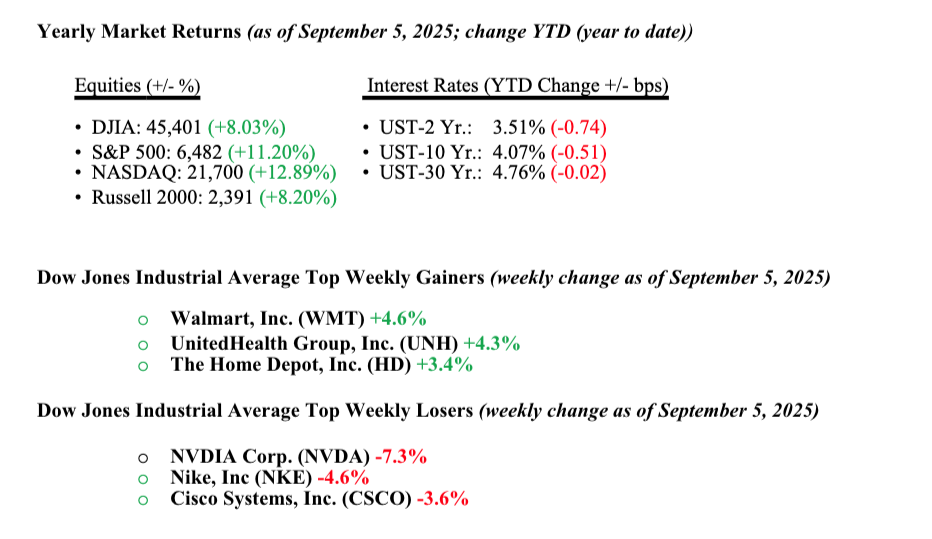

Markets had mixed performance last week, with the Dow Jones Industrial Average dipping 0.3%, the S&P 500 rising 0.3%, and the Nasdaq climbing 1.1%. All three major indexes remain within one percentage point of their recent record highs, reflecting a relatively resilient market backdrop. A significant boost midweek occurred after a federal court ruled in favor of Alphabet (GOOG) in an antitrust case, sparking a rally in the Nasdaq and the broader tech sector. Early-week volatility, along with a sharp rise in U.S. Treasury yields, was fueled by uncertainty over whether the Supreme Court may rule the White House’s tariffs unconstitutional in the coming months. However, yields eased later in the week following a string of softer-than-expected labor market data, including weak job openings, higher jobless claims, and disappointing August nonfarm payrolls, which signaled a cooling but not collapsing jobs market. Separately, oil prices dropped sharply on Wednesday after reports emerged that OPEC+ may be considering another production hike, raising concerns about oversupply. Treasury yields fell, with the 10-year U.S. Treasury dropping 16 basis points to end the week at 4.08%.

U.S. & Global Economy

- Last week’s focus was on the labor market, as a flurry of employment-related data painted a picture of continued cooling without signs of a sharp downturn. The most closely watched report, Friday’s August employment data, showed just 22,000 jobs added, well below expectations, while the unemployment rate ticked up slightly to 4.3%. Earlier in the week, job openings for July declined to 7.2 million, and ADP private payrolls missed forecasts, coming in at 54,000, down from over 100,000 the previous month. Initial jobless claims also rose slightly to 237,000. Despite the softer employment figures, wages remained stable, with hourly earnings rising 0.3% month-over-month and 3.7% year-over-year. Outside of jobs, economic data was mixed. ISM services rose more than expected to 52.0, suggesting modest expansion, while manufacturing data remained in contraction territory. Meanwhile, factory orders fell 1.3% in July, and the trade deficit widened to $78.3 billion. Overall, the data reinforced expectations of a gradually slowing economy, keeping investors focused on the Fed’s next move.

Policy and Politics

- Monetary policy remains in sharp focus ahead of the Federal Reserve’s next meeting on September 17. Last week’s weaker-than-expected jobs report increased the odds of a rate cut. Some investors are even beginning to price in the possibility of a larger 50-basis-point move. However, internal divisions among Fed officials, along with political and global economic pressures, are complicating the path forward. One positive development from the rising expectations of easier policy has been a noticeable drop in mortgage rates. This has provided some relief for the housing market, where affordability pressures remain high.

- A major tariff case heading to the Supreme Court is adding fresh uncertainty for businesses already navigating a complex policy landscape. President Trump is reportedly pushing to expedite the ruling, though legal experts say a decision may not arrive until early next year. The outcome could broadly affect trade policy and government revenue, as tariff collections play a key role amid large fiscal deficits. U.S. Treasury investors are watching closely, concerned that a ruling against the tariffs could reduce revenue, potentially affecting demand for government debt and putting upward pressure on long-term interest rates.

Economic Numbers to Watch This Week

- U.S. consumer credit for July 2025, previous $7.4 billion

- U.S. NFIB optimism index for August 2025, previous 100.

- U.S. producer price index (PPI) for August 2025, previous 0.9%

- U.S. core PPI for August 2025, previous 0.6%

- U.S. PPI year over year for August 2025, previous 3.3%

- U.S. core PPI year over year for August 2025, previous 2.8%

- U.S. consumer price index (CPI) for August 2025, previous 0.2%

- U.S. CPI year over year for August 2025, previous 2.7%

- U.S. core CPI for August 2025, previous 0.3%

- U.S. core CPI year over year for August 2025, previous 3.1%

- U.S. initial jobless claims for August 16, 2025, previous 237,000

- U.S. consumer sentiment (preliminary) for September 2025, previous 58.2

Last week was about jobs data, but this week will be about inflation. With the Fed’s next meeting approaching September 17, investors will closely watch August’s consumer and producer price index reports, due Wednesday and Thursday. Headline CPI is expected to rise to 2.9% year-over-year, while core CPI is forecasted to remain at 3.1%. PPI inflation is expected to tick down slightly, though it remains elevated. Both data sets remain above the Fed’s 2% target, partly due to lingering pricing pressures from tariffs. However, inflation may stabilize as one-time price increases fade and services inflation, which makes up the bulk of the index, starts to ease alongside a softening labor market. In addition to inflation, investors will be watching earnings reports from Oracle, Adobe, Kroger, and Restoration Hardware, as well as any developments in the Supreme Court case on tariffs, which continues to inject uncertainty into the outlook. As always, at Valley National Financial Advisors, we are watching developments closely and encourage clients to reach out with any questions about how current conditions may impact their financial plans.