Monthly Market Update for October 2025 with Bill Henderson

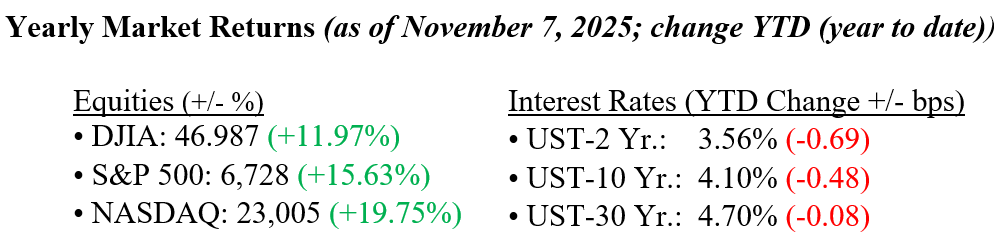

Equity markets declined across the board last week, with the tech-heavy NASDAQ taking the biggest hit, down 3.0%. Meanwhile, the S&P 500 and Dow fell 1.6% and 1.2%, respectively. The sell-off was driven by a mix of factors, including a surge in layoff announcements, continued uncertainty surrounding the unresolved government shutdown, and the Supreme Court’s commencement of hearings on a challenge to Trump’s tariff policy. In addition, high stock valuations have left markets vulnerable in the near term, with investors showing less tolerance for negative news or less-than-stellar earnings announcements. On the positive side, earnings from AI-related tech companies remain strong, although concerns have grown about their increasing reliance on debt-financed projects. Meanwhile, better-than-expected ADP job numbers and solid earnings from consumer-focused names like Expedia pointed to steady consumer spending, providing a bit of optimism amid an otherwise cautious market mood. The 10-year U.S. Treasury yield rose two basis points to end the week at 4.10%.

U.S. & Global Economy

- Last week, with official federal jobs data unavailable due to the ongoing government shutdown, private reports offered a snapshot of the labor market. ADP reported that 42,000 private-sector jobs were added in October, with wages rising 4.5% from the same period a year earlier. Hiring, however, remained slower than earlier in the year, with most new jobs originating from the trade, transportation, utilities, education, health services, and finance sectors. Other data showed job openings falling to their lowest level since early 2021, and surveys from the Institute for Supply Management pointed to weaker activity in both manufacturing and services. Wage growth was stronger among higher earners, while data from the Bank of America, Indeed, and Homebase suggested fewer jobs and fewer hours worked. Taken together, these reports paint a picture of a labor market that is cooling, not crashing.

Policy and Politics

- The ongoing federal government shutdown remained a major focus, with growing worries about its effect on food programs and public services. Meanwhile, frustration mounted over the lack of progress in negotiations, as both parties struggled to find common ground to end the standoff. In another development, off-year state and local elections drew national attention as an early gauge of voter sentiment, with closely watched races in Virginia, New Jersey, and New York City. Simultaneously, both parties continued legal battles over redistricting, and voters across the spectrum highlighted protecting democracy, rights, and economic stability as key priorities.

This week, investors will be watching earnings results from Applied Materials, Disney, Cisco, and CoreWeave while also looking for updates on the government shutdown, which hopefully will be resolved before the Thanksgiving holiday. We remain cautiously optimistic, as corporate earnings continue to grow at a healthy pace with Q3 results coming in better than expected, interest rates are trending lower, foreign investment in the U.S. are expected to gradually support the economy, and consumer spending and AI-related investments remain strong. Key risks include a cooling labor market, ongoing tariff uncertainty, high stock valuations, and the potential for a slowdown in AI spending. As always, please reach out to your financial professionals at Valley National Financial Advisors for questions or comments.

Economic Numbers to Watch This Week (Data subject to delay if government shutdown continues)

- U.S. NFIB (small business) optimism index for October, prior 98.8

- U.S. ADP weekly jobs report, prior +42,000

- U.S. CPI, no prior data available due to government shutdown

- U.S. PPI, no prior data available due to government shutdown

- U.S. Retail Sales, no prior data available due to government shutdown