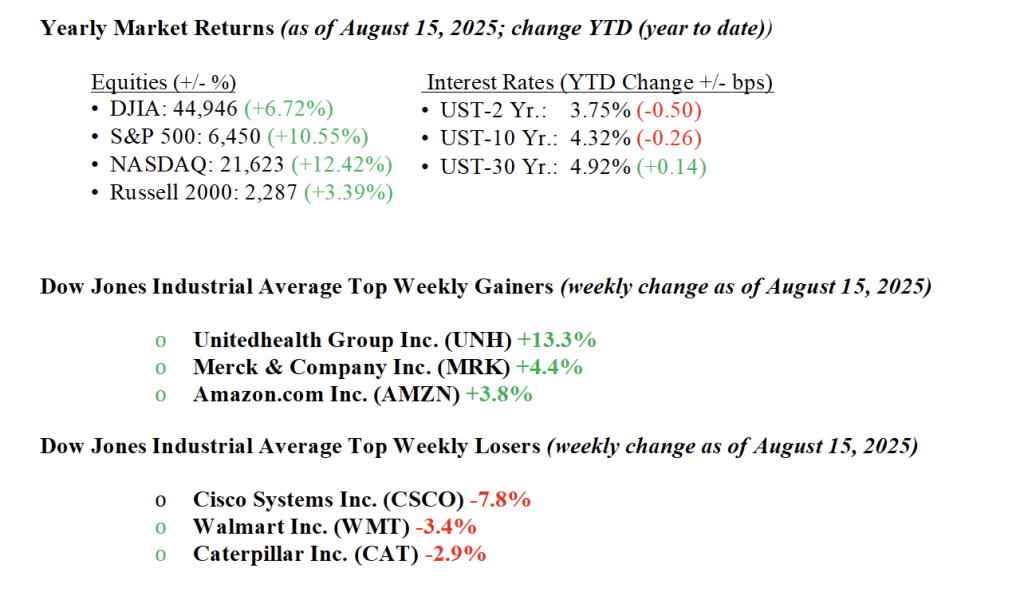

Equity markets posted solid gains last week, with the Dow rising 1.7%, the S&P 500 up 0.9%, the Nasdaq gaining 0.8%, and the Russell 2000 leading the pack with a 3.1% advance. The strength came as the Q2 2025 earnings season nears its end, revealing healthy corporate performance. Aggregate S&P 500 earnings per share grew 11% year over year, far surpassing the 4% consensus estimate. Inflation data offered a mixed picture: while the Consumer Price Index (CPI) came in line with expectations, the Producer Price Index (PPI) surprised to the upside. Still, market expectations for a Federal Reserve rate cut in September remain firmly in place, with odds holding above 90%. Investor attention also turned to commentary from Treasury Secretary Scott Bessent, who called for a bold 50-basis-point rate cut and suggested the Fed may need to ease further. Despite the hotter-than-expected PPI, U.S. Treasury yields held relatively steady, with the 10-year yield edging up just 3 basis points to end the week at 4.32%, signaling a market still largely in wait-and-see mode.

U.S. & Global Economy

- While consumer activity remains resilient, inflation pressures are proving stickier than expected, keeping markets and the Federal Reserve on alert. Economic data released last week painted a mixed picture of the U.S. economy. Small business optimism surprised to the upside, with the NFIB index rising to 100.3 in July, beating expectations. Inflation data was mostly in line, with headline CPI up 0.2% month-over-month and 2.7% year-over-year, though Core CPI rose a touch more than expected at 0.3% for the month and 3.1% annually. Initial jobless claims came in slightly below expectations at 224,000. However, producer prices jumped more than anticipated, PPI surged 0.9% in July and Core PPI rose 0.6%, both well above forecasts, pushing the year-over-year PPI up to 3.3%. Retail sales met expectations with a 0.5% monthly gain, though an upward revision to the prior month softened the positive impact. Consumer sentiment took a notable hit, with the University of Michigan’s August reading falling to 58.6 from 61.7, as inflation concerns resurfaced.

Policy and Politics

- President Trump and Russian President Vladimir Putin held a high-profile summit on August 15 in Alaska. This was their first face-to-face meeting and Putin’s first visit to the West since the 2022 invasion of Ukraine. The talks focused heavily on the ongoing war in Ukraine, with Trump pushing for a peace deal. While no formal agreement came out of the meeting, Trump suggested the ball is now in Ukraine’s court and hinted that some territorial concessions might be necessary, a stance that differs from Ukraine’s and Europe’s. Both leaders spoke optimistically about “progress,” but didn’t share details. On the trade front, Trump put a hold on threatened tariffs including a 100% tax on countries buying Russian oil and a 25% tariff on Russian imports to the U.S., citing progress in talks with China. He noted those tariffs could still be on the table in a few weeks. Trump is expected to meet with Ukrainian President Zelenskyy soon in Washington to keep the diplomatic push going.

- It was an eventful week on the trade front outside of Russia. The U.S. extended its tariff truce with China for another 90 days, keeping 10% tariffs in place through mid-November. At the same time, new U.S. tariffs on imports from over 60 countries kicked in, causing a shakeup in global trade and prompting the WTO to lower its 2025 trade growth forecast to just 0.9%. President Trump added more fuel to the fire, announcing plans for steep new tariffs, potentially up to 300% on semiconductors, and hinting at fresh duties on pharmaceuticals. The Commerce Department also expanded its 50% tariffs on steel and aluminum derivatives, which take effect August 18. All this tariff talk may be hitting consumer sentiment too, with inflation expectations rising to 4.9%, according to the latest University of Michigan survey.

Economic Numbers to Watch This Week

- U.S. Home builder confidence index for August 2025, previous 33

- U.S. Housing starts for July 2025, previous 1.32 million

- U.S. Building permits for July 2025, previous 1.4 million

- Minutes of Federal Reserve’s July 2025 FOMC meeting

- U.S. Initial jobless claims for the week of August 16, 2025, previous 224,000

- U.S. Philadelphia Fed manufacturing survey for August 2025, previous 15.9

- U.S. S&P flash services PMI for August 2025, previous 55.7

- U.S. S&P flash manufacturing PMI for August 2025, previous 49.8

- U.S. Existing home sales for July 2025, previous 3.93 million

- U.S. Leading economic indicators for July 2025, previous -0.3%

This week brings a mix of earnings, few economic data points, and one major event on the monetary policy front. Key consumer facing companies including Home Depot, Lowe’s, Walmart, TJ Maxx, and Target are set to report earnings. This will offer a timely update on the strength of the U.S. consumer and retail trends heading into the fall. On the economic data side, the calendar is relatively light, with a few housing-related releases and July’s leading economic indicators. However, markets will be paying close attention to Federal Reserve Chair Jerome

Powell’s appearance at the Jackson Hole Economic Symposium, where any comments on interest rates or the broader policy outlook could move markets. In equities, large-cap tech and AI continue to lead the way, with NVIDIA firmly in the spotlight ahead of its August 27 earnings release. The chipmaker alone accounts for roughly 2.5 percentage points of the S&P 500’s 10.5% year-to-date gain, highlighting the ongoing influence of a narrow group of mega-cap names on overall market performance. As always, at Valley National Financial Advisors, we’re watching developments closely and encourage clients to reach out with any questions about how current conditions may impact their financial plans.