altering the outlook moving forward. That said, the U.S. economy enters this period of uncertainty from a position of strength, with a strong labor market, healthy consumer and business balance sheets, and solid overall momentum.

Last week, several key economic indicators showed mixed results. The Chicago Business Barometer for March came in at 47.6, surpassing expectations of 43.6 but still below the previous month’s 45.5. The final U.S. manufacturing PMI for March was 50.2, slightly better than the expected 49.8, while the ISM manufacturing index for March fell to 49.0, missing the 49.5 forecast. Construction spending for February exceeded expectations, rising 0.7% versus the 0.3% expected, and job openings for February totaled 7.6 million, slightly below the 7.7 million expected. Auto sales for March surged to 17.8 million, well above the previous month’s 16.0 million. The ADP employment report showed a stronger-than-expected increase of 155,000 jobs in March, compared to the anticipated 120,000. Initial jobless claims for the week ending March 29 came in at 219,000, lower than the expected 228,000. The final U.S. services PMI for March rose to 54.4, slightly beating expectations of 54.2, but the ISM services index dropped to 50.8, below the 52.9 forecast. Lastly, the U.S. employment report for March revealed 228,000 new jobs, significantly surpassing the expected 140,000, though the unemployment rate ticked up to 4.2% from 4.1%.

Policy and Politics

Last week, tariff announcements created significant market uncertainty, as the proposed measures introduced both immediate and long-term risks to the global economy. The policy included a 10% blanket tariff on all imports, with higher rates targeting specific industries and countries, such as 60% on Chinese goods and 20% on EU steel. This raised concerns about retaliatory tariffs and strained trade relations. On Friday, China announced its retaliatory tariffs, further escalating tensions and adding to market volatility. Analysts warned that household goods like clothing and electronics could see price hikes, particularly due to reliance on Chinese manufacturing. The lack of clarity on exemptions and fears of a prolonged trade war increased concerns about disrupted supply chains, lower corporate profits, and inflationary pressures, overshadowing broader economic stability.

Despite the intense focus on tariffs last week, major global conflicts took a step back in terms of escalation. The Israel-Hamas conflict worsened as Israel intensified its military operations in Gaza. In the Russia-Ukraine war, violence continued to escalate, even as ceasefire negotiations remained stalled. Russia launched a deadly missile strike on President Zelenskyy’s hometown, Kryvyi Rih, while frontline fighting persisted, with Russian forces making advances near Pokrovsk and Ukrainian counterattacks occurring in Kursk Oblast. The humanitarian toll mounted, and diplomatic efforts remained gridlocked.

Economic Numbers to Watch This Week

- U.S. NFIB (small business) optimism index for March 2025. Previously 100.7.

- U.S. Weekly jobless claims for the week ending April 5, 2025. Previously +219,000.

- U.S. Consumer Price Index for March 2025. Previously 0.2%

- U.S. Core Consumer Price Index for March 2025. Previously 0.2%

- U.S. Producer price index for March 2025. Previously 0.0%.

- U.S. Core Producer price index for March 2025. Previously 0.2%

- U.S. Consumer sentiment (prelim) for April 2025. Previously 57.

Given the increased uncertainty stemming from the recently announced tariffs and their complex implications for the global economy, we believe it’s prudent to adjust the VNFA Heat Map to a more neutral stance. However, we acknowledge that this is a self-inflicted challenge for the economy that could evolve over time. We will continue to monitor the situation closely, and we encourage investors to stay focused on their long-term investment plans.

This week, attention will be focused on several key data releases, including the NFIB Small Business Optimism Index, CPI and PPI inflation data, and the preliminary reading on consumer sentiment for April. These reports will provide important insights into the economy’s health, particularly in terms of inflationary pressures and consumer confidence. At the same time, the ongoing news flow surrounding the recently announced tariffs is expected to continue dominating market attention, with potential updates on their economic impact likely to add further volatility. While trade policy uncertainties remain, the U.S. economy is still positioned from a place of strength, with solid consumer and business fundamentals. Additionally, the recent drop in oil prices and interest rates could help mitigate some of the potential price increases and supply chain disruptions that could arise from the tariffs. Encouragingly, as of Sunday, April 6th, both Vietnam and Taiwan have expressed a willingness to negotiate an end to the tariffs with the U.S., signaling potential steps toward de-escalation. This could offer much-needed calm to the markets and a hopeful sign that further diplomatic efforts may reduce tensions and ease economic uncertainty. Importantly, a balanced long-term focused portfolio typically includes exposure to fixed-income investments, specifically U.S. Treasury bonds and investment grade bonds. Those sectors perform well in times of drastic uncertainty, such as what we are experiencing in today’s markets. If you have any questions or need more information, contact your advisor at Valley National Financial Advisors.