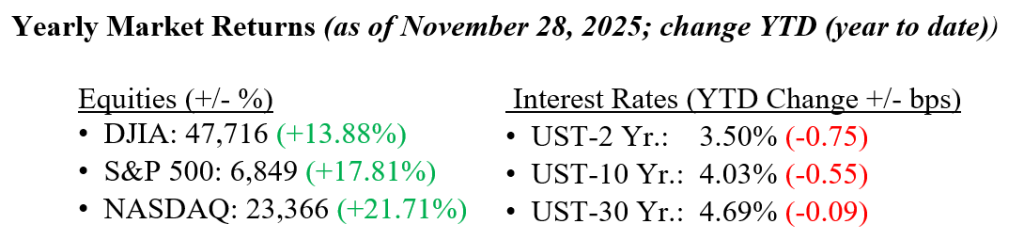

Last week’s holiday-shortened trading session delivered a strong rebound across equity markets, with the Dow Jones, S&P 500, and Nasdaq each posting gains of more than 3% for the week. In November, performance was more mixed; the Nasdaq fell 1.5%, ending its seven-month winning streak, while the S&P 500 finished roughly unchanged, and the Dow Jones Industrial Average rose 0.3%. Last week, markets were boosted by comments from Federal Reserve officials, combined with several weaker-than-expected economic reports, which together raised expectations for a December interest rate cut, now priced at an 87% probability in 30-Day Fed Funds futures. At the same time, investors continued shifting toward new leadership areas in the AI tech space, showing growing enthusiasm for Google’s Gemini large language model, which has demonstrated strong performance and benefits from Google’s ability to fund development internally while leveraging the strength of its existing search business. The 10-year Treasury yield declined slightly last week, closing at 4.04%.

U.S. & Global Economy

- Recent delayed economic reports point to a cooling U.S. economy, with retail sales rising only 0.2% in September, down from August’s 0.6% and below expectations, while sales excluding autos and gas barely increased, and key control-group sales slipped. Producer inflation remained contained as September PPI rose 0.3% and core PPI just 0.1%. The labor market showed mixed signals, with initial jobless claims falling to a seven-month low but continuing claims edging higher. Consumer confidence weakened notably in November, dropping to its lowest level since April amid concerns about prices, tariffs, and politics. The Federal Reserve’s Beige Book reinforced these themes, mainly noting flat economic activity, a slightly softer labor market, moderate price increases driven partly by tariffs, and further slowing in consumer spending, although higher-end retail remained relatively resilient. With the government shutdown now behind us, companies learning to better manage tariff uncertainty, and lower interest rates expected ahead, we remain cautiously optimistic about economic growth prospects for 2026.

Policy and Politics

- Last week brought renewed diplomatic pressure for a Russia-Ukraine ceasefire as Ukrainian officials met with senior U.S. leaders in Florida for new peace talks, even as fighting escalated with Russia’s large missile and drone strike on Kyiv and Ukraine’s naval-drone attacks on Russian “shadow-fleet” oil tankers. In trade policy, the U.S. extended tariff exclusions on select Chinese goods to ease near-term supply-chain strain. Tensions with Venezuela also surged after President Trump declared Venezuelan airspace “closed,” prompting Venezuela to revoke flight rights for several airlines and heightening regional instability.

Next week’s market focus will be on key economic data, including the ISM Manufacturing and Services Indexes, the ADP employment report, personal income and spending, the PCE price index, and preliminary consumer sentiment from the University of Michigan. Corporate earnings will also be in focus, with reports expected from companies including Marvell Technology, CrowdStrike, Salesforce, Kroger, Dollar Tree, Snowflake, Dollar General, and Hewlett Packard. Investors will also watch for updates on AI and tech profitability, alongside insights from Amazon’s Re: Invent conference. The Federal Reserve is in a “blackout period” ahead of its upcoming rate decision, meaning there will be minimal commentary from Fed officials. As always, please contact your financial professionals at Valley National Financial Advisors with any questions or comments.

Economic Numbers to Watch This Week

With the government shutdown over, economic data is starting to return, but it’s still unclear which reports will be released and when.

- U.S. S&P Final Manufacturing PMI for November 2025, prior rate 51.9

- U.S. ISM Manufacturing Index for November 2025, prior rate 48.7%

- U.S. ADP Employment Report for November 2025, prior rate 42,000

- U.S. S&P Final Services PMI for November 2025, prior rate 55.0

- U.S. ISM Services Index for November 2025, prior rate 52.4%

- U.S. Initial Jobless Claims for week ended November 29, 2025

- U.S. Trade Deficit for October 2025, prior rate -$59.6B

- U.S. Personal Income for September 2025, prior rate —

- U.S. Personal Spending for September 2025, prior rate —

- U.S. PCE Price Index for September 2025, prior rate —

- U.S. Core PCE Price Index for September 2025, prior rate —

- U.S. Consumer Sentiment (Preliminary) for December 2025, prior rate 51.0