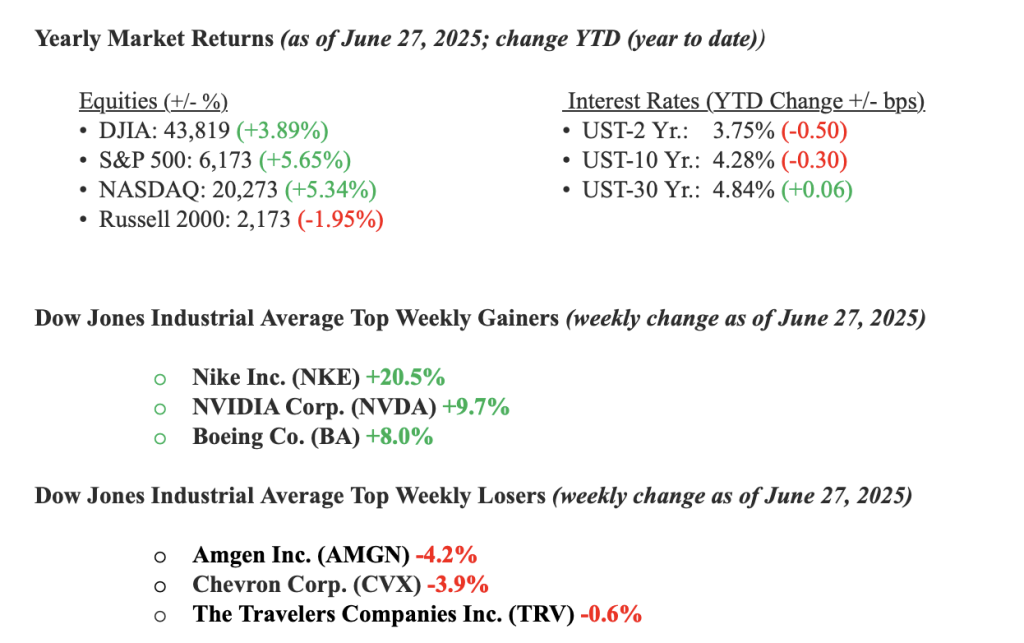

Last week, all three major stock market indexes rallied, with the S&P 500 Index hitting a new record high after rallying 4.0% for the week. Markets got a much-needed dose of good news last week. Momentum is building behind President Trump’s ‘Big Beautiful Bill’ in the Senate, a fragile but steady ceasefire is holding between Israel and Iran, and the U.S. and China reached some constructive agreements on tariffs. After last week’s moves higher, all three indexes are now positive on a year-to-date basis (see numbers below). U.S. Treasuries also rallied, with yields on bonds falling throughout the week. The 10-year Treasury yield decreased 10 basis points to close the week at 4.28%, down significantly from recent highs near 4.60%. U.S. economic activity remains strong, with the unemployment rate at 4.2% and more than 7 million job openings still available. The Federal Reserve continues to hold off on interest rate cuts, maintaining a cautious stance. Currently, Fed Chairman Jay Powell remains committed to achieving the central bank’s goals of 2.0% inflation, full employment, and maintaining healthy liquidity in the financial markets. The recent 1Q GDP revision to -0.50% from -0.20% suggests the Fed’s next move will be to lower rates, and sooner rather than later.

U.S. & Global Economy

Despite ongoing tariff uncertainty and global tensions, the U.S. economy is still holding up well. June’s manufacturing and services activity came in slightly better than expected, and existing home sales also beat forecasts, showing some underlying strength. While consumer confidence measured by the Conference Board dropped, the University of Michigan’s consumer sentiment reading remained healthy, suggesting people are still feeling good about the economic outlook. New home sales came in below expectations, but jobless claims stayed steady, pointing to a resilient labor market. A standout was the big jump in durable goods orders, thanks largely to Boeing, which helped boost industrial demand. On the downside, GDP for the first quarter was revised lower, and personal income and spending both dipped in May. Still, inflation data was mostly in line, with core PCE ticking up only slightly. All in all, despite a few soft spots, the economy continues to hang in there surprisingly well, with key fundamentals intact and a long-term outlook that remains bright.

Policy and Politics

- The U.S. Senate advanced former President Trump’s “Big, Beautiful Bill” — a sweeping tax cut and spending package — by a narrow 51–49 procedural vote, drawing criticism from some Republicans. However, as the bill approaches the target date set by President Trump of July 4th, confidence is growing in the markets that the tax cuts alone will fuel future economic growth and spur capital expenditures by corporations.

- In New York City, democratic candidate Zohran Mamdani pulled off a surprising upset in the mayoral primary, energizing progressives while provoking sharp attacks from Trump, centrist Democrats, and GOP figures. His election paints a stark contrast to the sweeping victory that President Trump ushered in of conservative, U.S. centrist-based politics.

- Global politics have simmered down a bit with a tenuous ceasefire holding between Israel and Iran, and China trade and tariff talks moving forward rather than backward.

Economic Numbers to Watch This Week

- U.S. Crude Oil Production for April 2025, prior reading 418.18 billion barrels

- U.S. Job Openings: Total Nonfarm for May 2025, prior reading 7.391M

- ADP Employment Change for June 2025, prior reading 37,000

- U.S. Claims for Unemployment Insurance for the week of June 28, 2025, prior level 236,000

- U.S. Labor Force Participation Rate for June 2025, prior reading 62.40%

- U.S. Nonfarm Payrolls MoM for June 2025, prior reading 139,000

- U.S. Unemployment Rate for June 2025, prior reading 4.20%

- U.S. Trade Balance of Goods & Services for May 2025, prior level -$61.62B

- U.S. ISM Manufacturing for June 2025, prior reading 48.5%

- U.S. ISM Services for June 2025, prior reading 49.9%

As markets approach the shortened July 4th holiday weekend, the outlook remains cautiously optimistic, buoyed by a robust 4.0% rally in the S&P 500 to a new record high, positive developments in U.S.-China tariff negotiations, and a tenuous Israel-Iran ceasefire. Despite the first quarter GDP being revised down to -0.5%, it’s encouraging to see economists expecting a return to growth in Q2 2025, as the import surge seen earlier, driven by efforts to beat tariffs, begins to normalize. The advancing ‘Big, Beautiful Bill’ tax package, along with a solid consumer sentiment reading of 60.7, point to potential for continued economic growth. Still, challenges like a cooling labor market and lingering inflation concerns will need to be watched closely. At Valley National Financial Advisors, we remain vigilant, leveraging our belief in the market’s efficiency to guide your investments, and we encourage you to reach out to your advisor for personalized insights or support.