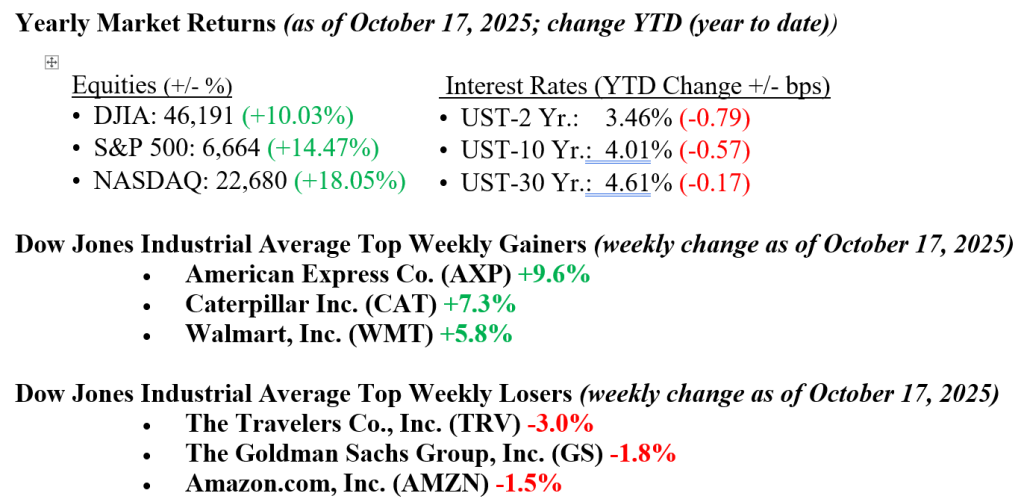

Markets had a volatile week but ultimately closed higher across the board, with the Dow up 1.6%, the S&P 500 gaining 1.7%, the NASDAQ rising 2.1%, and the Russell 2000 leading with a 2.4% increase. Notably, the recent surge in small caps has been mainly driven by speculative, unprofitable companies. Strong earnings from major U.S. banks, American Express, and Taiwan Semiconductor helped lift financials and broader indices. Meanwhile, oil prices fell to $57 per barrel amid oversupply concerns and easing geopolitical tensions following the Israel-Hamas peace deal. Some regional banks came under pressure late in the week after disclosing exposure to recent high-profile bankruptcies, though analysts currently view these issues as contained. A dovish tone from Fed Chair Powell also boosted market sentiment, with investors now pricing in a 95% to 100% chance of rate cuts at the Fed’s October and December meetings. U.S. Treasury yields declined, with the 10-year falling two basis points on the week to 4.01%.

U.S. & Global Economy

- Despite the ongoing government shutdown, several key economic data points were released last week. Small Business optimism dipped slightly, and manufacturing data showed conflicting signals: stronger-than-expected results in New York but sharp declines in Philadelphia. Homebuilder confidence improved modestly. Meanwhile, Fed Chair Jerome Powell and other officials signaled a shift in focus toward employment risks, reinforcing expectations of interest rate cuts despite inflation staying above target. The Fed’s Beige Book report echoed this cautious tone, highlighting steady employment and rising wages but noting weaker consumer spending, continued price increases, and more reports of layoffs.

Policy and Politics

- In the Israel-Hamas conflict, a fragile ceasefire remains in place, but tensions are high as Israel accuses Hamas of violations and aid to Gaza is stalled. In Ukraine, the war with Russia is escalating, with Ukraine launching drone attacks on Russian energy sites and Russia pressing for territorial gains. President Donald Trump has renewed his push for a meeting with Vladimir Putin, suggesting Ukraine may need to make land concessions to achieve peace. Meanwhile, U.S.-China trade tensions are volatile, with China accusing the U.S. of cyber-espionage, even as both sides adjust trade restrictions, highlighting continued friction in their economic relationship.

This week, markets will focus on the release of September’s CPI and a wave of major corporate earnings from companies like Netflix, GE Aerospace, Tesla, IBM, Intel, Union Pacific, Capital One, and SAP. Despite the government shutdown, the CPI will be released on October 24 as the data was collected beforehand and is needed to calculate next year’s Social Security cost-of-living adjustment. However, other reports such as jobs and trade data may be delayed or skipped if the shutdown continues. Market leadership remains narrow, with AI-related tech stocks continuing to drive performance, reflected in fewer than 40 percent of S&P 500 stocks trading above their 50-day moving averages. That said, the quality of earnings reported so far this month has been solid and encouraging. As always, at Valley National Financial Advisors, we closely monitor developments and encourage clients to reach out with any questions about how current conditions may impact their financial plans.

Economic Numbers to Watch This Week (Data subject to delay if government shutdown continues)

- U.S. Leading Economic Indicators for September 2025, previous -0.5%

- U.S. Initial Jobless Claims for the week ending October 18, 2025, previous N/A

- U.S. Existing Home Sales for September 2025, previous 4.0 million

- U.S. Consumer Price Index (CPI) for September 2025, previous 0.4%

- U.S. Core Consumer Price Index (CPI) for September 2025, previous 0.3%

- U.S. S&P Flash Services PMI for October 2025, previous 54.2

- U.S. S&P Flash Manufacturing PMI for October 2025, previous 52.0

- U.S. Consumer Sentiment (Final) for October 2025, previous 55.0

- U.S. New Home Sales for September 2025, previous 800,000