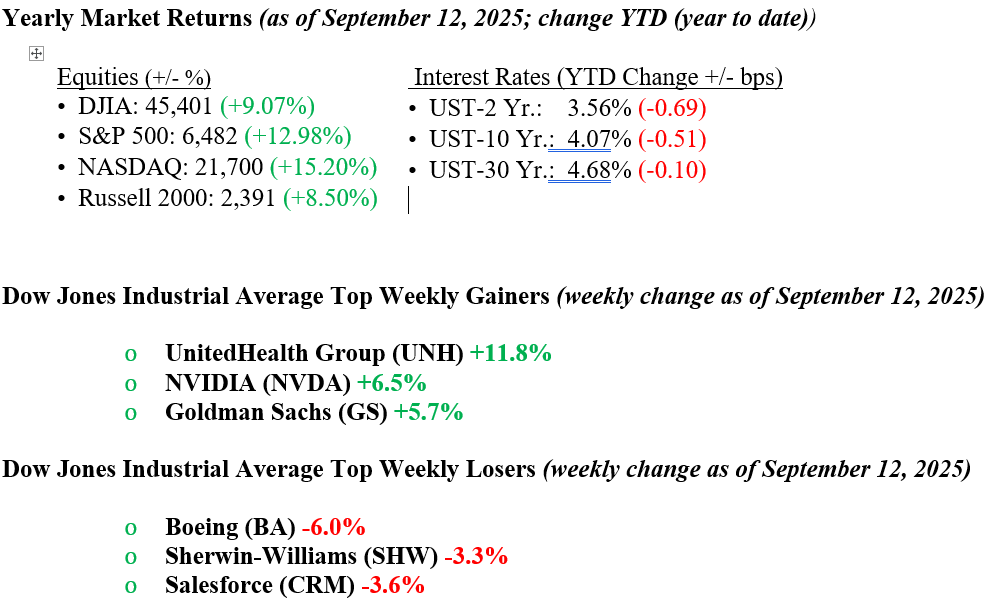

U.S. stock markets posted strong gains this week, with all major indexes reaching new record highs. The Dow Jones Industrial Average rose 1%, the S&P 500 climbed 1.6%, and the Nasdaq Composite led the way with a 2% gain, while the small-cap Russell 2000 saw a more modest increase of 0.3%. Much of the optimism was driven by continued enthusiasm around the artificial intelligence boom, which was further bolstered by Oracle’s mid-week earnings report, revealing a significantly larger business backlog than expected. While some economic data pointed to potential challenges, such as a higher-than-anticipated CPI reading, softening in the labor market, and declining consumer confidence, investors seem confident that these issues are temporary. Markets are increasingly pricing in the likelihood of numerous Federal Reserve rate cuts. In addition, reassuring comments from Visa and Mastercard management suggested that consumer spending remains healthy and resilient, helping to reinforce the market’s positive outlook, despite ongoing macroeconomic uncertainty. Treasury yields fell, with the 10-year U.S. Treasury dropping four basis points to end the week at 4.07%.

U.S. & Global Economy

- This week’s economic data gave a mixed but manageable snapshot of the U.S. economy. Small business optimism in August ticked slightly higher to 100.8, just above expectations. Inflation data was a bit of a mixed bag. August’s Producer Price Index (PPI) unexpectedly slipped by 0.1%, while Core PPI rose 0.3% as expected. On a year-over-year basis, headline PPI eased to 2.6%, while Core PPI increased to 2.8%. On the consumer side, August CPI came in a bit hotter at 0.4% versus 0.3% expected, but Core CPI was right on target at 0.3%, with annual rates holding steady at 2.9% and 3.1%. Labor market data showed some weakness, with initial jobless claims jumping to 263,000, well above forecasts. Adding to the picture, the Bureau of Labor Statistics released a preliminary benchmark revision showing employment was overestimated by about 911,000 jobs for the year, ending in March 2025, pointing to slower job growth than previously reported. That said, we’d describe the current trend more as a cooling labor market than a crashing one. Consumer sentiment slipped in early September, reaching 55.4 compared to 58.2. While a few cracks are starting to show, markets seem to feel the Fed is on top of it and ready to act if needed.

Policy and Politics

- Monetary policy in the U.S. appears to be at a turning point, with the Federal Reserve widely expected to deliver its first interest rate cut of 2025 at this week’s meeting. The move would mark a shift away from the Fed’s cautious hold stance that has been in place since late 2024, as signs of a cooling labor market are taking precedence over lingering inflation pressures. Market odds currently suggest a 93% chance of a 25-basis point cut this week, with only a slim 6–12% chance of a larger move. Looking ahead, traders are pricing in further easing, with the odds of an additional 25-basis point cut in October at 79% and 74% for December. As the Fed navigates the delicate balance between still-elevated inflation and softening job data, the focus is once again squarely on its dual mandate of stable prices and maximum employment. Against this backdrop, attention is also turning to longer-term leadership at the central bank, with reports suggesting that Trump is weighing Hassett, Warsh, and Waller as possible candidates for the next Fed chair, while Bessent has reportedly declined interest in the role.

- Outside of monetary policy, the broader geopolitical and domestic policy landscape remains highly active and increasingly unpredictable. President Trump recently called on European nations to impose tariffs on China and India for purchasing Russian energy, pledging that the U.S. would match any such actions. Meanwhile, in Washington, the White House is pushing to extend the October 1 government funding deadline to January 31, though the proposal faces resistance from Democrats and many Republicans. On the international front, tensions escalated further as Poland and NATO forces shot down Russian drones that entered Polish airspace, following continued attacks by Moscow on Ukraine.

Economic Numbers to Watch This Week

- U.S. Empire State manufacturing survey for September 2025, previous 11.9

- U.S. retail sales for August 2025, previous 0.5%

- U.S. retail sales minus autos for August 2025, previous 0.5%

- U.S. import price index for August 2025, previous 0.4%

- U.S. home builder confidence index for September 2025, previous 32

- U.S. housing starts for August 2025, previous 1.43 million

- U.S. building permits for August 2025, previous 1.35 million

- U.S. initial jobless claims for the week ending September 13, 2025, previously 263,000

- U.S. Philadelphia Fed manufacturing survey for September 2025, previous -0.3

- U.S. leading economic indicators for August 2025, previous -0.1%

For the week ahead, investors will be closely watching the much-anticipated Federal Reserve meeting, where an expected interest rate cut could help set the tone for markets. Focus will be on the Fed’s policy outlook and any guidance provided by Fed Chair Powell on the pace of future rate reductions, particularly considering recent signs of labor market weakness and inflation that remains above target. Beyond central bank developments, key corporate earnings reports from Lennar, FedEx, and Darden Restaurants, along with new economic data including retail sales, consumer credit, and housing figures, will offer additional insight into the state of the economy and corporate performance. Sectors sensitive to interest rates, such as housing, finance, and real estate, may see increased activity, while ongoing trends in artificial intelligence, trade discussions, and global growth will also remain in the spotlight. As always, at Valley National Financial Advisors, we are watching developments closely and encouraging clients to reach out with any questions about how current conditions may impact their financial plans.