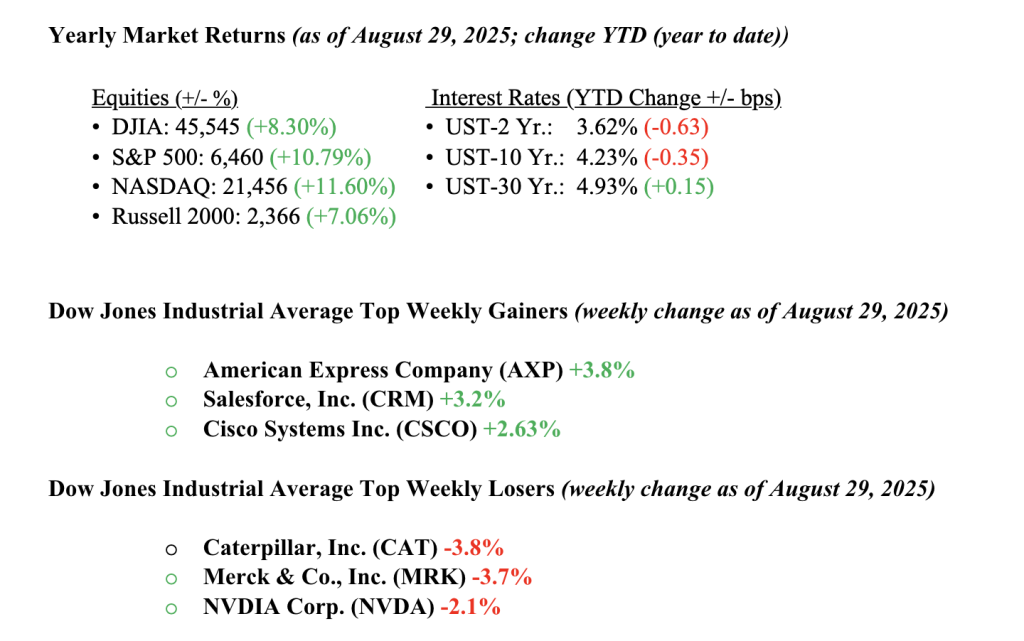

Markets ended the week slightly lower, with a Friday pullback, especially in tech stocks, wiping out gains from earlier in the week. The Nasdaq lagged the S&P 500 and Dow, but overall, August was a solid month for investors. The S&P 500 rose about 1.9%, with total returns at 10.8% year to date. The Nasdaq is up over 11% year to date. Economic data showed inflation ticking up slightly in July, while second-quarter GDP growth was revised higher, suggesting the economy remains relatively stable. One of the week’s key highlights was NVIDIA’s highly anticipated earnings report, which topped expectations. CEO Jensen Huang noted that demand for AI data center infrastructure remains strong, helping to boost investor sentiment midweek. Corporate earnings overall have remained solid, with most companies reporting healthy profit growth. While markets have shown resilience, uncertainty around inflation, interest rates, and global conditions could lead to more volatility ahead. Treasury yields fell, with the 10-year U.S. Treasury dropping four basis points to end the week at 4.23%.

U.S. & Global Economy

- Economic data released last week was generally mixed but leaned slightly positive. New home sales in July were above expectations, and durable goods orders, while down overall, were better than forecast, especially when excluding transportation. Consumer confidence dipped slightly in August but remained within a normal range. Weekly jobless claims were slightly lower than expected, pointing to a still-resilient labor market. The second estimate of Q2 GDP was revised upward to 3.3%, indicating stronger economic growth than previously thought. On Friday, inflation data showed that core PCE, the Federal Reserve’s preferred measure of inflation, rose to 2.9% year-over-year, a modest uptick from 2.8% and right in line with expectations. The steady pace of inflation suggests that the Fed may closely monitor labor market trends as it considers future policy moves. Meanwhile, the University of Michigan’s final consumer sentiment reading for August declined to 58.2 from 61.7 in July, reflecting ongoing concerns about high prices and economic uncertainty. Despite this, long-term inflation expectations remained relatively stable, with the one-year outlook at 4.8% and the five-year at 3.5%.

Policy and Politics

- U.S. trade and monetary policies are facing some challenges. The U.S. recently imposed a 50% tariff on imports from India, which led to push back from India. Meanwhile, President Trump warned that the U.S. might impose a 200% tariff on rare earth exports from China if Beijing restricts shipments again. These moves are adding to trade tensions and inflation concerns. On the monetary side, markets are now pricing in a high chance, around 85%, that the Federal Reserve will cut interest rates in September, especially after softer job growth numbers. At the same time, political tensions are rising, with Trump attempting to remove a Fed governor, raising concerns about the Fed’s independence and how that could influence future policy decisions.

- Recently, the conflict between Ukraine and Russia has escalated, with Russia intensifying airstrikes on Kyiv and advancing toward strategic towns, while Ukraine has responded with drone attacks. Recent hopes for a ceasefire following the Trump-Putin meeting now appear to be fading as the fighting continues unabated. At the same time, in Gaza, Israel has stepped up air and ground assaults on Gaza City, resulting in heavy casualties, widespread civilian displacement, and severe restrictions on humanitarian aid. This has deepened the humanitarian crisis and raised serious concerns across the international community.

Economic Numbers to Watch This Week

- U.S. S&P final manufacturing PMI for August 2025, previous 53.3,

- U.S. ISM manufacturing index for August 2025, previous 48.0%,

- U.S. construction spending for July 2025, previous -0.4%,

- U.S. job openings for July 2025, previous 7.4 million

- U.S. factory orders for July 2025, previous -4.8%,

- U.S. ADP employment change for August 2025, previous 104,000,

- U.S. initial jobless claims for week ending August 30, 2025, previous 229,000

- U.S. productivity (revision) for Q2 2025, previous 2.4%

- U.S. trade deficit for July 2025, previous -$60.2 billion

- U.S. S&P final services PMI for August 2025, previous 55.4

- U.S. ISM services index for August 2025, previous 50.1%

- U.S. employment change for August 2025, previous 73,000

- U.S. unemployment rate for August 2025, previous 4.2%,

- U.S. hourly wages for August 2025, previous 0.3%,

- U.S. hourly wages year-over-year for August 2025, previous 3.9%

Summary

- This week brings a mix of high-profile earnings and key economic data that could help shape market direction. Companies including Salesforce, Broadcom, Lululemon, Dollar General, and Hewlett-Packard will report earnings results. On the economic side, several important updates on the labor market are expected, including job openings, the ADP employment report, and Friday’s U.S. jobs report. One positive point to note is that oil prices remain relatively low, hovering around $63 a barrel, which could help ease some of the inflationary pressures related to tariffs. September and October have historically been more volatile months for equities, so a period of cooling would not be unusual and could offer a healthy pause following recent gains. As always, at Valley National Financial Advisors, we’re watching developments closely and encourage clients to reach out with any questions about how current conditions may impact their financial plans.