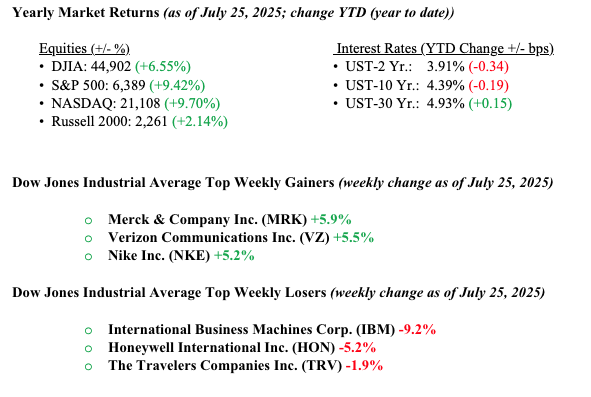

Markets closed out the week strong, the S&P 500 hit a new record, and the Dow, NASDAQ, and Russell 2000 gained about 1%, showing widespread investor confidence. Markets were lifted by a strong start to earnings season, with 88% of S&P 500 companies that have reported beating analyst estimates by an average of 7%. Upbeat corporate commentary also helped, with Google’s CEO stating that AI has a positive impact on every part of the business. Blackstone President Jon Grey pointing to a strengthening deal environment. Investor sentiment also benefited from easing trade tensions after the U.S. and Japan reached a new deal reducing tariffs on Japanese imports from 25% to 15% and outlining $550 billion in Japanese investment in the U.S. Bond markets remained steady, highlighted by a well-received $13 billion auction of 20-year Treasuries with strong foreign demand. The 10-year bond yield finished the week unchanged at 4.39%. Still, with the S&P 500 trading around 22.5× forward earnings, elevated valuations could leave the market vulnerable to negative surprises.

U.S. & Global Economy

Economic data this week was mixed but offered some encouraging signs. Weekly jobless claims came in at 217,000, below expectations of 227,000, suggesting a resilient labor market. The S&P flash services PMI surprised to the upside at 55.2 vs. 53.2 expected, pointing to continued strength in the services sector. On the other hand, the manufacturing PMI disappointed at 49.5, below the expected 52.7, indicating contraction in that part of the economy. Housing data remained soft, with existing and new home sales missing estimates, a sign that activity in the sector is still subdued. That said, there’s cautious optimism that lower rates in the months ahead could provide a much-needed boost to housing. Durable goods orders dropped 9.3%, slightly better than the -11.1% forecast but still reflecting a sharp pullback after a strong prior month. Meanwhile, leading economic indicators declined by 0.3% vs. a 0.2% expected drop. We continue to monitor recent tariff developments, which may contribute to some of the volatility seen in recent data points.

Policy and Politics

U.S. trade policy saw major movements last week. President Trump reached a key deal with Japan, cutting tariffs on Japanese goods, including autos, from 25% to 15%. In return, Japan committed to a $550 billion investment package focused on U.S. industries and agreed to boost imports of American agricultural products. The agreement is a benchmark for ongoing talks with China. In a related development, the U.S. and EU finalized a trade framework of their own, locking in reciprocal 15% tariffs on most goods and avoiding a potential trade clash. The EU also committed hundreds of billions in U.S. energy purchases and investments. These deals are putting pressure on other trading partners to follow suit. Meanwhile, President Trump continued urging Fed Chair Jerome Powell to cut interest rates further, arguing that it would support exports and help offset currency manipulation by other countries.

Economic Numbers to Watch This Week

- U.S. Consumer confidence for July 2025, previous 93

- U.S. Job openings for June 2025, previous 7.8 million

- U.S. ADP employment report for July 2025, previous –33,000

- U.S. GDP (Q2 2025), previous –0.5%

- U.S. Initial jobless claims for the week of July 26, 2025, previous 217,000

- U.S. Personal income for June 2025, previous –0.4%

- U.S. Personal spending for June 2025, previous –0.1%

- U.S. FOMC meeting – no rate changs anticipated

- U.S. PCE index for June 2025, previous 0.1%

- U.S. PCE year-over-year for June 2025, previous 2.3%

- U.S. Core PCE index for June 2025, previous 0.2%

- U.S. Core PCE year-over-year for June 2025, previous 2.7%

- U.S. Employment report for July 2025, previous 147,000

- U.S. Unemployment rate for July 2025, previous 4.1%

- U.S. Hourly wages for July 2025, previous 0.2%

- U.S. S&P final U.S. manufacturing PMI for July 2025, previous 49.5

- U.S. ISM manufacturing index for July 2025, previous 49.0%

- U.S. Construction spending for June 2025, previous –0.3%

- U.S. Consumer sentiment (final) for July 2025, previous 61.8

It is a packed week ahead for markets, with big-name earnings and key economic data on the way. Major companies such as Visa, Microsoft, Meta, Qualcomm, Apple, Amazon, Mastercard, Merck, and Boeing all report earnings this week, and their results could set the tone for the rest of the earnings season. On the economic side, investors will be watching for fresh updates on the job market and hoping to see Q2 GDP rebound after a weak first quarter. The Fed’s go-to inflation gauge, the PCE Index, is also due and could shape expectations for monetary policy going forward. While no rate cut is expected at Wednesday’s Fed meeting, traders will listen closely for hints on when cuts might begin. A key point to take away from this week’s EPS and economic reports is simply that: 1) companies are making a lot of money and 2) the economy continues to grow, prosper, and create more jobs for Americans. At Valley National Financial Advisors, we continue to keep a close eye on market trends and policy changes. We encourage you to contact your advisor for personalized guidance as conditions continue to evolve.