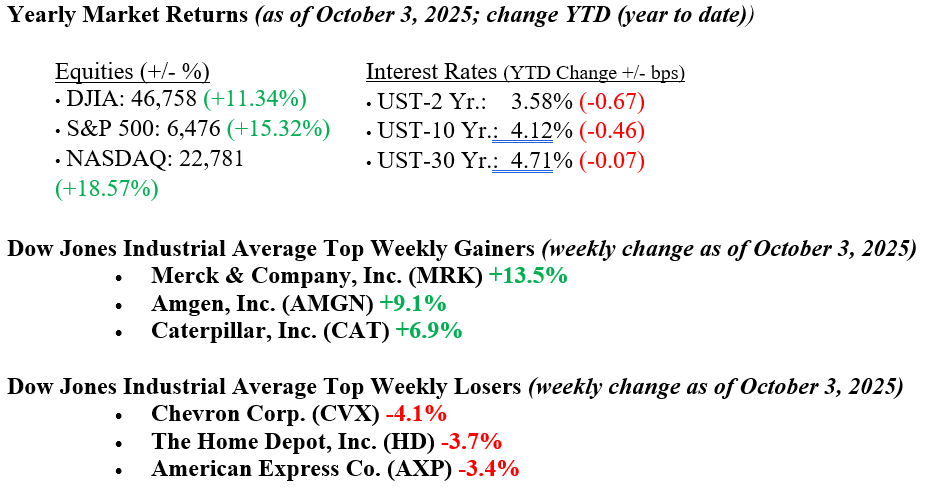

Markets rallied across the board as each major index climbed more than 1% for the week. The government shutdown turned out to be just another bad movie from Washington, D.C. as leaders from both parties failed to reach an agreement to extend funding, even temporarily. It is poignantly ironic that the markets shrugged off the malaise in Washington and instead focused on the growth of EPS, the impact of trillions of dollars of AI investments by U.S. companies, and billions of dollars of investments into the U.S. manufacturing sector by foreign countries and companies, all of which will have a positive impact on the U.S. economy and growth. Treasury also rallied as yields fell across the board, and the 10-year U.S. Treasury yield ended the week at 4.12%.

U.S. & Global Economy

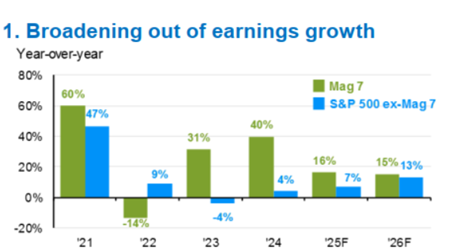

- U.S. economic activity remains healthy, and early returns on the large investments in Artificial Intelligence are beginning to emerge. There are initial signs that AI is helping improve efficiency and reduce costs across a broader range of businesses, not just within the Magnificent Seven. See Chart 1 below from J.P. Morgan showing a broadening of earnings growth from the MAG-7 companies to S&P 500 ex-MAG-7 companies. We expect this trend to continue well into 2026.

Policy and Politics

- With the government shut down in place, little new economic data was released as the BLS (Bureau of Labor Statistics) is not considered an essential service. We expect negotiations between the Democrats and Republicans to continue this week, and we hope an agreement will be reached to fund the government. Meanwhile, essential services will continue, making one wonder if the federal government was once envisioned to provide only essential services.

Last week’s market returns demonstrated the efficiency and forward-thinking nature of the markets. Rather than focusing on the government shutdown, Wall Street looks beyond the noise to concentrate on earning growth, investments across the entire manufacturing spectrum, a healthy and resilient consumer, and falling interest rates. Adding to that optimism, markets will be watching a series of speeches from Federal Reserve officials this week for signals on whether more interest rate cuts could be on the horizon. This week may bring an agreement in Washington to fund the government, or it may not; however, essential services will continue. The focus in Washington should instead be on creating more effective ways to provide those vital services. As always, at Valley National Financial Advisors, we closely monitor developments and encourage clients to reach out with any questions about how current conditions may impact their financial plans.

Economic Numbers to Watch This Week (subject to government BLS operations)

- U.S. Trade Balance on Goods for August 2025, prior -$103.88 billion

- U.S. Consumer Credit Outstanding MoM for July 2025, prior $7.37 billion

- 30-year Mortgage Rate for the week of October 9, 2025, prior rate 6.34%

- U.S. Index of Consumer Sentiment for October 2025, prior rate 55.10