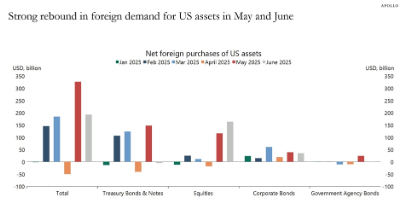

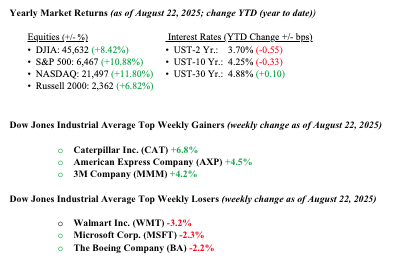

Fed Chairman Jay Powell handed the markets what they wanted last Friday when he admitted that rate cuts at the September FOMC were warranted. Markets rallied strongly on Friday, and all major indexes ended the week higher. This year, we’ve had a consistent message that economic growth in the United States and a strengthened labor market would fuel the markets and propel them higher. Both factors have been a harbinger of growth and have shown that the United States remains the best place for investment. The chart below from the U.S. Department of the Treasury and Apollo shows net foreign purchases of U.S. investments. While this remains our thesis for 2025, there is always a chance for a market sell-off if, for example, a MAG-7 tech stock misses earnings, but those events have proven short-lived as the economic message wins out in the end. Treasury yields fell, with the 10-year U.S. Treasury dropping 6 basis points to end the week at 4.26%.

U.S. & Global Economy

- The U.S. economy shows continued resilience as consumer spending remains strong despite modest inflationary concerns from tariff worries. The growing U.S. deficit ($1.7 trillion) and rising debt costs ($659 billion) are weighing on markets and economists, but Washington, D.C., refuses to deal with this issue, and ironically, U.S. Treasury debt instruments are in strong demand from foreign investors. Globally, economic growth remains uneven, with Europe grappling with sluggish demand and high energy costs, while China faces deflationary pressures and a property sector slowdown, though stimulus measures are supporting some recovery there. Emerging markets are navigating U.S. tariff effects and currency fluctuations, but global trade tensions and geopolitical uncertainties continue to challenge growth, prompting businesses to adapt to an ever-changing economic landscape.

Policy and Politics

- Recent Washington policy debates have generated some headlines. Still, the broader investment picture remains encouraging: despite tariff proposals and fiscal negotiations, international investors continue to view the United States as an attractive destination, pouring a cumulative $5.4 trillion into U.S. businesses through the end of 2023. In 2024 alone, foreign firms spent $151 billion to acquire, establish, or expand operations in the United States, evidence of sustained confidence in America’s large consumer market, skilled workforce, and open regulatory environment. While policymakers debate tariffs, Social Security reforms, and fiscal sustainability, the ongoing inflow of foreign capital underscores a resilient economy that continues to attract global investment amid policy uncertainty. Lastly, President Trump continues to encourage and invite foreign governments to commit to increased investments in U.S. markets and manufacturing.

Economic Numbers to Watch This Week

- U.S. Durable Goods Orders MoM for July 2025, prior rate -9.34%

- U.S. Initial Claims for Unemployment Insurance for the week of August 23, prior 235,000

- U.S. Real GDP for Q2 2025, prior 3.00%

- U.S. PCE Price Index YoY for July 2025, prior 2.58%

- U.S. Core PCE Price Index YoY for July 2025, prior 2.79%

- U.S. Index of Consumer Sentiment for August 2025, prior 58.60

After Fed Chairman Jay Powell signaled that rate cuts are likely in September, equity markets surged last week, and all major indices posted gains—part of an impressive YTD advance that has the S&P 500 up almost 11 % and the Dow industrials nearly 8.5%. That strength reflects a U.S. economy still expanding at a healthy clip, supported by robust consumer spending and a resilient labor market; even as deficits and tariff talk persist, America continues to attract more investment than any other country. Looking ahead, data on durable‑goods orders, unemployment claims, Q2 GDP, and the Fed’s preferred inflation gauge (Core PCE) will offer fresh insights, but the underlying message is unchanged: the U.S. remains the premier destination for capital and a solid foundation for investors seeking growth and stability. As always, at Valley National Financial Advisors, we’re watching developments closely and encourage clients to reach out with any questions about how current conditions may impact their financial plans.