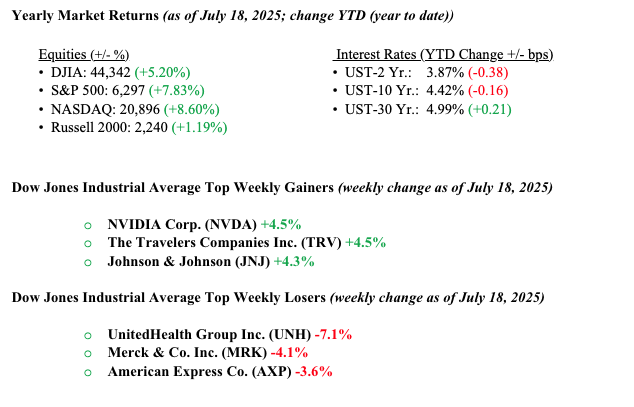

Last week, U.S. stock markets delivered a mixed performance with a slight upward bias, as the S&P 500 and Nasdaq Composite reached new record highs, closing with gains of approximately 0.75% and 1.0% respectively, while the Dow Jones Industrial Average remained nearly flat with a marginal 0.01% decline, reflecting cautious optimism amid strong corporate earnings and economic data. The rally was driven by solid earnings reports from companies like Netflix and JPMorgan Chase, which exceeded expectations. A better-than-expected 0.6% rise in June retail sales also helped, signaling resilient consumer spending. However, gains were somewhat tempered by concerns over President Trump’s newly announced 30% tariffs on EU and Mexican imports, set to take effect on August 1. Bond markets saw a modest uptick in U.S. Treasury yields, with the 10-year yield rising to 4.42% from 4.41%, the 2-year yield edging up to 3.87% from 3.86%, and the 30-year yield climbing to 4.99% from 4.95%, influenced by mixed signals from a Producer Price Index (PPI) rise of 0.4% month-over-month (annual 2.8%) and Core PPI up 0.3% (annual 3.1%), suggesting slight inflationary pressure emerging from tariff uncertainties. Economic data, including jobless claims at 233,000, pointed to a stable but cooling economy, while markets are pricing a 64% chance of a September rate cut, despite rising concerns over inflation and trade-related supply chain risks.

U.S. & Global Economy

Economic data came in mostly better than expected last week, painting a relatively upbeat picture of the economy. June’s consumer price index matched expectations, while core CPI came in slightly cooler than forecast, suggesting inflation pressures may be easing. Producer prices were flat, softer than expected, which adds to the narrative of stabilizing costs. Jobless claims dropped more than anticipated, pointing to continued strength in the labor market. Retail sales saw a strong rebound in June, rising much more than forecast, which, along with solid gains in sales excluding autos, highlights the ongoing resilience of the consumer. Manufacturing data also surprised to the upside, with both the Empire State and Philadelphia Fed surveys posting strong improvements in July. Overall, the data is encouraging and reflects a steady, resilient consumer base. That said, we’ll be keeping a close watch on how the evolving landscape of tariffs and trade tensions might impact these trends in the weeks ahead.

Policy and Politics

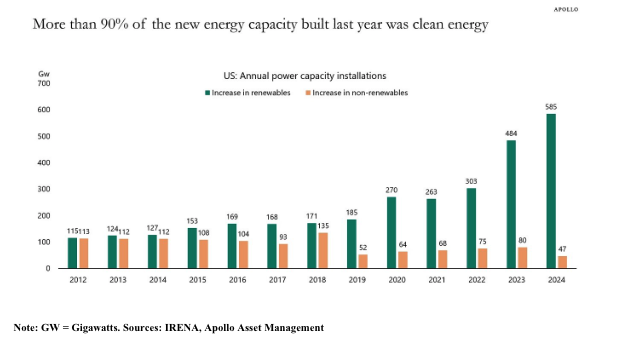

U.S. policy and politics are shaped by President Trump’s bold trade agenda, with the “One Big Beautiful Bill” raising the debt ceiling by $5 trillion and delivering sweeping tax cuts, despite fiscal conservative concerns over its $4.7 trillion decade-long cost. However, progressive wins like Zohran Mamdani’s New York City mayoral upset highlight a dynamic political landscape taking place in the U.S. The announced 30% tariffs on EU and Mexican imports, effective August 1, and a proposed 15–20% blanket tariff increase have sparked debate, but also opportunity, as they encourage domestic production, including in renewable energy. On the renewable energy front, the bill’s shift from phasing out Biden-era wind and solar credits (e.g., $7,500 for new EVs) to boosting geothermal and nuclear power presents a promising pivot, leveraging stable, homegrown energy sources that align with national security and could attract significant investment amid global supply chain challenges. This strategic realignment offers investors a chance to capitalize on growing demand for reliable, innovative clean energy solutions, positioning the U.S. as a leader in sustainable technology with long-term growth potential. See the chart below from Apollo showing how significant renewable energy is among new domestic power production installations.

Economic Numbers to Watch This Week

- U.S. leading economic indicators for June 2025, previous –0.1%

- U.S. Existing home sales for June 2025, previous 4.03 million

- U.S. Initial jobless claims for the week of July 19, previous 221,000

- U.S. S&P flash U.S. services PMI for July 2025, previous 52.9

- U.S. S&P flash U.S. manufacturing PMI for July 2025, previous 52.9

- U.S. New Home Sales for June 2025, previous 623,000

- U.S. Durable goods orders for June 2025, previous 16.4%

It’s shaping up to be a busy week, with a wave of earnings reports coming in from major players like Google, SAP, Tesla, Union Pacific, Blackstone, and Intel. These results will give investors an update on how big tech, transportation, and private investment managers are holding up. On the economic side, we’ll be watching for new data on home sales, durable goods orders, and key PMI readings for both the services and manufacturing sectors, which should offer more insight into the broader health of the economy. Fed Chair Jerome Powell is also scheduled to deliver opening remarks at a banking conference on Tuesday, and markets will be listening closely for any signals on interest rate policy or the Fed’s economic outlook. On top of all that, attention will be on trade developments, especially as we approach the recently set August 1st deadline, which could bring some important updates or shifts in negotiations. At Valley National Financial Advisors, we remain vigilant, recognizing the market’s efficiency while monitoring the impact of policy shifts, and we encourage you to consult your advisor for tailored guidance amidst these dynamic conditions.