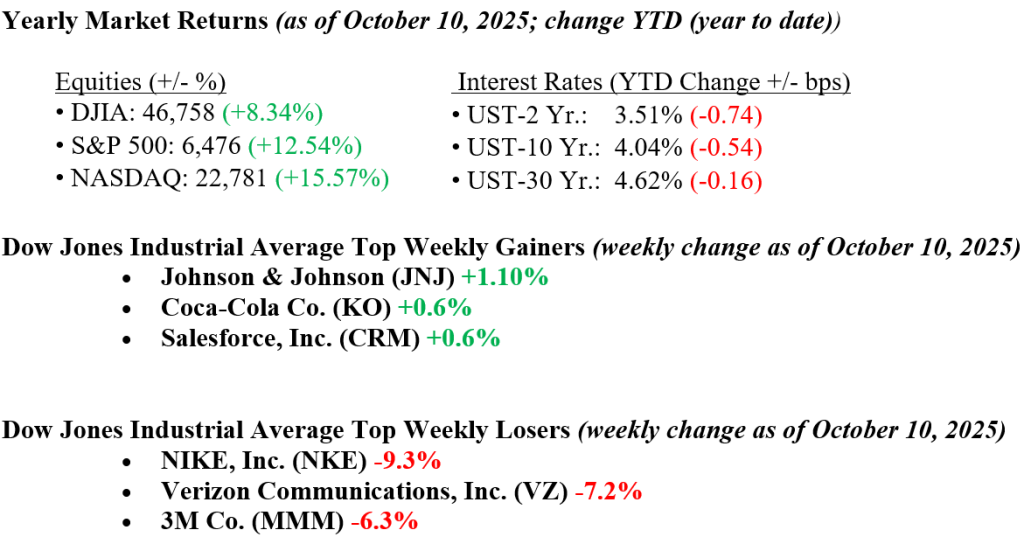

U.S. stocks fell last week as escalating U.S.-China trade tensions, sparked by President Trump’s threats of steep tariff increases in response to China’s restrictions on rare earth exports, rattled investor confidence. Persistent concerns over a prolonged U.S. government shutdown further dampened market sentiment, contributing to broad declines across major indexes. The S&P 500 lost 2.3%, the Nasdaq Composite dropped 2.6%, and the Dow Jones Industrial Average fell 2.8%, marking one of the weakest weeks since early summer. Gold prices surged 2.2%, closing above $4,000 per ounce, amid increased demand for safe-haven assets, while crude oil slid 3.2% to approximately $58.10 per barrel, driven by easing geopolitical tensions and supply concerns. U.S. Treasury yields declined with the 10-year falling to 4.06%, reflecting a flight to safety. Meanwhile, minutes from the Federal Reserve’s September meeting suggested policymakers remain cautiously open to additional rate cuts, highlighting lingering risks tied to inflation and the labor market.

U.S. & Global Economy

- The U.S. economy remained resilient in early October 2025, showing steady growth and persistent inflation. However, the ongoing government shutdown has delayed the release of key data, such as the consumer price index and employment figures, adding uncertainty for the Federal Reserve as it prepares for its next meeting later this month. To address some data gaps, the Labor Department announced it will recall staff to complete the September CPI report, which is now scheduled for release on October 24, nine days later than initially planned. Even with the expected update just before the meeting, policymakers will still be working with limited information, making it likely that the Fed will move cautiously, possibly continuing with a rate cut while signaling greater restraint in future decisions until regular data reporting resumes. Despite the uncertainty, bond markets continue to price in a 97 percent chance of a rate cut at the upcoming meeting.

Policy and Politics

- In response to China’s control on rare earth exports, President Trump threatened a 100% tariff on Chinese imports starting November 1, which unsettled the markets and increased U.S.-China trade tensions. On October 10, a U.S.-brokered ceasefire between Israel and Hamas began, including a hostage exchange and a partial Israeli withdrawal from Gaza. The U.S. government shutdown, which began on October 1 and has no end in sight, has resulted in furloughed workers and delayed the release of essential data. Meanwhile, Russia stepped up attacks on Ukraine’s energy grid and made advances near Pokrovsk, while Ukraine targeted Russian refineries, raising tensions further.

It is shaping up to be a busy week as earnings season gets underway, and several Federal Reserve officials will speak. Big banks will be in the spotlight, with results coming from JPMorgan Chase, Wells Fargo, and Johnson & Johnson on Tuesday followed by Bank of America and ASML Holding on Wednesday. On the economic front, key reports, such as the CPI on Wednesday and jobless claims, PPI, and retail sales on Thursday, are scheduled, although the ongoing government shutdown could delay some of this data. Investors will also likely continue to digest the recent wave of AI-related deals, which has sparked both optimism and growing concerns about a possible spending bubble. With limited fresh data and plenty of Fed commentary expected, markets will be looking for any clues as to where policy heads next. As always, at Valley National Financial Advisors, we closely monitor developments and encourage clients to reach out with any questions about how current conditions may impact their financial plans.

Economic Numbers to Watch This Week (Data subject to delay if government shutdown continues)

- U.S. NFIB Small Business Optimism Index for September 2025, previous 100.8

- U.S. Empire State Manufacturing Survey for October 2025, previous -8.7

- U.S. Retail Sales for September 2025, previous 0.6%

- U.S. Producer Price Index (PPI) for September 2025, previous -0.1%

- U.S. Core Producer Price Index (PPI) for September 2025, previous 0.3%

- U.S. Initial Jobless Claims for the week ending October 11, 2025, previous N/A

- U.S. Home Builder Confidence Index for October 2025, previous 32

- U.S. Building Permits for September 2025, previous 1.31 million