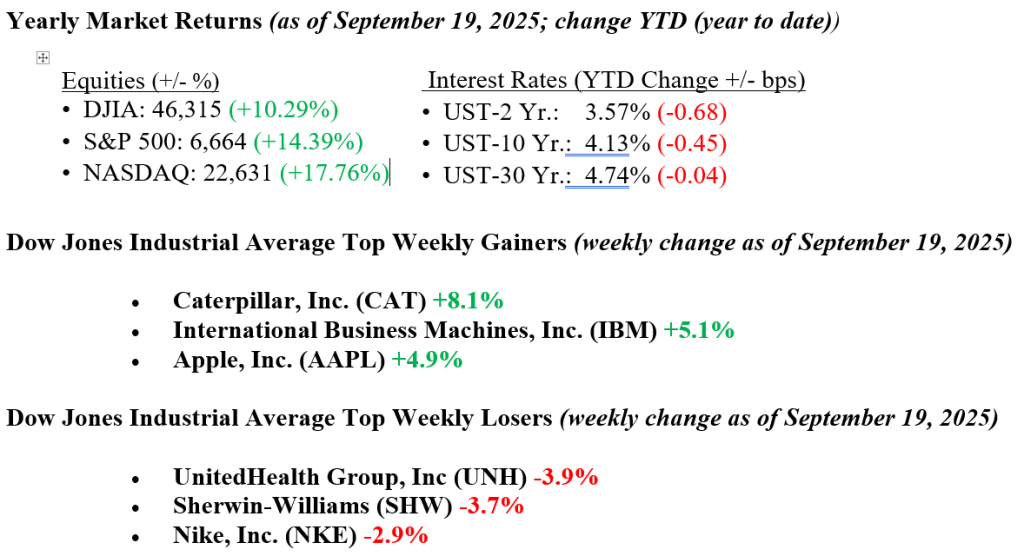

U.S. stocks posted solid gains last week, driven by optimism around monetary policy and continued strength in key sectors. The Dow Jones Industrial Average rose 1.1%, the S&P 500 gained 1.2% and both the Nasdaq and Russell 2000 climbed 2.2%. Information Technology and Communication Services were the top-performing sectors, while Consumer Staples and Real Estate underperformed. As widely anticipated, the Federal Reserve approved a quarter-point interest rate cut in response to signs of a cooling U.S. labor market. Futures markets are now pricing over a 90% probability of two additional rate cuts before the end of the year. Despite elevated valuations, bullish sentiment remains dominant, supported by rate cuts, resilient consumer spending, solid corporate earnings, and sustained momentum in artificial intelligence developments. Despite Wednesday’s rate cut by the Fed, Treasury yields rose for the week, with the 10-year U.S. Treasury yields increasing 7 basis points to end the week at 4.13%.

U.S. & Global Economy

- While not without some signs of softness, last week’s economic data largely reinforced the view of a stable U.S. economy, supported by a strong consumer backdrop. Retail sales for August came in well above expectations, rising 0.6% overall and 0.7% excluding autos, both significantly stronger than forecast, underscoring resilient consumer demand despite higher prices. While manufacturing data was weaker, notably the Empire State survey and housing starts, industrial production surprised to the upside. Import prices rose modestly, suggesting some lingering inflation pressure. In response to signs of labor market softening, the Federal Reserve implemented a rate cut, with markets expecting further cuts later this year, moves that should help ease inflationary pressures and support continued consumer strength.

Policy and Politics

- In addition to last week’s big monetary policy announcement on interest rates, attention is likely to turn to the federal budget challenges ahead, with a potential government shutdown just days away. Senate Democrats blocked a House-passed Republican stopgap bill that would’ve kept the government funded through late November, mainly over disagreements on health care and domestic spending. Only one Democrat broke ranks, and now both sides are pointing fingers as the clock ticks toward the September 30 deadline. Democrats are pushing their own version of the bill, which includes expanded health care support and increased funding for public safety, while Republicans, backed by Trump, say they won’t budge. With Congress heading into recess and no deal in sight, a messy funding showdown is looking increasingly likely.

Economic Numbers to Watch This Week

- U.S. S&P flash U.S. services PMI for September 2025, previous 54.5

- U.S. S&P flash U.S. manufacturing PMI for September 2025, previous 53.0

- U.S. New home sales for August 2025, previous 652,000

- U.S. Initial jobless claims for the week ending September 20, 2025, previous 231,000

- U.S. GDP (third estimate) for Q2 2025, previous 3.3%

- U.S. Advanced trade balance in goods for August 2025, previous -$103.6 billion

- U.S. Advanced retail inventories for August 2025, previous 0.2%

- U.S. Advanced wholesale inventories for August 2025, previous 0.2%

- U.S. Durable-goods orders for August 2025, previous -2.8%

- U.S. Durable-goods orders minus transportation for August 2025, previous 1.1%

- U.S. Existing home sales for August 2025, previous 4.01 million

- U.S. Personal income for August 2025, previous 0.4%

- U.S. Personal spending for August 2025, previous 0.5%

- U.S. PCE index for August 2025, previous 0.2%

- U.S. Core PCE index for August 2025, previous 0.3%

This week, markets will focus on how the recent Federal Reserve rate cut fits into the broader economic picture. The big question is whether the move was preemptive, an “insurance” cut meant to support the economy before real trouble hits, or a reaction to deeper problems, as seen in past recessions. So far, the data leans toward the more positive scenario: unemployment remains low, corporate earnings are holding up, and GDP growth is steady. That supports the view that the Fed is acting early, not out of panic. Investors will also be watching key economic reports this week, especially the Fed’s preferred inflation gauge, the PCE index, and durable goods orders, which offer insight into inflation trends and business spending. On the corporate side, a few notable earnings reports are on deck, including results from Costco, Accenture, KB Home, Micron Technology, and AutoZone, which could offer further perspective on consumer and business trends. While September and October are often more volatile for markets, any short-term pullbacks may reflect normal seasonal fluctuations rather than a fundamental shift. As always, at Valley National Financial Advisors, we watch developments closely and encourage clients to reach out with any questions about how current conditions may impact their financial plans.