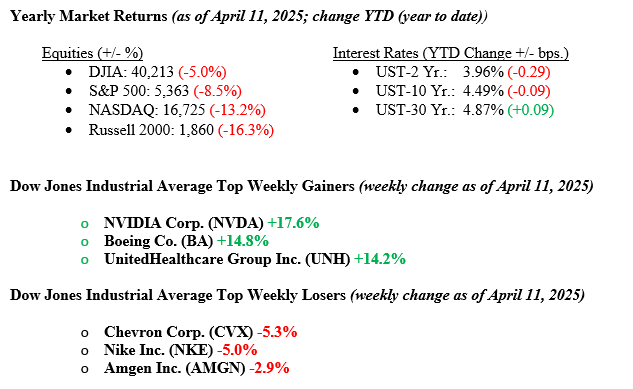

In the rare chance that our readers were not watching the news or markets last week, we are here to tell you that last week was a bit volatile. We saw the biggest one-day rally since the Great Financial Crisis. Market Volatility spiked to “Covid-like” levels, and a sell-off in bonds sent yields surging while the U.S. Dollar slid, and gold rose to a new record high of $3,245/Troy ounce. Within all that noise, by the end of the week, all three major averages ended the week with a positive return: Dow Jones (+5.0%), S&P 500 Index (+5.7%), and the NASDAQ (+7.3%). On Friday alone, the Dow closed +619 points, a shocking move to cap off a volatile week. Readers of TWC know how much we hate uncertain and unexplained volatility; however, this volatility can best be explained just as Wall Street traders called it: Self-induced pain. The news out of D.C. is so jarring and uncertain that there will be blood in the trading pits until everything settles down, and we say: “Ignore the noise and try to remain focused on long-term goals.” As mentioned, the 10-year U.S. Treasury yield rose to 4.49%, 48 basis points higher than the prior week, as investors showed an odd distaste for U.S. Treasury bonds in a tile of heightened volatility and uncertainty.

U.S. & Global Economy

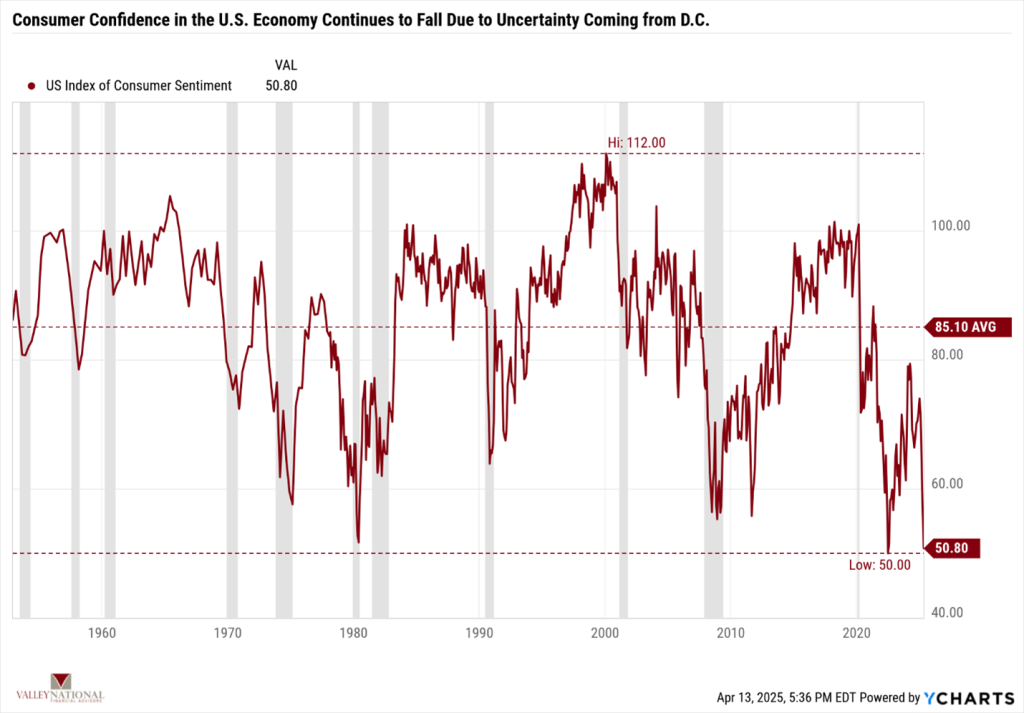

The data from last week reflect the U.S. economy, which shows that inflation continues to moderate. Our concern is about consumer confidence. The University of Michigan Index of

Consumer Sentiment is reaching levels not seen since the Great Financial Crisis. See Chart 1 below from Valley National Financial Advisors and Y Charts.

While the economy remains solid, a strong, healthy, and spending U.S. consumer is critical to future growth. Consumers must have confidence in the economy, government, and their investment portfolio. President Trump and the Administration have been clear about tariffs: “There will be some short-term pain for long-term gain.” We expect that will be the case, but the timing will be key and will determine how long a road-weary consumer will hang in there

Policy and Politics

Recent tariff policy changes have moved quickly, with shifting announcements and sometimes confusing messages from governments. The U.S. and its trading partners have responded with a mix of new tariffs, pauses, and exemptions, making it challenging to track what’s in effect. Below is a simplified timeline of the key developments over the last week.

- April 9, 2025

90-Day Tariff Pause: The Trump administration paused planned tariff increases (11–50%) for most countries for 90 days. China, Canada, Mexico, and certain goods like steel and aluminum were excluded.

China Tariff Increase: Tariffs on Chinese imports rose to 125%, but later, they were clarified to 145% for some goods. - April 10, 2025

Clarified Rates: The White House confirmed a 145% tariff on certain Chinese goods.

EU Response: The EU matched the U.S. pause on retaliatory tariffs for 90 days. - April 12, 2025

China’s Retaliation: China imposed 125% tariffs on all U.S. goods, effective immediately.

Electronics Exemption: U.S. Customs exempted cell phones and select electronics from the 145% rate. - Ongoing Measures

10% Baseline Tariffs: A 10% tariff has been in place since April 5 on most imports, excluding those from USMCA countries.

Auto Tariffs: A 25% tariff remains on non-USMCA vehicles and auto parts. - Global Reactions

Canada/Mexico: Still applying 25% tariffs on U.S. autos and certain goods.

EU: Preparing countermeasures while continuing trade talks.

Economic Numbers to Watch This Week

- U.S. Retail & Food Service Sales MoM for March 2025, prior 0.20%

- U.S. Industrial Production MoM for March 2025, prior to 0.75%

- U.S. Housing Starts for March 2025, prior to 1.501M

- U.S. Initial Claims for Unemployment Insurance week of April 12, 2025, prior 223,000

- 30-year Mortgage Rate for the week of April 17, 2025, current level 6.62%

The economy entered this current period of tariff uncertainty with solid underlying momentum. Weekly jobless claims remain very healthy, inflation is trending in the right direction, and early earnings reports from major financial firms like JPMorgan, Morgan Stanley, and BlackRock have come in solid. The 90-day pause on reciprocal tariffs has eased some of the more extreme concerns, and recent inflation data and falling oil prices should help cushion the impact of existing and new tariffs. However, uncertainty remains high. China has raised tariffs in response, auto tariffs are still in place, and corporate decision-making may slow as businesses wait for clarity. The negotiation process is likely to be noisy and drawn out, which could weigh on sentiment in the short term. Still, long-term fundamentals remain intact, including continued investment in AI and resilient consumer and labor market trends. In this environment, staying diversified and focused on long-term goals is more important than ever. If you have any questions or need more information, contact your advisor at Valley National Financial Advisors.